Sei, the layer-1 blockchain for high-frequency crypto trading, saw its native token’s price jump more than 25% in the last 24 hours.

On Sept. 25, Sei (SEI) rose from an intraday low of $0.366 to hit a high of $0.471 earlier in the day across major exchanges.

This is the highest level the token has been since June 12, with its market capitalization leaping to $1.6 billion, positioning it as the 59th largest digital asset globally, according to CoinGecko data.

The price surge came alongside a 187% rise in its daily trading volume, currently hovering around $523 million. Further, Coinglass data shows that SEI’s daily open interest was up 34.4% to $170.3 million when writing, pointing to heightened investor activity fueling SEI’s ongoing rally.

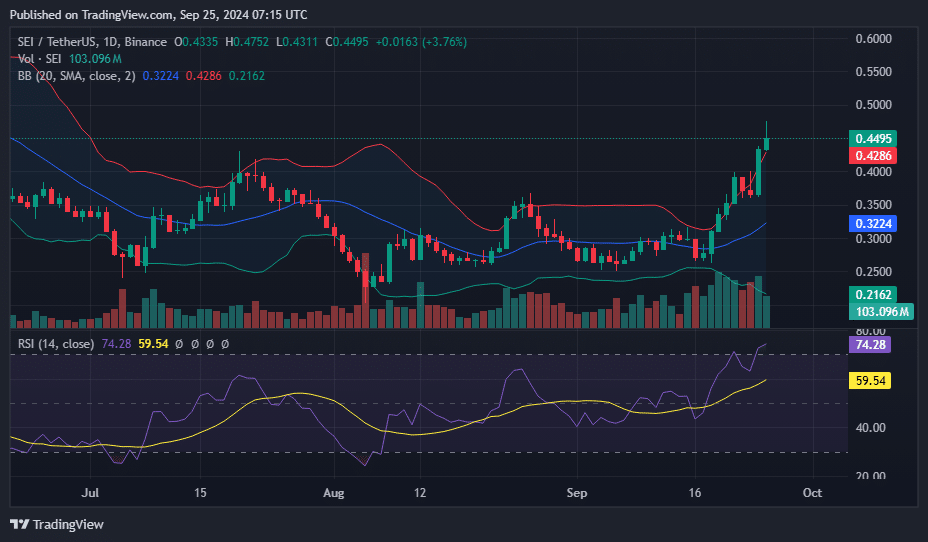

On the 1-day chart, SEI had broken out of a falling wedge pattern, a technical setup that typically signals further upside potential.

SEI price, Bollinger Bands and RSI chart -Sept. 25 | Source: crypto.news

SEI price, Bollinger Bands and RSI chart -Sept. 25 | Source: crypto.newsIt has also broken the upper Bollinger Band, which stands at $0.4503, indicating that upward momentum remains strong.

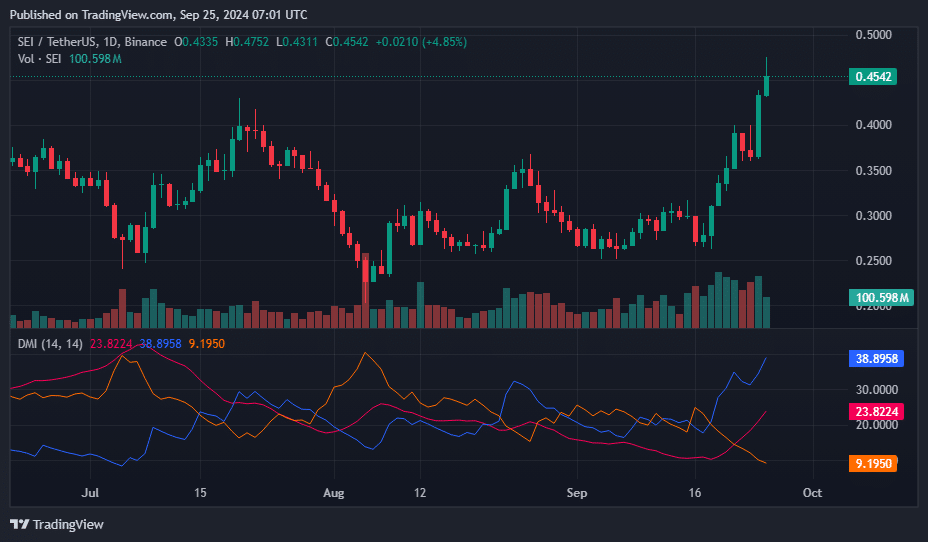

The Directional Movement Index shows increasing bullish momentum, with a rising +DI and a falling -DI, indicating reduced selling pressure. At the same time, the Average Directional Index is climbing, suggesting that the previously weak bullish trend is gaining strength.

