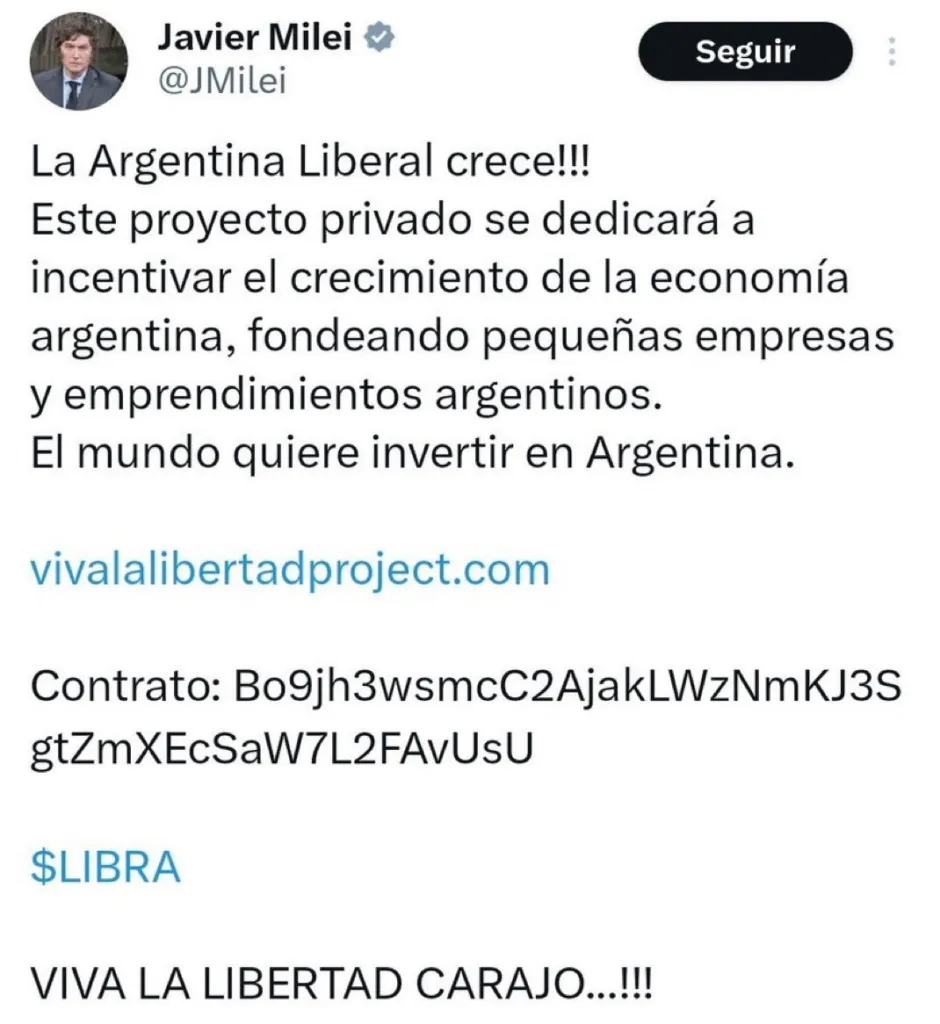

Argentina’s President Javier Miler controversial $LIBRA tweet

This week, Argentina’s President Javier Milei is being accused of playing a crucial role in a ‘crypto’ rug pull. On February 14, the president tweeted about a project called $LIBRA, sharing details of the project, its website, and its contract number so that potential investors could locate the token and “support” the initiative.

However, any “support” would have been extremely short-lived. Within 45 minutes of Milei’s tweet, the price of $LIBRA skyrocketed, peaking at $5.54 per token. The first buyer purchased $LIBRA at around $0.21 per token, but just 37 minutes later, that buyer dumped most of their tokens, raking in a net profit of $6.5 million. However, their massive sell-off in a relatively small liquidity pool sent the market into freefall, with $LIBRA crashing 70% within an hour, plummeting from $4.74 to $1.44. It was later discovered that a significant number of profitable trades on the $LIBRA token came from the token’s development team, which not only led to fraud accusations against Milei, but insider trading accusations against the token’s launch team as well.

