TL;DR: Day 2 of the WFIS 2025 highlights banking disruptions, digital finance innovation, and the Philippines’ push for transparency and inclusion in the public finance sector.

- Disruptions in traditional banking models

- Modernizing public financial systems

- Building connections for startups

- Identifying steps to future-proof banks

The banking industry has been one of the first sectors to experience significant disruptions. These changes have transformed the industry from a traditional paper-based banking system to its modern form. Notable disruptions include the adoption of technological advancements such as artificial intelligence (AI), blockchain, and cloud computing, as well as the evolving consumer demand for personalized services.

Since the height of the COVID-19 pandemic, digital payments and near-instant cross-border transfers have quickly become the new normal. A study by Mastercard (NASDAQ: MA) reveals that 1 in 2 Gen Alphas have digital wallets and access to a financial account, at least in the Asia Pacific region.

These disruptions are a current trending topic at conferences such as the World Financial Innovation Series in Pasay City, Philippines, on September 24. Bankers, innovators, and even government officials explored the various factors influencing banking today and how emerging technologies are being leveraged to combat fraud, automate processes, and foster trust in the finance sector.

And just like that, the World Financial Innovation Series is a wrap!

Thanks for following our two-day coverage. We got a first-hand look at the future of FinTech, from adoption to AI governance. Follow us for all our recap articles and videos from the event.

#WFISPhilippines… pic.twitter.com/k5nzsPhmax

Modernizing the Philippines’ public finance

To kick off Day 2 of the WFIS, Sharon Almanza discussed the efforts of the Philippines Bureau of Treasury in digitalizing revenue collection and modernizing the public financial management process, as well as the treasury’s strategies to combat corruption and promote trust within the department.

“The Philippines, like many countries, continues to steer towards an economic landscape that is unpredictable… As we all know, at the turn of this decade, the world faced a generation-defining pandemic. An event that tested not only our health systems, but also the very foundations of global finance,” she said in her keynote speech.

With this, Almanza outlined the two key principles that shape their strategy: transparency and diversification.

To promote transparency, the Bureau of the Treasury ensures that its funding plans and management objectives are clearly communicated to the public. Additionally, the department aims to diversify by attracting new investors to foster a sustainable, greener economy and fulfill its obligations to the Filipino people.

“Transparency also extends to how we report back to the public. We have this allocation of impact reports; these reports are for our sustainable finance insurance, where we inform investors on how funds are used and how they support our sustainability commitments. This openness is not just about accountability, it is also about building trust,” she said.

Apart from promoting trust, Almanza shared that they are supporting digitized collections of government revenues. And as of June this year, 89% of collections from DIR and 97% of DOC collections are processed electronically, she said.

