Trump Media & Technology Group (NASDAQ: DJT), the company behind TRUTH Social and majority-owned by Donald Trump, is one of the latest publicly traded companies to announce plans to create a BTC treasury. But they’re not alone. A growing number of publicly traded companies are beginning to adopt this strategy, with some buying BTC for the first time while others are topping up the holdings in their existing treasury.

What is a BTC treasury, and how does it work?

Creating a BTC treasury isn’t a new idea. However, we’ve only recently seen a surge in public companies deploying this strategy. Beyond Trump Media, companies like GameStop (NASDAQ: GME), Tesla (NASDAQ: TSLA), and MicroStrategy (NASDAQ: MSTR) have made headlines for doing the same.

To begin with, every company has a treasury; it’s essentially the company’s war chest. The treasury department is responsible for managing cash flow, liquid assets, and investments. Traditionally, this meant cash, bonds, and other relatively stable financial instruments. However, in a BTC treasury strategy, a company swaps out a portion of those traditional reserves for BTC.

This doesn’t always mean companies are directly trading their cash reserves for BTC. Some companies are taking a more aggressive approach, actively raising capital to buy Bitcoin.

MicroStrategy popularized this approach, issuing corporate debt via convertible notes and using the proceeds to buy BTC. Others, like Trump Media, have issued new shares in addition to convertible debt to raise capital and then used that funding to acquire BTC for their treasury.

Just a few years ago, this strategy was considered reckless, financially irresponsible, and therefore suboptimal for shareholders. To be fair, many people would still tell you this is the case. But at the same time, that sentiment is not as strong as before. So why are these companies taking on what some see as an unnecessary risk to hold millions, sometimes even billions, of dollars’ worth of BTC?

Why are companies betting on bitcoin?

At this point, companies like GameStop and Trump Media are late to the party. They’re trying to capitalize on the narrative and success that pioneers in the BTC treasury space, such as MicroStrategy, built out. That being said, these newcomers are following the steps of early BTC treasury adopters because announcing a BTC treasury sends a signal to the market. It broadcasts the idea that a company is forward-thinking, embraces digital innovation, and is aligned with the values of its growing base of retail investors who care about crypto.

