This week, the cryptocurrency markets continued their descent, with prices across the board continuing to fall amidst unmet expectations in the cryptocurrency industry and the further deterioration of the space, with hundreds of millions of dollars still being liquidated from the market every few hours.

JUST IN: $250 million liquidated from the cryptocurrency market in the past 4 hours.

— Watcher.Guru (@WatcherGuru) March 3, 2025From the perspective of a crypto-holder, this year in crypto just hasn’t played out the way that many supporters believed it would. Although the Trump administration has made efforts to make it easier for cryptocurrency companies to do business, this has been to the detriment of the retail investor, who, as a result, is usually on the receiving end of pump-and-dump schemes.

The problem is even though it is easier for crypto companies to do business, there hasn’t been any innovation in the industry in years. The most popular application of cryptocurrencies is still “speculation.” Now, thanks to some of the changes to the policy by the Trump administration, it’s easier than ever to do—and get away with—fraud, especially through memecoin launch of Ponzi schemes.

For prices to stop falling in the short term, I’m sure a few strong words of encouragement from the president will get people clicking the “buy” button once again, but for the industry to truly survive and grow in the long run, more legitimate businesses need to build actual products (not one-off tokens) that solve real pain points consumers are experiencing. The industry needs businesses that launch products—not just vaporware—that customers can use and have a demand for.

To be fair, even though the Trump administration has done some shortsighted things that lend to the deterioration of the industry, such as launching their own memecoin and removing prosecutors that were actually trying to protect consumers, they’ve also laid the groundwork for incubating healthy crypto companies. It’s now up to the crypto companies, builders, innovators, and enthusiasts to take this opportunity and do the right thing—something they haven’t done so far and honestly show no interest in doing.

Trump’s strategic crypto reserve: A missed opportunity?

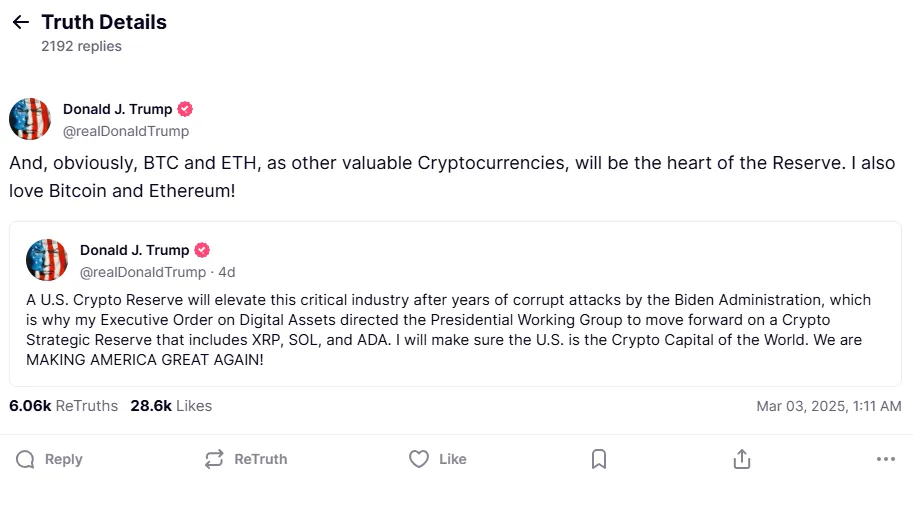

This week, President Donald Trump announced a strategic crypto reserve, and although you would think crypto supporters would be happy with this news, the reality is much different.

Source: Truth Social

Source: Truth SocialAt the time of the announcement, Trump only mentioned three cryptocurrencies that were to be included in the reserve: Solana (SOL), Ripple (XRP), and Cardano (ADA). This immediately caused confusion and even outrage.

Trump had partially campaigned on a Bitcoin Strategic Reserve, not a reserve filled with second-rate, speculative cryptocurrencies. This discrepancy led many of his supporters from the cryptocurrency industry to question the choice of assets and the motivations behind including those three coins in the reserve.

The negative feedback must have returned to the president because just two hours after the initial announcement, Trump followed up by saying that BTC and ETH would also be included in the reserve.

Source: Truth Social

Source: Truth SocialThere are several problems with this announcement. For starters, the choice to include SOL, XRP, and ADA seems to have come out of left field. These currencies, especially ADA, aren’t known for much. XRP, despite being the third-largest crypto by market cap, has not done anything remarkable in recent years beyond battling the SEC. Although popular and widely used, Solana primarily serves as a launchpad for memecoins. None of these coins are behind real products that solve real pain points in customers’ lives.

On top of that, this “strategic reserve” is neither strategic nor a real reserve. An actual strategic reserve is a government stockpile of a commodity that can be used and distributed in times of emergency or crisis. It’s hard to imagine a scenario where the U.S. needs to unleash ADA from its reserve to ease an economic catastrophe.

More than anything, this move shows that the administration doesn’t understand or care much about blockchain and cryptocurrency. If they did, they would have been more thoughtful about the steps they’ve taken regarding the industry since taking office. Instead, we’ve seen them legalize memecoin launches and pump-and-dumps, and now, launch a reserve that seems to be ignorant to what the crypto-supporters actually had a demand for, and they’ve done all of this within their first 100 days.

Crypto Czar moves to remove more regulations

Out of the White House this week, Crypto Czar David Sacks announced his support for a joint resolution that would nullify a reporting rule the Internal Revenue Service (IRS) had for the cryptocurrency industry.

The rule, titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sale,” expanded the definition of a “broker” to include not just traditional financial brokers but also certain cryptocurrency platforms and Decentralized Finance (DeFi) services. This meant that any crypto or DeFi platform would have to keep a record and subsequently report any of its users’ transaction history for tax purposes.

The crypto industry immediately pushed back on the rule, arguing that it was a compliance burden and an example of regulatory overreach that would ultimately stifle innovation.

On March 4, the Senate passed the joint resolution in a 70-27 vote, overturning the reporting rule.

Once again, this is another win for crypto corporates that has come out of the White House, which seems to be a theme with this administration. The Trump administration has been labeled as “pro-crypto,” which has been true—but so far, only for corporates.

Corporations have reaped the benefits of the administration’s policy changes, or rather, policy removals, which make it easier and cheaper for these businesses to operate and rake in revenue without compliance fears or the threat of prosecution. While this is good for businesses, it unfortunately makes it easier for fraud to take place in the industry. There has been an uptick in fraud since the administration removed some of the guardrails in the cryptocurrency space. With the IRS reporting requirements gone, you can expect that number to increase even further. Without reporting requirements, it will be easier for crypto-users and companies to commit tax fraud.

As the year progresses, one theme that has become clear is that while the current administration’s actions are making life easier for crypto businesses, the retail investor is being left behind. Unless more innovation occurs, cryptocurrency’s future may continue its current downward spiral.

Watch: Bringing the Metanet to life with Teranode

English (US) ·

English (US) ·