content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Federal Reserve Chair Jerome Powell may not have mentioned Bitcoin—but to Jack Mallers, he didn’t have to. In a fiery video released just hours after Powell’s latest speech, the Strike CEO declared that the Fed Chair had “finally said the quiet part out loud”: that the post-World War II monetary system is collapsing, and Bitcoin is the only rational response.

“The Bretton Woods era is over. And they’re telling you,” Mallers said, eyes locked on the camera. “They’re invalidating us Bitcoiners—by validating everything we’ve been saying for years.”

Bitcoin Is The Only Way Out

The comments came in response to Powell’s June 2 remarks at the Federal Reserve’s 75th anniversary of its International Finance Division, in which the Fed Chair openly acknowledged that the 1970s marked a fundamental break in monetary policy. “The end of the Bretton Woods era fundamentally changed the conduct of monetary policy,” Powell had said. “Policymakers had to understand the effects of potentially more volatile movements of the US dollar.”

For Mallers, this wasn’t a historical footnote—it was an admission of systemic failure. “Before, the Fed’s job was to defend the peg. The dollar was redeemable for gold,” Mallers explained. “But when we divorced ourselves from the gold standard, we also divorced ourselves from the physical constraints of mother nature. And the world’s been a fucking mess ever since. Excuse my language—it’s a kids’ show, I know.”

The heart of Mallers’ critique is rooted in physics. Gold, and now Bitcoin, are governed by physical laws. Fiat money is not. “None of us can print energy. None of us can defy the laws of time,” he said. “Proof-of-work ties us to reality. That’s what makes Bitcoin the hardest asset humans have ever known.”

In Powell’s comments, Mallers saw a shift—not in theory, but in tone. “He’s admitting it. He literally said: our job got more complicated. And he’s right. When you’re not anchored to reality, when you can print money without limit, your job becomes about managing politics, leverage, volatility—basically managing chaos.”

Mallers argued that this new mandate has turned the Fed into a machine for volatility suppression—not price stability. “Markets today are structurally short volatility,” he said. “Why? Because they’re addicted to leverage. And leverage can’t survive volatility. So what do the authorities do? They spoon-feed the market. They telegraph every move. And now Jerome Powell is warning us—gently, methodically—that he’s going to change the inflation target. He’s going to change the employment target. He’s laying the groundwork for a regime shift.”

Mallers insisted the public is being softened up for major monetary changes. “Let me be on record,” he said. “If Powell comes out and says the inflation target is 4%, not 2%—boom. If he says the Fed will help fund the US government through some form of yield curve control—boom. This was the first breadcrumb. There are more coming.”

But the broader theme of Mallers’ video was more existential than tactical. “You cannot replace Chinese or Russian buying power with Wall Street hedge funds,” he said. “So you let them lever up. But when you do that, you have to kill volatility. You have to micromanage everything. And eventually, it all breaks.”

And when it breaks? “Bitcoin is the exit,” Mallers declared. “It’s the only monetary instrument governed by the laws of physics. Gold used to do that, until we left it. Bitcoin is that—on the internet. And it’s here. And it’s working.”

To underscore the seriousness of Powell’s shift, Mallers referenced a recent Reuters article titled “Historic Dollar Fall Needed to Eliminate US Trade Deficit.” “This is not fringe anymore,” he said. “The media, the Fed—they’re all saying it. The post-war dollar system is collapsing. They’re saying the quiet part out loud.”

He finished with a stark prediction: “This is a monetary regime change. You don’t get many in a lifetime. And Bitcoin is going to play a massive role in what comes next.”

For years, Bitcoiners have claimed that US monetary policy was built on illusion. Now, with Powell’s own words, Jack Mallers believes the illusion is cracking—and the world is watching what comes next.

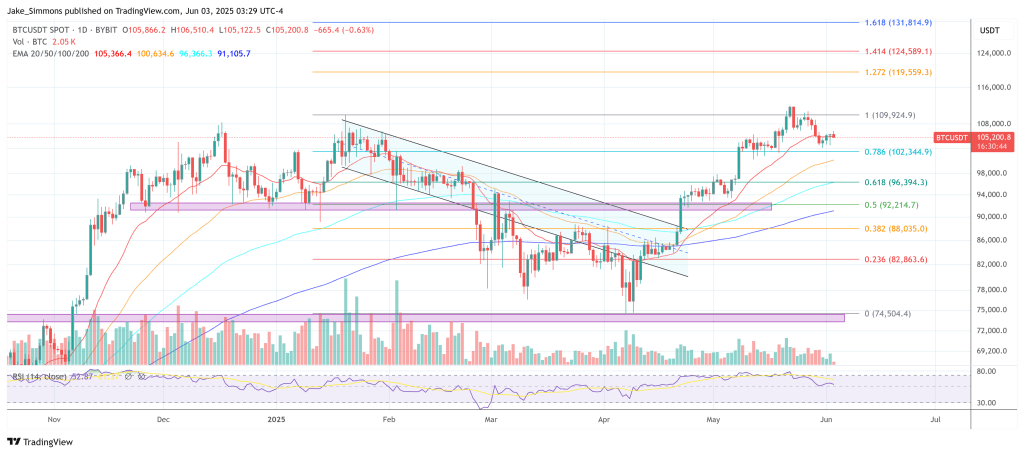

At press time, BTC traded at $105,200.

BTC price, 1-day chart | Source: BTCUSDT on TradingView.com

BTC price, 1-day chart | Source: BTCUSDT on TradingView.comFeatured image created with DALL.E, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

English (US) ·

English (US) ·