SEI DMI – Sept. 25 | Source: crypto.news

SEI DMI – Sept. 25 | Source: crypto.newsGiven the current trend, traders should keep an eye on the $0.50 mark, which could serve as the next psychological resistance. A successful breach of this level, combined with strong volume, might push the price toward $0.55 or higher.

However, the overbought Relative Strength Index at 74 signals the possibility of a near-term correction or consolidation. In case of a reversal, the middle Bollinger Band around $0.3224 may serve as a key support level.

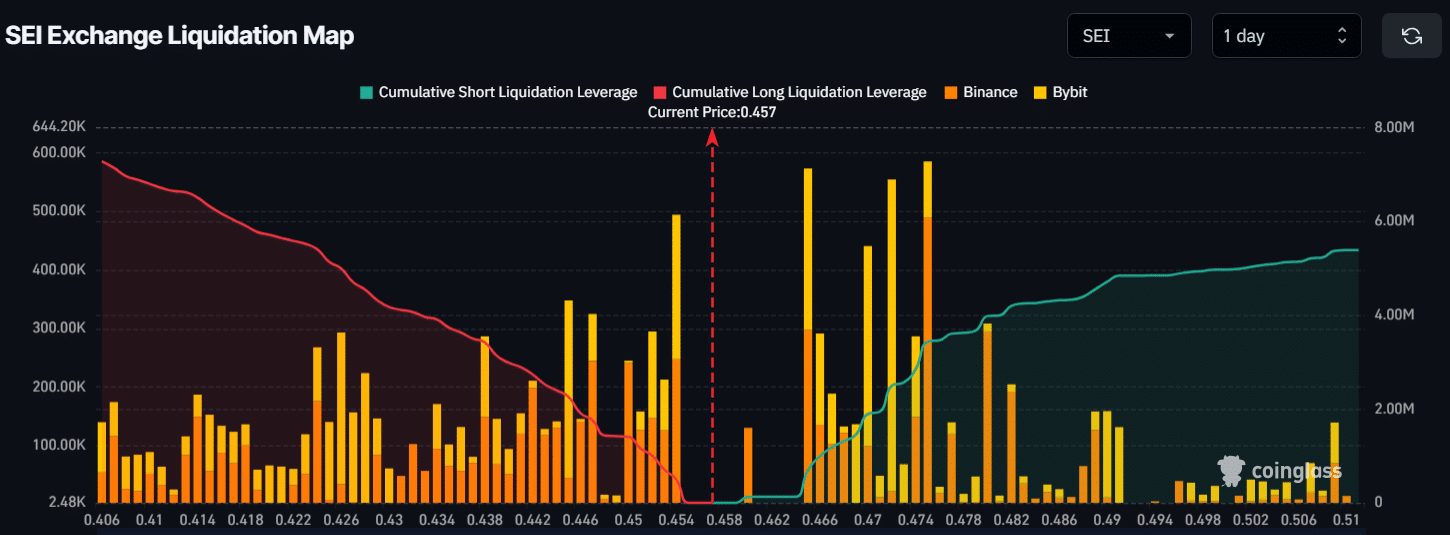

Major liquidation levels

Currently, the key liquidation thresholds for SEI are around $0.454 on the downside and $0.475 on the upside, with significant leverage among intraday traders at these levels, according to Coinglass.

Source: CoinGlass

Source: CoinGlassIf SEI drops to $0.454, nearly $494.47K in long positions could be liquidated. Conversely, a rise to $0.475 could lead to the liquidation of approximately $3.44 million in short positions.

At press time, bulls seemed to be in control, with the potential to trigger liquidations of short positions at higher levels.

English (US) ·

English (US) ·