Key Notes

- RWA project valuations on Solana surged to $500.10 million ATH with 10% monthly net inflows and growing adoption.

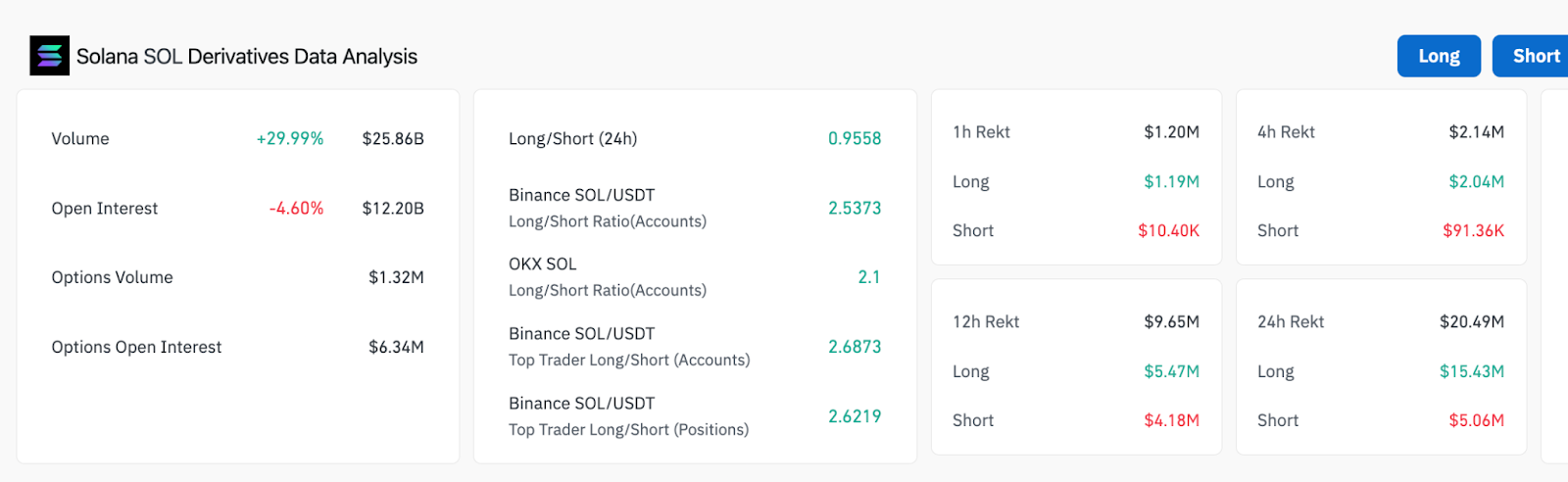

- SOL futures volume jumped 29.99% to $25.86 billion while open interest declined 4.60% indicating trader repositioning.

- Technical analysis shows potential for $300 target if SOL rebounds above $200 resistance with Fed rate cuts ahead.

Solana SOL $199.6 24h volatility: 2.5% Market cap: $108.04 B Vol. 24h: $6.99 B price kicked off September under modest selling pressure, retracing 3% intraday to $198 on September 1, even after closing August above $200 to register its highest since January 2025. The pullback came as traders reacted to new data confirming that Real World Asset (RWA) projects on Solana hit an all-time high above $500 million.

Citing real-time data from RWA.xyz, ecosystem news aggregator SolanaFloor reported the value of RWA assets listed on Solana climbed to an all-time high of $500.10 million on Monday. A closer look at the other key metrics shows a 2.09% increase in Solana RWA project valuations reflecting 10% net new inflows during the last month.

🚨BREAKING: The total value of tokenized real-world assets (RWAs) on @Solana has surpassed $500M, a new all-time high. pic.twitter.com/Rg8xwk9gbY

— SolanaFloor (@SolanaFloor) September 1, 2025

Meanwhile, RWA holders rose 5.27% to 66,732 wallets, and the number of listed RWA assets reached 92.

Stablecoin holders increased 3% to 11.21 million, while the total value of RWA activity surged to $11.62 billion, up 9.19% from 30 days ago. Together, these figures point to steady organic growth backing Solana’s expanding footprint in the tokenized real-world assets sector.

Yet in price terms, Solana saw a muted response as traders opted to cash in on the news. After briefly opening intraday trading at $205, the native SOL coin slipped 3%, tumbling below the psychological $200 mark and trading as low as $197 at press time.

Solana Derivatives Market Analysis | Source: Coinglass

However, derivatives market data provide a more nuanced outlook on Solana’s near-term price action. Coinglass’ latest figures show Solana futures trading volumes surged 29.99% to $25.86 billion, even as open interest dipped 4.60% to $12.20 billion.

While the open interest decline confirms over $600 million in SOL liquidations in the last 24 hours, the larger surge in trading activity suggests short-term demand remains strong, pointing toward traders repositioning rather than completely capitulating.

This may explain why SOL’s spot price 3% dip remains lower than the 4.6% decline in open interest. If markets close daily trading with the current dynamics, SOL price could be poised for a rapid rebound in the days ahead.

SOL Price Forecast: Will SOL Price Hit $300 in September?

With Bitcoin BTC $109 029 24h volatility: 0.1% Market cap: $2.17 T Vol. 24h: $38.86 B and Ethereum ETH $4 352 24h volatility: 2.3% Market cap: $525.37 B Vol. 24h: $26.88 B each hitting new all-time highs in August, it remains to be seen if the 3rd and 4th ranked cryptocurrencies, XRP XRP $2.77 24h volatility: 1.3% Market cap: $164.74 B Vol. 24h: $7.45 B and Solana, could be next in line for September.

However, Solana has kicked off the month on a choppy note on Monday, with an intraday dip to $198 after its strongest monthly close of 2025 so far at $205.

Solana (SOL) Technical Price Analysis | Source: TradingView

Technical indicators show mixed signals. On the monthly chart, SOL remains well above its 20-month moving average at $167.78, indicating structural bullishness. The Bollinger Bands suggest immediate resistance around $232.34, while the upper limit near $293 represents the long-term breakout barrier. The MACD remains in positive territory, reinforcing that Solana’s broader trend is still intact despite short-term dips.

In a bullish scenario, a decisive rebound above $200 could set the stage for a retest of $232, followed by a possible push toward $250 in September. If momentum persists, SOL could challenge the $293 resistance zone where previous monthly highs capped the August rally.

On the downside, continued pressure below $200 could drag Solana prices toward the $167 support level, which aligns with the middle band. A break lower would risk extending losses toward the $150 region, though current on-chain growth suggests buyers may defend key supports aggressively.

In summary, Solana’s RWA momentum and ecosystem growth remain positive bullish catalysts. While near-term volatility may persist, the balance of data suggests SOL could attempt another push to new peaks in September, especially as traders have one eye on the widely anticipated first US Fed rate cut of the year.

Maxi Doge Presale Gains Momentum as Solana Faces Near-Term Resistance

With Solana consolidating near $200 as traders balance RWA optimism against sell-the-news pressure, newly-launched projects like Maxi Doge (MAXIDOGE) are attracting significant interest. Positioned as a community-driven token with 1000x leverage and no stop-loss, Maxi Doge is capturing attention among investors seeking outsized returns beyond top-ranked projects.

Maxi Doge Presale

Currently priced at $0.000253, the Maxi Doge presale has raised more than $1.7 million of its $1.9 million goal. Prospective participants can still secure MAXIDOGE tokens through the official Maxi Doge site before the next stage of the presale.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Solana (SOL) News, Cryptocurrency News, News

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·