The crypto market experienced an intense wave of liquidations as Bitcoin’s price surged to a new all-time high yesterday on the back of the Trump election victory.

As Republican candidate Donald Trump secured the lead in the presidential elections, Bitcoin (BTC) witnessed a dramatic rise which allowed it to reach a new all-time high of $76,480.

The bullish momentum led to massive liquidations, reaching $611.5 million on Nov. 6, according to data from Coinglass. This figure represented the largest single-day liquidation event since August.

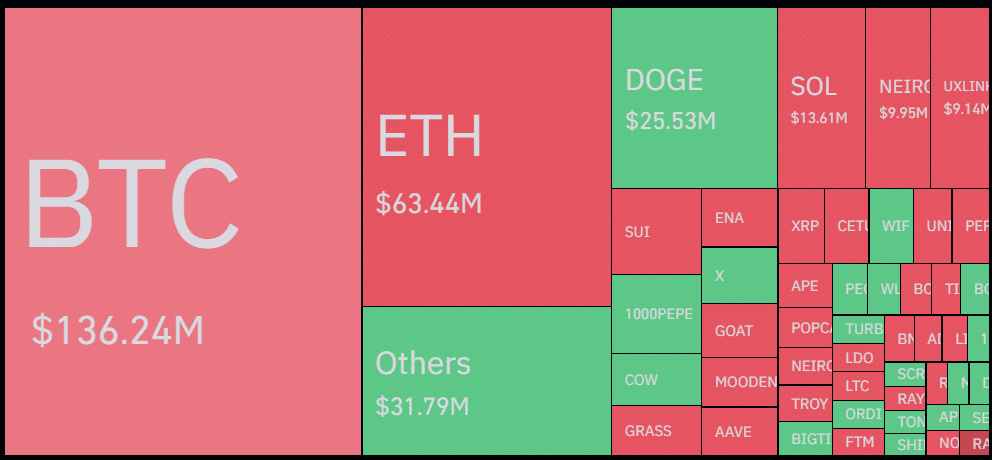

Crypto liquidations map | Source: Coinglass

Crypto liquidations map | Source: CoinglassMost of the liquidations stemmed from traders holding short positions who had bet against Bitcoin’s upward momentum. Approximately 70% of the liquidations, or $426.891 million, were from shorts. Conversely, long positions also took a hit amid the high volatility, with $183.46 million in liquidations.

The pressure on short positions remains, with $107.69 million in shorts liquidated so far. Long positions, although lower in liquidation volume, still saw about $63.86 million wiped out today.

Meanwhile, further data reveals that open interest remains elevated, suggesting that trading activity is still heightened amid confidence among investors.

The total crypto open interest rose by 7.39% over the past 24 hours to reach $83.14 billion. However, futures volume has seen a decrease of 20.69%, now at $235 billion, as the initial excitement from Bitcoin’s surge begins to normalize.

Furthermore, the Bitcoin long-to-short ratio has seen a slight decline, dropping by half a percentage point to a current level of 1.01. This ratio indicates a subtle preference for long positions among investors, signaling a generally balanced sentiment.

Notably, Bitcoin’s all-time high yesterday broke the previous peak of $73,679 set in March. Despite the price facing a slight pullback following the ATH, the spike marked an intraday gain of 9.01%, the largest since August.

Notably, the rally propelled the entire market upward, pushing the global crypto market cap to a five-month peak of $2.52 trillion yesterday. This massive push contributed to the intense liquidations yesterday.

Bitcoin is up 2.41% over the last 24 hours and is trading at $75,091 at the time of writing. With trade volume down by nearly 21% to $76.55 billion, volatility has reduced in the market. Despite this, the asset would look to close the week above $76,000 to maintain its bullish outlook.

English (US) ·

English (US) ·