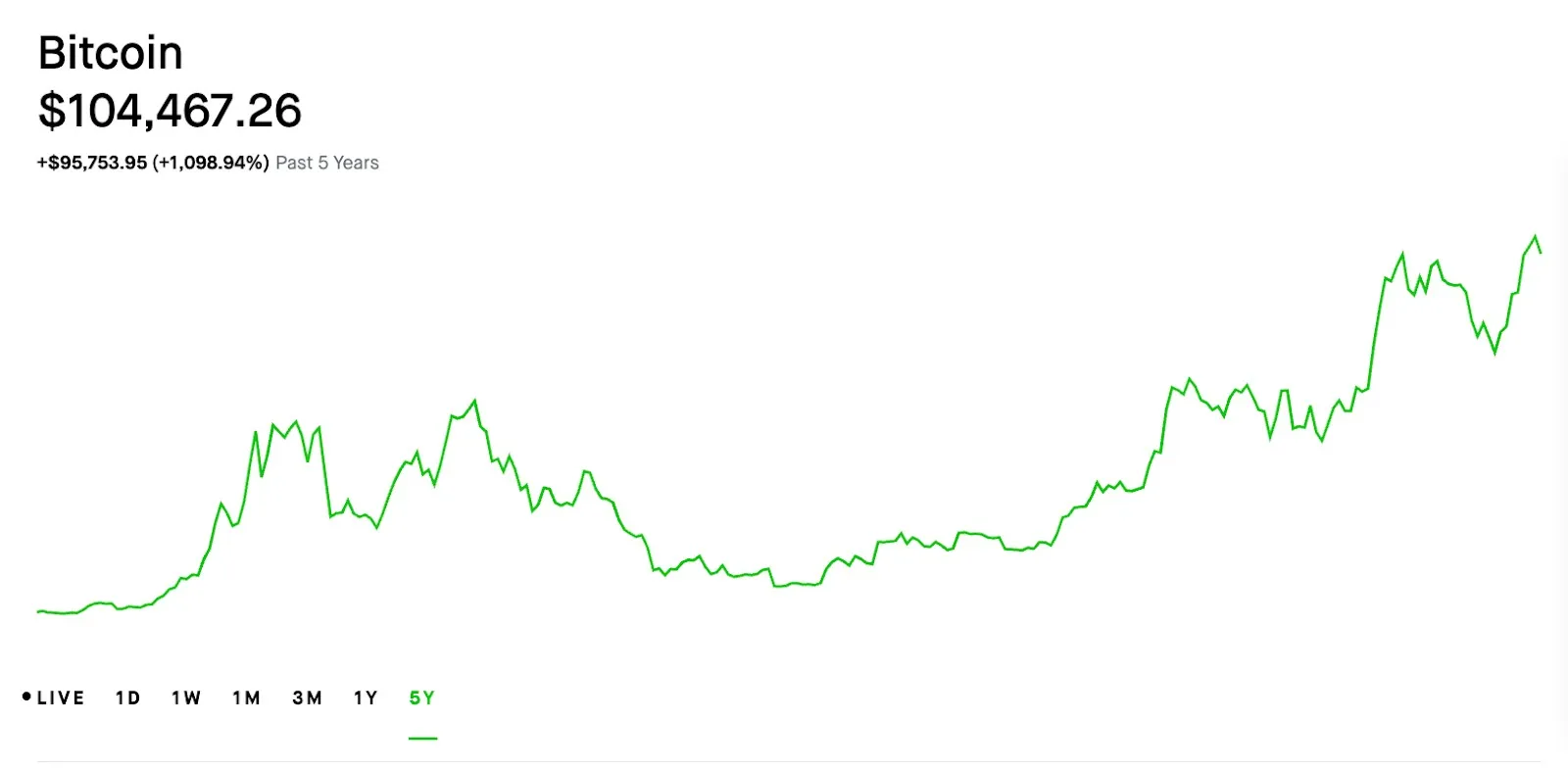

But the earlier adopters—MicroStrategy (2020), Block (formerly Square, 2020), and Tesla (2021)—most likely built their BTC treasuries because they had different motivations. Most of these companies believed the U.S. dollar was weakening, and they saw BTC as a way to protect their businesses from inflation. They believed that holding BTC was a better move than holding cash since there was a chance the digital asset would appreciate, and if that were the case, it would ultimately serve their shareholders better than holding cash.

In addition, for companies like Tesla and Block, holding BTC was also on-brand. Holding BTC, especially by a major corporation in 2020, signaled that a company was tech-forward, chasing and implementing disruptive technology.

Whether any of those motivations and incentives were actually true is debatable. Regardless, one thing quickly became clear about BTC treasuries: announcing that your company was creating a BTC treasury or topping up its BTC treasury could move stock prices.

