Solana spot inflows have hit a six-month low of $180 million following its recent decline to $185, despite having seen two SOL ETFs debut on the U.S market this week.

Summary

- Solana’s spot inflows have dropped to a six-month low as investor interest in newly launched SOL ETFs fades, leading to weakened liquidity and rising exchange outflows.

- After failing to hold above the $200 mark, Solana’s price has slipped to around $186, with technical indicators and moving averages signaling a short-term bearish trend and potential retest of lower support levels.

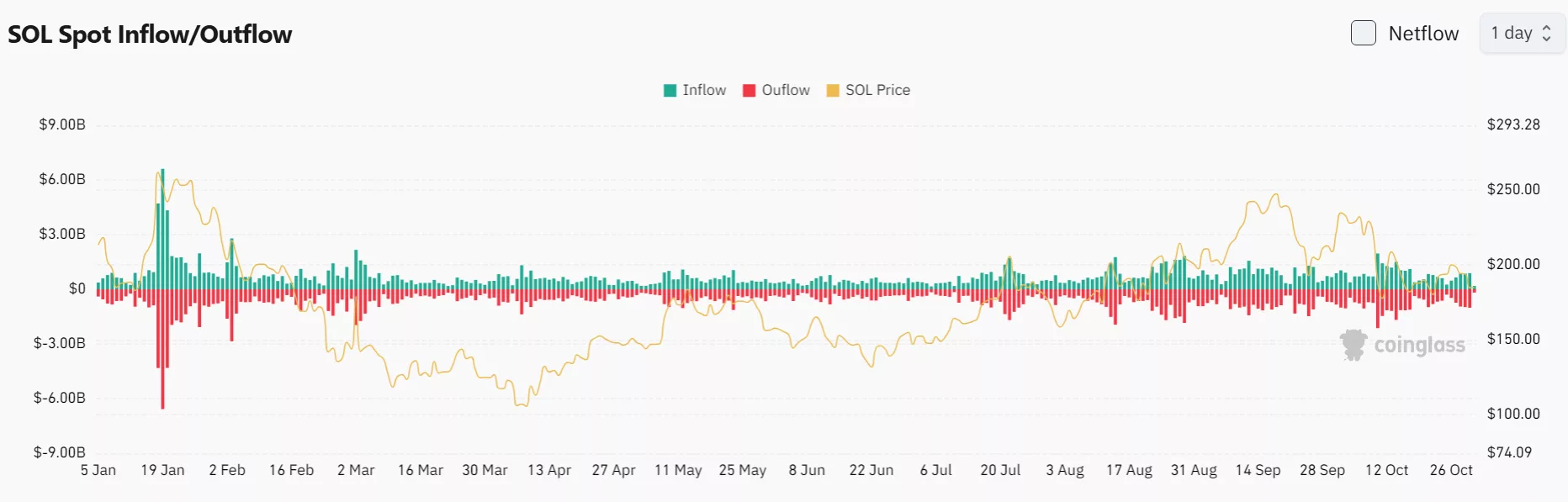

According to data from Coinglass, Solana inflows have plunged to a six-month low, tethering on the edge of $180.7 million. The number is a far cry compared to inflows from a day prior, which saw the asset hitting $885.02 million in inflows. Low inflows typically signal waning demand in the market as the hype surrounding new Solana ETFs have faded.

At the same time, exchange data shows an increase in net outflows after weeks of relative calm. This means that more tokens are moving into exchanges rather than being pulled out into cold storage or being held by users on-chain. On Oct. 31, major exchanges like Binance, OKX, Coinbase and Bybit are seeing more outflows for SOL (SOL).

Binance alone has seen about $52.89 million in net outflows from SOL, while OKX recorded $26.98 million outflows. Within the past day, the only exchanges which have seen inflows coming in for SOL are Bitstamp with $1.19 million and Kraken with $501,160.

The decline in inflows coincides with the token’s drop to around $185 shortly after failing to maintain its hold above the $200 psychological threshold. In addition, the Chaikin Money Flow indicator for Solana has dipped significantly, signaling that liquidity is weakening and that large-scale accumulation is not currently in play.

Solana inflows have fallen to a six-month low at $180.7 million on Oct. 31 | Source: Coinglass

Solana inflows have fallen to a six-month low at $180.7 million on Oct. 31 | Source: CoinglassAfter the launch of the first Solana ETFs on the U.S market, Bitwise Solana Staking ETF followed by a second contender in the form of Grayscale’s SOL-backed ETF, the token was fueled by investor enthusiasm into reaching above $200. However, the rally was brief as it fell back to $195 not long after that. Now, the token has only fallen further away from the $200 threshold.

Despite having reached more than $110 million in daily net inflows after their debut on the market, the two Solana ETFs have seen daily inflows fall to just $37.33 million according to SoSoValue. This indicates that investors may have lost interest in the new ETFs and reverted back to more mainstream crypto ETFs that are backed by Ethereum (ETH) and Bitcoin (BTC).

Solana price analysis

After failing to break through the $200 mark, Solana continues to fall further down. In the past 24 hours, the token has dropped by 4.7% and is currently trading at around $186, hovering just below the 30-day moving average which sits near $187.50.

The MA has now flipped into resistance, suggesting the short-term trend has shifted bearish. Each minor rebound attempt over the past few sessions has been capped by the moving average, reinforcing the idea that sellers remain in control. Unless SOL can decisively reclaim the $190 to $195 zone, a retest of lower support levels near $180 and possibly $172 remains likely.

Solana has fallen below its 30-day moving average zone | Source: TradingView

Solana has fallen below its 30-day moving average zone | Source: TradingViewMomentum indicators further confirm this weakening structure. The Relative Strength Index, currently oscillating around 47, shows a lack of bullish momentum after failing to push above the neutral 50 line. The RSI’s recent lower highs suggest that buying pressure has continued to fade even during minor bounces, which is consistent with the idea that liquidity and demand for SOL are tapering off.

Solana’s failure to break through $200 reflects a cooling market sentiment following months of strong gains. With both the moving average and RSI showing weakness, the path of least resistance in the short term appears to lead downward. To reverse this setup, bulls would need to reclaim and hold above the $190 to $195 range with renewed volume.

If SOL fails to bounce back, it could see continued consolidation or a further pullback below $180 before any meaningful recovery attempt can be made.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

English (US) ·

English (US) ·