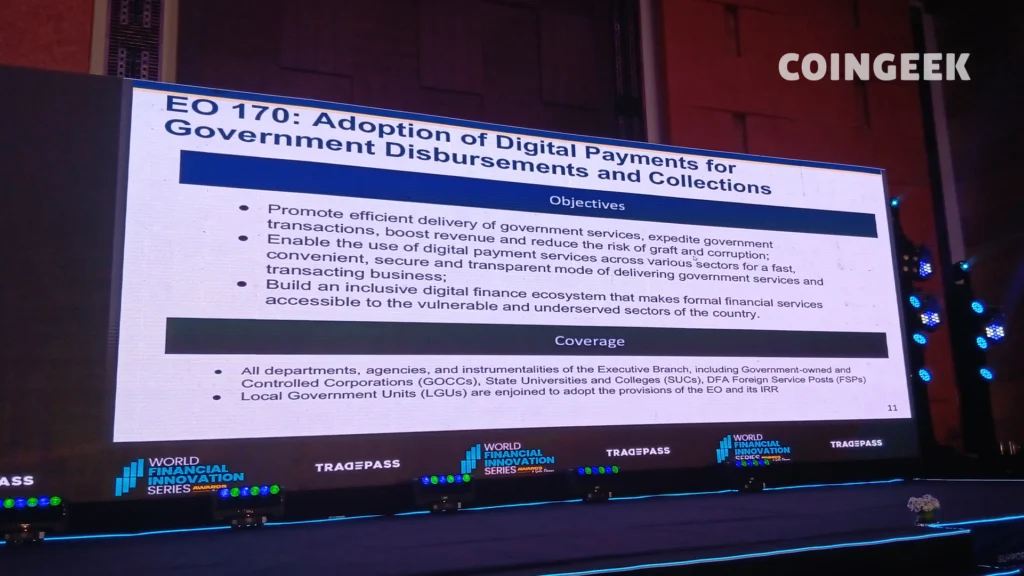

Bureau of the Treasury’s Sharon Almanza’s slide for the WFIS 2025

Bureau of the Treasury’s Sharon Almanza’s slide for the WFIS 2025“This reflects strong progress in our digitalization efforts. At the same time, the digital payments transformation roadmap 2020-2023 and the national strategy for financial inclusion 2022-2028 highlight the crucial role of digital payments in establishing a comprehensive digital financial landscape,” she explained. President Ferdinand “Bongbong” Marcos Jr. issued EO 170, mandating the use of digital payments for government disbursements and collections. This directive applies to all departments, agencies, state universities, colleges, government-owned and controlled corporations, and local government units (LGUs).

EO 170: Adoption of Digital Payments for Government Disbursements and Collections

EO 170: Adoption of Digital Payments for Government Disbursements and Collections“But our journey is far from over. The challenges we face will only grow more complex, and that is why we must remain committed to building resilient financial systems, defending our markets, and expanding access to the opportunities so that opportunities reach all Filipinos,” she said.

