TradFi foreign exchange currency trading in decline as stablecoins usage surges Liam 'Akiba' Wright · 4 seconds ago

TradFi foreign exchange currency trading in decline as stablecoins usage surges Liam 'Akiba' Wright · 4 seconds ago

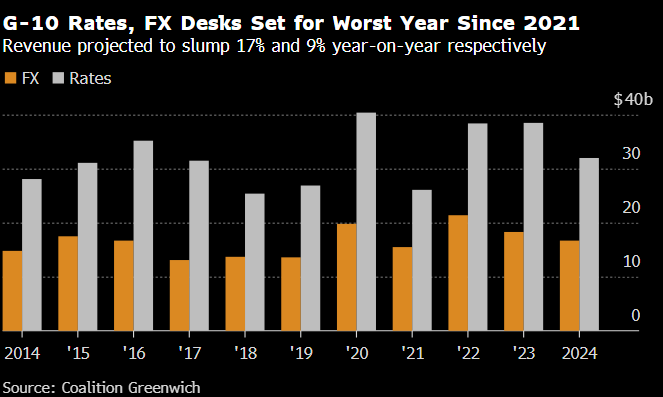

Banks are experiencing a significant decline in foreign exchange and rates trading revenue, while stablecoins are gaining traction as an alternative for cross-border transactions. Global banks are on track to report the lowest FX and rate trading revenue since before the pandemic, with projections showing a 17% year-on-year slump and a 98% decline, specifically in FX desks, according to Head of digital Assets Research at VanEck, Matthew Sigel.

FX Desks 2024 (Source: X)

FX Desks 2024 (Source: X)Meanwhile, stablecoins had a market capitalization of $188 billion as of Nov. 2024, with Tether (USDT) and USD Coin (USDC) accounting for the majority. Monthly stablecoin transactions averaged $425 billion in 2024, indicating growing adoption beyond digital asset trading. A survey found that 69% of respondents in emerging markets use stablecoins for currency substitution and 39% for cross-border payments.

Matthew Sigel noted that “Global Banks are on track to Report the Lowest Revenue from FX and Rates Trading Since Pre-Pandemic,” highlighting the impact of tighter margins and electronic trading advancements. In a thread, Sigel agreed with LondonCryptoClub that it’s “insane to think of any bank not building out a crypto desk,” emphasizing the need for adaptation in the banking sector.

The contrast between declining traditional FX revenues and the steady growth of stablecoins illustrates a shift in the financial landscape. As stablecoins offer faster and more accessible cross-border transactions, banks may have to integrate digital assets into their services to remain competitive.

English (US) ·

English (US) ·