Once the token collapsed, Milei deleted his tweet and claimed, “I was not informed of the fine details of the project and after learning, I decided not to continue spreading it (that’s why I deleted the tweet).” But by that point, the damage was done. The token was already dead due to liquidity issues, and lawsuits soon followed. Investors targeted the development team and any high-profile individuals tied to the launch—including the President of Argentina himself, accusing him of fraud and playing a central role in what turned out to be a pump-and-dump scheme.

Unfortunately, as of 2025, this incident isn’t an outlier, and I actually think it’s indicative of what we will see more of in the short term; high-profile figures and celebrities are increasingly launching tokens, most branded as “memecoins,” that ultimately function as short-term pump and dumps. The winners are always insider traders and those who buy early and sell fast, while the losers are the majority of retail investors who are left holding the bag.

And because the U.S. is taking a hands-off approach to ‘crypto’ regulation, particularly with the Securities and Exchange Commission (SEC) scaling back enforcement efforts, North America is becoming the perfect location for this type of fraud to proliferate.

SEC, Coinbase, and Binance: The crypto lawsuits in limbo

This week, the SEC made a move that could signal the end of its high-profile lawsuits against Coinbase (NASDAQ: COIN) and Binance—cases that began under the Biden administration when Gary Gensler led the agency’s crackdown on crypto.

In a new filing, the SEC requested a 28-day extension to respond to Coinbase’s appeal arguments and a 60-day hold against Binance. The SEC justified these delays by pointing to a new Crypto Task Force created by the Trump administration, which aims to develop a clear regulatory framework for the industry.

“The work of this task force may impact and facilitate the potential resolution of this case,” stated the SEC’s motion regarding Binance. While the courts have yet to rule on these requests, the filings signal major shifts that are taking place in the cryptocurrency regulatory landscape.

When Trump entered office, there was speculation that he would be a “crypto-friendly” president. With many long-time crypto supporters believing that his administration would shepherd the industry into maturity, giving blockchain and digital assets the legitimacy they lacked. But the reality is much different. I would even go as far to say that outside of corporate advancements, the industry has devolved in regards to its consumers.

This is because Trump’s regulatory shift isn’t aimed at empowering everyday crypto investors. Instead, it’s increasingly clear that the beneficiaries of these policy changes will be large corporations and tech giants looking to extract value from retail investors while offering little in return beyond speculative opportunities.

The biggest proof of this is the rise of memecoins. As these pump-and-dump scams masked as novelty collectibles flood the market, retail investors are often left holding the bag with little to show for it, while on the other side of the table, established crypto giants like Coinbase and Binance, are able to take advantage of the regulatory shift and rake in more money for their businesses.

How important is crypto globally?

When you’re deeply involved in a niche industry, it’s easy to believe that what you’re working on is the most important thing in the world. You assume that people generally share your level of knowledge and interest. But sometimes, the data tells a different story.

FUN FACT: Less than 7% of the global population is invested in crypto.

— Watcher.Guru (@WatcherGuru) February 15, 2025Despite the noise and headlines, crypto ownership remains shockingly low. Only about 6.8% of the world’s population owns any cryptocurrency.

Image source: Visual Capitalist, “Crypto Ownership Growth by Region,” 2024

Image source: Visual Capitalist, “Crypto Ownership Growth by Region,” 2024This statistic translates into a massive challenge for the industry. Since the inception of blockchain and cryptocurrency, a small but dedicated group has been working to commercialize and productize the technology, aiming to build legitimate businesses and financial systems. However, this industry subset is vastly outnumbered by speculators, people treating crypto like a casino, hoping to make a quick buck on token volatility.

The result is that the larger, louder group of memecoin gamblers dominate the narrative, pushing the speculative side of crypto into the mainstream. Meanwhile, the builders and innovators working to legitimize the industry are increasingly being drowned out.

To add insult to injury, the entire demographic of crypto owners and builders is already small, so when we talk about the people doing legitimate work, we end up talking about a niche within a niche.

However, overall, this statistic indicates an imbalance that has had and will continue to have long-term consequences. Because this group is so small, governments and regulators see crypto as a fringe issue, with little incentive to prioritize any meaningful regulation to help the industry mature. But without serious intervention, the space risks being trapped in a doom loop where Ponzi-like token launches continue dominating headlines while meaningful blockchain applications struggle for legitimacy.

Watch: Converging IPv6 & Bitcoin for decentralized future

English (US) ·

English (US) ·