Key Notes

- The company's Treasury exposure has positioned it ahead of entire nations in government debt ownership rankings.

- USDT circulation jumped by $17 billion in three months, driving total stablecoin market capitalization past $300 billion.

- Excess reserves of $6.8 billion and diversified holdings in Bitcoin and gold strengthen the token's backing structure.

Tether International announced Q3 2025 results, confirming that net profits for the year have exceeded $10 billion, as detailed in its latest attestation prepared by BDO, a global independent accounting firm.

The company’s Financial Figures and Reserves Report was published as of September 30, 2025. The report shows that Tether continues to grow as one of the most financially robust entities in the fintech sector. The company expects to reach $15 billion in net profit by the end of 2025.

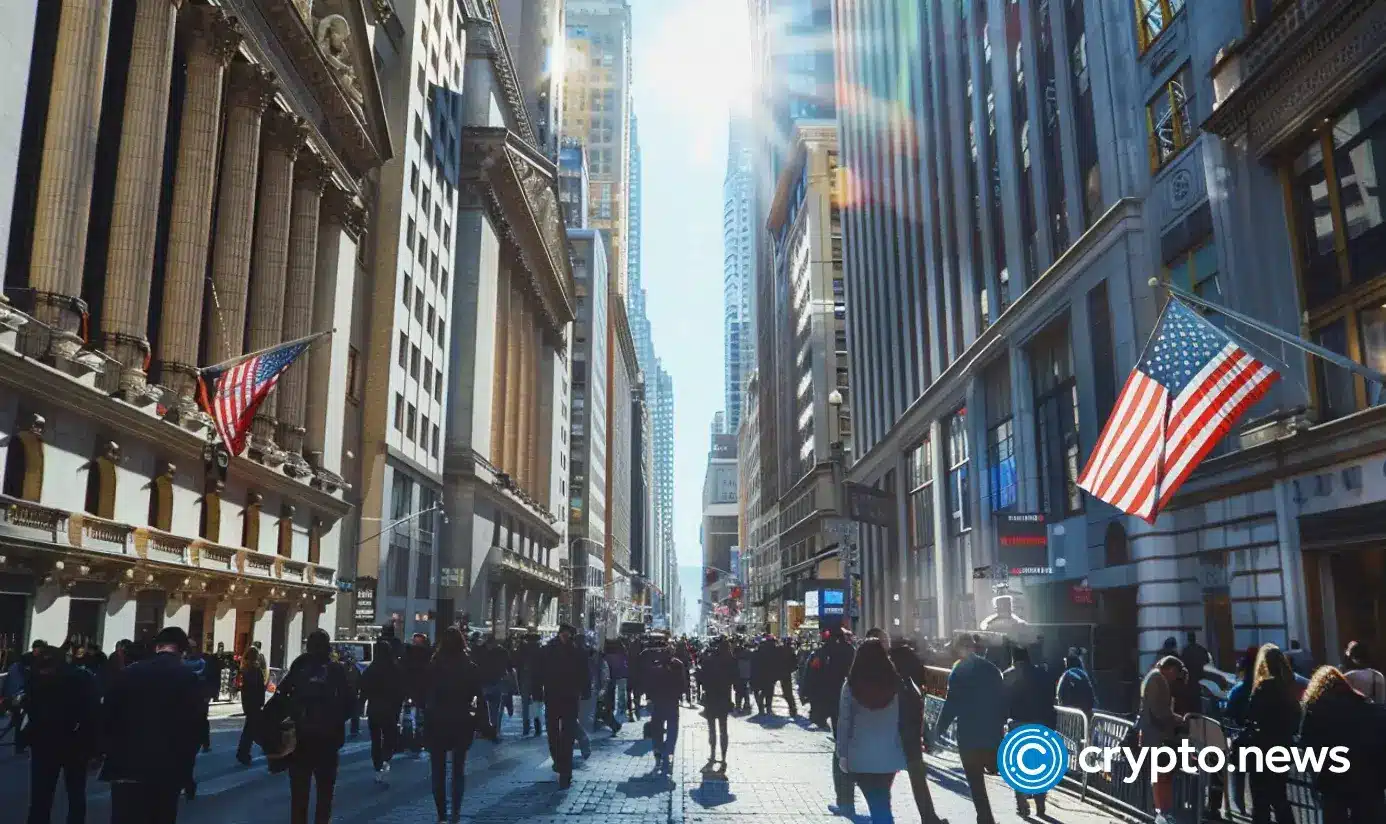

US Treasury Holdings Reach Historic Levels

For the third quarter, Tether’s total exposure to US Treasuries, including both direct and indirect holdings, surged to an all-time high, reaching approximately $135 billion. This places Tether as the 17th-largest holder of US government debt globally, surpassing several nation-states, including South Korea.

The growing allocation to US Treasuries underscores Tether’s reserve strategy, which focuses on liquidity and asset diversification. This strategy is gaining momentum now more than ever, thanks to the approval of the GENIUS Act in the US.

Tether reported issuing over $17 billion in new USDT during Q3, bringing the circulating supply to over $174 billion as of the quarter’s end, according to the announcement.

By October 2025, the number of tokens in circulation surpassed $183 billion, solidifying Tether’s position as the leading issuer of stablecoins. Also, as USDT grew, the market cap of stablecoins surpassed $300 billion at the beginning of October.

The company’s user base has expanded to over 500 million, driven by global demand for reliable stablecoins amid macroeconomic volatility.

Bitcoin and Gold Reserves Add Diversification

Tether’s reserves as of September 30 included $12.9 billion in gold and $9.9 billion in Bitcoin BTC $109 306 24h volatility: 1.6% Market cap: $2.18 T Vol. 24h: $65.18 B , totaling around 13% of total reserves. Proprietary investments in AI, energy, and communications are managed separately and not included in the reserves backing USDT, highlighting a separation between operational growth and token backing.

Tether closed the third quarter with excess reserves of $6.8 billion, providing a security buffer above outstanding liabilities. The total proprietary Group equity is nearing $30 billion. Liabilities connected to issued tokens stood at $174.4 billion, matched by assets exceeding $181.2 billion.

Paolo Ardoino, Tether’s CEO, described the results as evidence of continued trust and growth, stating that investors are increasingly turning to USDT for stability and liquidity. The attestation and reserve breakdown reinforce Tether’s position amid ongoing global economic uncertainty. He also explained the details of the report in his account on X.

Tether just released its quarterly attestation for Q3 2025.

USDT has become the biggest financial inclusion success story in the history of humanity, with more than 500 million users across the emerging markets and developing countries.

Highlights as of 30 September 2025:

*… https://t.co/XVYeVq1u64 pic.twitter.com/nZ2V1EKZ3x

— Paolo Ardoino 🤖 (@paoloardoino) October 31, 2025

Their Recent Legal Issues and Subsequent Developments

In October, Tether completed a $299.5 million settlement in the Celsius-related litigation using company investment capital, with no impact on token backing.

Moreover, the company plans to raise more than $20 billion to continue expanding its operations worldwide. In their roadmap, they plan to return to the United States after a long period marked by a problematic relationship with past governments. They even contracted the former Trump’s Crypto Official, as a strategy advisor, to be closer to President Trump.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Tether (USDT) News, Cryptocurrency News, News

Marco is a passionate journalist with a deep addiction to cryptocurrencies and a keen interest in photography. He is fascinated by trading and market analysis. He has 5+ years of experience working with cryptocurrency projects.

English (US) ·

English (US) ·