Startups, innovation, and establishing long-term connections in fintech

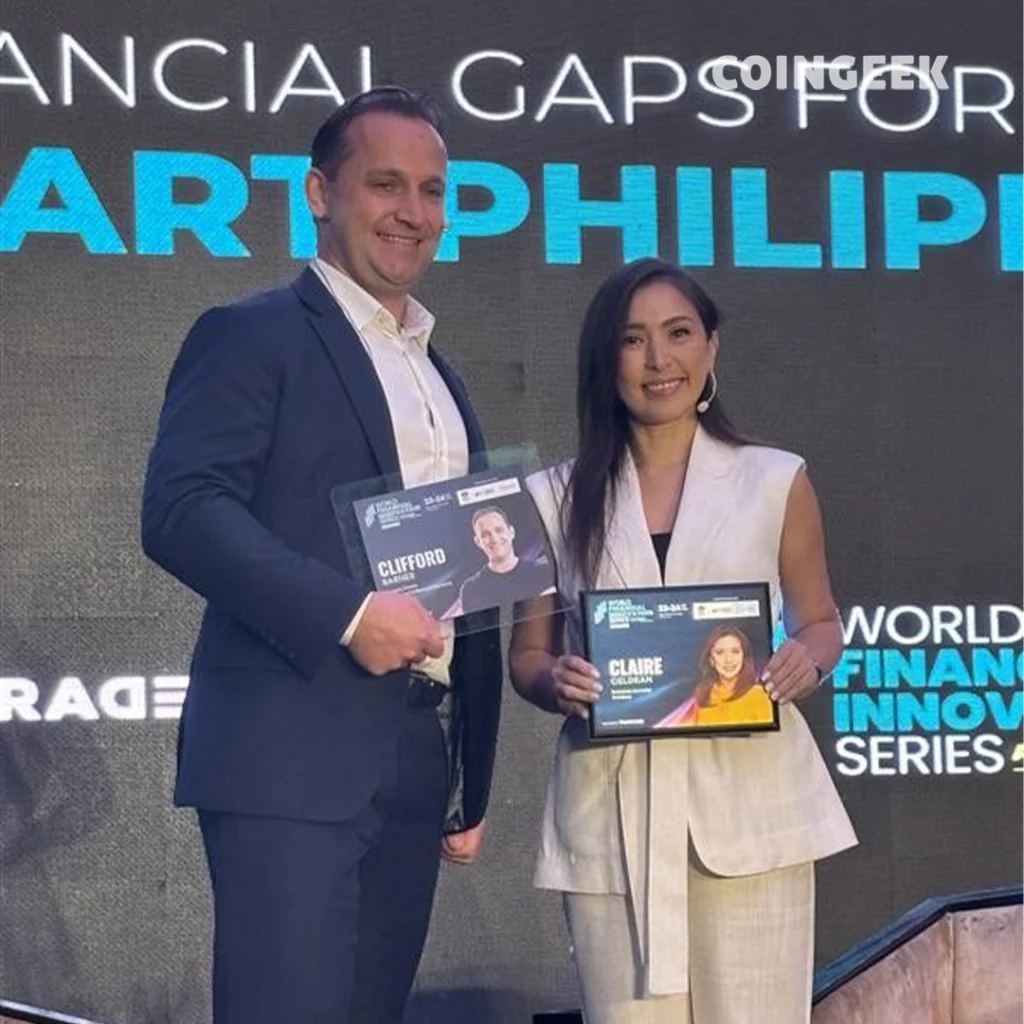

Almanza also emphasized that collaborating with reputable institutions is essential for realizing a digitalized future in finance. This topic was explored during a 15-minute fireside chat between Claire Celdran from CoinGeek and Clifford Barnes, managing director of SC Ventures at Standard Chartered (NASDAQ: SCBFF). They discussed the drive for innovation within the Philippines’ financial landscape and the partnership between traditional banks and fintech startups.

Starting this conversation is a tricky question in redefining meaningful innovation in 2025. Barnes was quick to point out that innovation must first begin with solving an actual need, such as addressing the growing number of underbanked and underserved communities in the world. “There’s no point in creating something that no one actually needs,” he expressed.

From interviews to moderating discussions: CoinGeek's @ClaireCeldran took the stage at the World Financial Innovation Series, leading a captivating fireside chat with Clifford Barnes, Managing Director of SC Ventures by Standard Chartered.

We'll be bringing you the full story… pic.twitter.com/2QHVTxraOJ

“Incumbents [and legacy banks] need to be incredibly aware of what’s going on. They need to be investing. They [still] need [to] be doing their digital transformations. And they can’t just sit back and wait,” he added.

Since 2020, Filipino adults have been embracing digital banking. A study by the Bangko Sentral ng Pilipinas (BSP) showed that 51.2% of Filipinos own bank accounts, with 25.2% of these accounts now digital. In addition, 20.1% of Filipinos use digital payments for their transactions. Ultimately, the Philippines has been a key driver of digital transformation in Asia. Returning to the fireside discussion, Celdran asked Barnes about the advantages he could see within the Philippine market, “leapfrogging” away from legacy financial systems.

In Picture (Left to right): Clifford Barnes and Claire Celdran

In Picture (Left to right): Clifford Barnes and Claire Celdran“The thing I love about emerging markets like the Philippines is they have a need,” Barnes answered. “They have a problem they need to solve… So emerging markets will be at the forefront of innovation because they have the largest need for it… And when you look at the Philippines and you look at the tech-savvy nature, it’s still quite a young population. The innovations coming from here will be quite substantial.”

Barnes also notes a significant growth in invisible banking, where banks integrate non-banking processes into users’ daily activities. “We’re seeing a huge demand for this as everyone’s fighting for a larger share, so everyone’s looking to offer more products and services to entice new customers and, of course, for retention strategies,” he said.

Barnes and Celdran discussing building connections at the WFIS 2025

Barnes and Celdran discussing building connections at the WFIS 2025Celdran and Barnes conclude their session with rapid-fire questions exploring the fintech sector.

What is the most overhyped trend in fintech right now?

Barnes: “Agentic AI. I think we’re still a very long way away from human beings allowing agentic AIs to do what it’s capable of doing. I think AI is a massive price, but specifically agentic is going to take a little bit of time…It’s there, but I don’t think we are ready to embrace its full potential.”

What is a fintech you wish more people were paying attention to?

