On 10 Oct 2024, the United States Securities and Exchange Commission (SEC), under Gary Gensler, filed a lawsuit against Cumberland.

As per the SEC’s lawsuit, Cumberland violated the Securities Act; the company has been operating as an unregistered securities dealer in the crypto market since 2018.

All these accusations against Cumberland are similar to the SEC’s charges against the top crypto exchanges Binance and Coinbase.

The SEC has filed a lawsuit against the crypto trading company Cumberland DRW LLC, accusing it of operating as an unregistered securities dealer. Similar to previous SEC lawsuits against Binance and Coinbase, the SEC has also listed a “non-exhaustive list” of cryptocurrencies…

— Wu Blockchain (@WuBlockchain) October 10, 2024The Cumberland DRW legal team has engaged in extensive discussions with the SEC over the past five years, providing numerous documents and materials.

The company mentioned a very interesting thing that happened in 2019 via a tweet post. As per the shared information, the firm acquired a registered broker-dealer in 2019 to comply with SEC requirements but was informed that it could only trade Bitcoin and Ethereum, which are considered “commodities.” As a result, Cumberland DRW has decided not to change its business operations or the assets for which it provides liquidity.

It means Cumberland became a securities broker officially by admitting to the SEC’s objections, but the SEC still does not allow this firm to operate crypto-related transactions, except for Bitcoin and Ethereum.

Paradigm CEO against SEC chairman Gary Gensler

In defence of Cumberland, Paradigm CEO Justin Slaughter suggested that SEC chairman Gary Gensler should openly acknowledge his rumoured intention to undermine the cryptocurrency market for the benefit of other financial markets.

Slaughter implied that Gensler is willing to risk the SEC’s regulatory authority in this effort, comparing the situation to a gamble akin to singing “Luck Be a Lady Tonight” at the Supreme Court.

Look, at this point, I’d admire it if Chair Gensler just said openly what he is rumored to say privately: that he’s trying to destroy crypto for sake of other markets and he’s willing to bet the SEC’s regulatory powers at this Supreme Court while singing “luck be a lady tonight.” https://t.co/3v6TbjzaJY

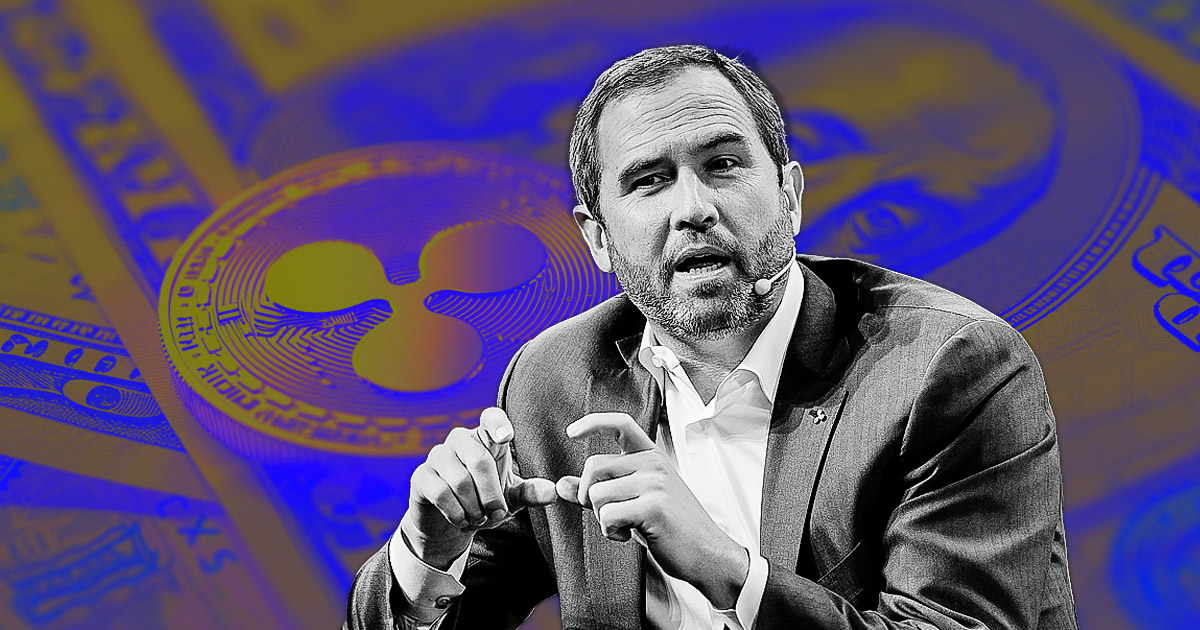

— Justin Slaughter (@JBSDC) October 10, 2024Ripple vs SEC

The San Francisco headquartered blockchain firm, which has been in a legal dispute with the SEC since 2020 over the nature of XRP cryptocurrency and Ripple’s financial activities with XRP coin, also criticised the SEC over the lawsuit against Cumberland.

Recently, in the latest interview with FOX Business, SEC commissioner Mark Uyeda said that the SEC has been introducing its crypto-focused rules and laws through enforcement actions.

The SEC official also stated that the agency has failed to provide the industry with the needed guidance. He noted that while most crypto regulations are enacted through court verdicts, there have been different and inconsistent rulings.

By referencing Mark’s comments on SEC chairman Gary Gensler’s leadership, Ripple CEO Brad Garlinghouse said that people inside the SEC are also dissatisfied with the SEC’s unfair regulatory approach to crypto.

Garlinghouse noted that Mark’s comment coincided with the SEC filing a lawsuit against Cumberland for violating federal securities law.

The calls are coming from inside the house…

Commissioner Uyeda calls the SEC’s approach to crypto a disaster – and right on cue the agency sues @CumberlandSays for operating as an unregistered securities dealer.

This circus needs to end. https://t.co/wquwzZ4lLF

Read also: Fidelity Digital Assets says “Pension funds are just beginning to talk about investing in Bitcoin”

English (US) ·

English (US) ·