Putting real-world assets onchain opens up new markets, increases capital velocity and democratizes access to finance, advocates say.

Tokenization will transform the financial industry faster than digital technology disrupted legacy media, such as print newspapers, physical copies of music and other analog formats, according to Keith Grossman, president of crypto payments company MoonPay.

“While many feared digitization would destroy media, what it actually did was force its evolution,” Grossman said, adding that real-world asset (RWA) tokenization, the process of representing traditional assets onchain, will force traditional institutions to adapt. He added:

“This is no longer hypothetical. BlackRock is offering tokenized funds. Franklin Templeton is running tokenized money market funds on public blockchains. Major global banks are piloting onchain settlement, tokenized deposits and real-time asset movement.” The market capitalization of the RWA sector, excluding stablecoins, is nearly $19 billion at the time of this writing. Source: RWA.XYZ

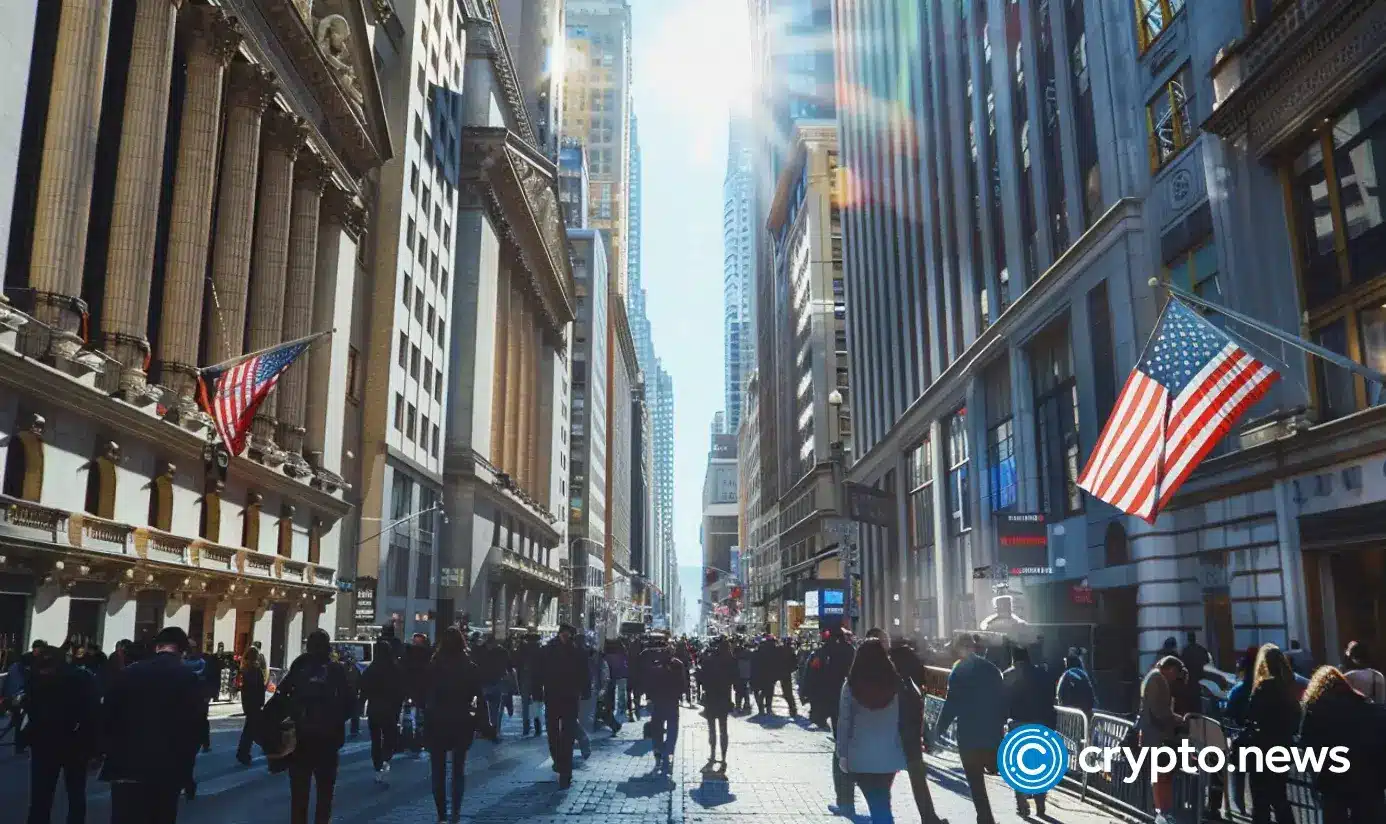

The market capitalization of the RWA sector, excluding stablecoins, is nearly $19 billion at the time of this writing. Source: RWA.XYZFinancial incumbents like Citi, Bank of America, JPMorgan Chase and others will continue to exist in a different form, Grossman said, much like media companies continued to exist after the shift to digital distribution in the late 1990s and early 2000s, which disrupted business models that worked for decades.

Ultimately, the survivors and winners of the ongoing shift toward tokenized finance will be those companies that get ahead of the change and not those that attempt to stop the inevitable shift to a global financial system powered through blockchain rails, he said.

Related: Wall Street’s $4 quadrillion backbone to roll out tokenized US Treasurys

Why tokenized assets can change the game

Tokenizing real-world assets carries several benefits, including enabling 24/7 access to markets, making asset classes global in scale, cheaper transaction costs through disintermediation, and lowering settlement times to minutes, instead of days.

In September, the United States Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) issued a joint statement on creating a regulatory framework to enable 24/7 capital markets.

The overwhelming majority of tokenized RWA value has found its home on the Ethereum network. Source: RWA.XYZ

The overwhelming majority of tokenized RWA value has found its home on the Ethereum network. Source: RWA.XYZThe financial system shifting to 24/7 trading represents a major departure from how traditional markets, which close on nights, weekends and holidays, currently operate.

In December, the Depository Trust and Clearing Corporation (DTCC), a settlement and clearing company that processed about $3.7 quadrillion in settlement volume in 2024, received approval from the SEC to start offering tokenized financial instruments.

The DTCC plans to roll out tokenized assets in the second half of 2026, starting with US Treasuries and stock indexes.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom

3 hours ago

1

3 hours ago

1

English (US) ·

English (US) ·