Barnes: “Full banking stack that could both power new digital banks and revolutionize incumbent banking stats and migrate off-grid legacy cores. So, I think people should pay a bit more attention to just how powerful the tool is.”

What’s one thing you’d change about the way banks approach innovation?

Barnes: “I would remove about 15 levels of the red tape of approval to be able to actually go off and do something. I understand risk aversion, but risk is necessary for innovation.”

What is one emerging market you’re most excited about right now?

Barnes: “Obviously, the Philippines.”

Where will SC Ventures be focusing in the next 12 months?

Barnes: “Our strategy won’t change much. We’re still focused on putting a full banking stack into emerging markets like the Philippines and through the Middle East and Africa. And we’ll continue to look at new startups, new ventures, both incubating internally.”

Plans for future-ready banking

Speaking of digital transformation, the second day of WFIS 2025 also had a discussion centered on the future of banking and how the industry can adapt to the evolving global environment.

Future-Ready Banking panelists with Moderator Maria Adeliadee Capistrano

Future-Ready Banking panelists with Moderator Maria Adeliadee CapistranoModerating this panel discussion on the importance of redesigning banks’ core systems and leveraging technology was Maria Adelaidee Capistrano, the Chief Risk Officer of Maya Bank. With Capistrano were Catherine Urtola, Senior VP and Chief Compliance Officer of the Bank of China – Manila branch; Amar Laddha, Technology Product Management Associate Director of Wolters Kluwer; Sergio Ceniza, FVP and Chief Compliance Officer of Philippine Business Bank; and Atty. Guadalupelyn De Dios, SVP, Chief Compliance Officer of Mizuho Bank.

Capistrano emphasized that today, banks are becoming more interconnected—they are not just exchanging data, but are also changing norms, expectations, and identities. Rounding this off, she shared that “banks must rethink trust and redesign systems that will serve everyone.”

The pandemic forced everyone around the globe to transition from traditional bank settlements to digital counterparts, such as digital wallets, banking, and payments, Urtola mentioned. She commented that she wasn’t a fan of these digital transactions at first, but back then, we had no choice but to embrace them. Underscoring these key trends, Urtola noted that, in addition to enjoying the benefits of digital banking, regulations must also be improved.

In Picture (Left to right): Maria Adelaidee Capistrano, Catherine Urtola, Amar Laddha, Sergio Ceniza, and Atty. Guadalupelyn De Dios

In Picture (Left to right): Maria Adelaidee Capistrano, Catherine Urtola, Amar Laddha, Sergio Ceniza, and Atty. Guadalupelyn De Dios“We don’t know what kind of risks will evolve. For example, another situation like COVID, or maybe a climate situation, or the tariff impact. For all these situations, banks must be prepared, so that if you have the right technology, right solution, and strategy, you can overcome or respond quickly and adapt to these changes,” added Laddha.

As for Ceniza, changing mindsets must also be considered when developing a future-ready framework. “If the traditional banks do not adjust and keep themselves addressed to these developments, then they will lose their relevance,” he said. “If you really want to modernize, we look at the cost not as an expense, but as an investment in the future.”

“A digital-ready bank—a future-ready bank—is something that actually is still grounded here but prepared shaping for the future,” De Dios said, agreeing with Ceniza. “Using modernization to improve trust, to improve speed, and also personalization, I think that’s the baseline of banking,” Capistrano added.

CoinGeek as media partner at the WFIS 2025 Philippines

CoinGeek as media partner at the WFIS 2025 PhilippinesOverall, the panel emphasized the importance of legacy banks undergoing a digital transformation, not just in terms of technology, but also in terms of mindset and organizational culture, to future-proof the fintech sector. They also examine the risks and compliance functions involved in transitioning to modern banking systems.

The Philippines’ digital banking economy is still in its nascent stages, but insights from conferences like the WFIS lay the foundation for a better digitalized economy that seeks to combat red tape and corruption, building a better future for all Filipinos.

Watch: Philippine ingenuity sparks green innovation at Shell LiveWire 2025

English (US) ·

English (US) ·