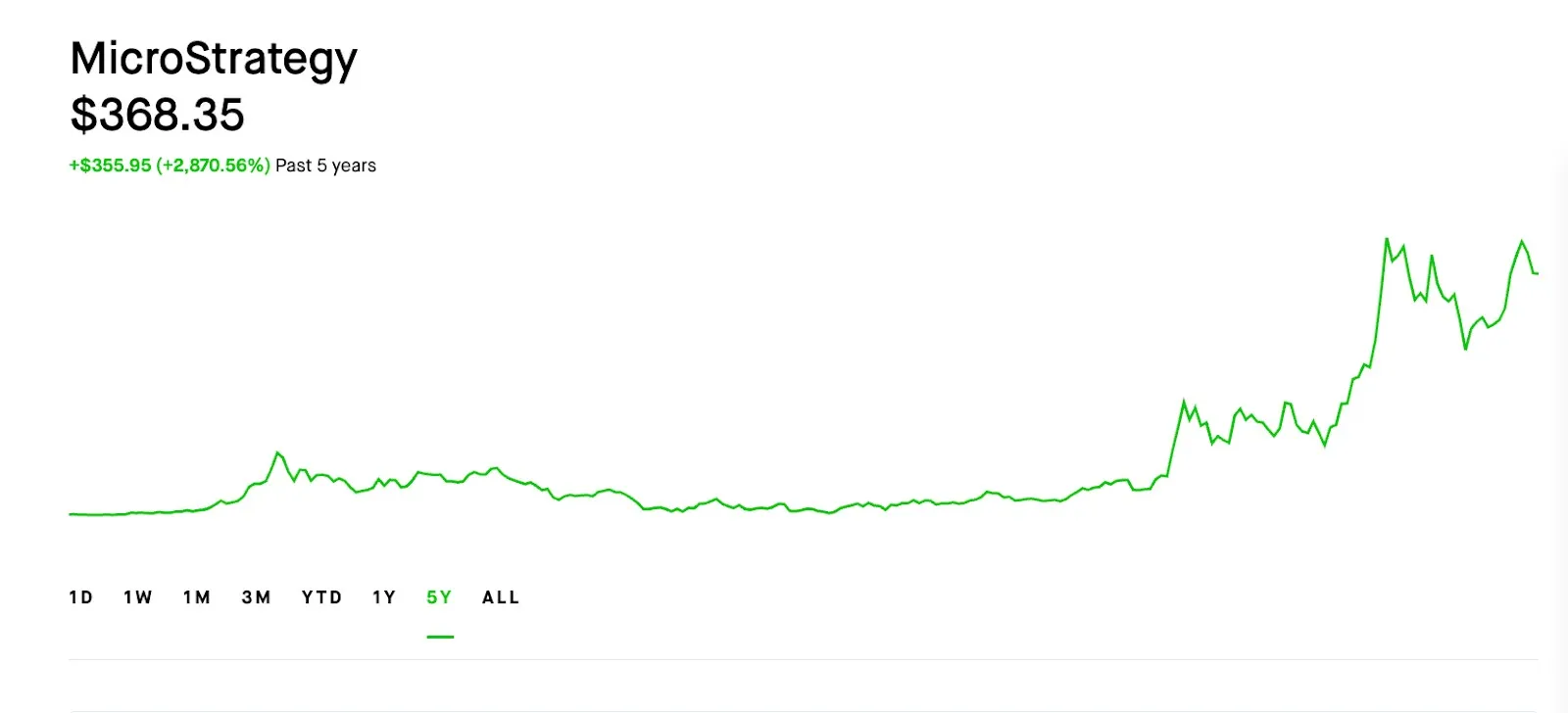

How Bitcoin fueled MicroStrategy’s 453% rally

MicroStrategy is the best-case scenario and a prime example of this treasury announcement strategy. When they announced their first BTC purchase on August 11, 2020, their stock jumped from $123.62 to $134.89 on the day—a 9% increase.

But it didn’t stop there. Each new BTC purchase from the company got more attention from the media, and that attention translated into more people buying MicroStrategy stock, creating a bit of a flywheel that ultimately led to MicroStrategy’s stock skyrocketing, climbing 453% within one year of its initial BTC purchase. During that same stretch, the price of BTC rose just 306%, which is still impressive, but not as successful as the gains MicroStrategy saw during that same period.

To be fair, part of the reason MicroStrategy had such great success has to do with timing. When they announced their BTC treasury, it was at a point in time when many accredited investors still struggled with investing in or getting exposure to digital currency due to regulations around banks and brokers dealing in crypto assets. For that reason, many accredited institutions realized they could invest in a publicly traded company with a BTC treasury—like MicroStrategy—to get exposure to digital assets indirectly. These days, direct crypto investment opportunities for accredited investors are abundant.

Beyond that unique market position, the BTC treasury was a core part of MicroStrategy’s business model, and its founder had a very high conviction in BTC as an asset and was always willing to let that be known. In other words, BTC wasn’t a side bet or something MicroStrategy was merely experimenting with; it was the core of their corporate strategy, one that they dumped billions of dollars into and just so happened to work out.

Why BTC treasuries are backfiring for some companies

With that being said, it’s not surprising that other companies are trying to replicate MicroStrategy’s approach to the BTC treasury. However, in the past year, no company has been able to replicate MicroStrategy’s success. Actually, many are seeing the announcement of a BTC treasury as having more drawbacks than advantages. When Trump Media and GameStop recently announced their own BTC treasury strategies, both companies actually saw their stock prices dip by about 2% that same day.

So what’s the difference? For starters, MicroStrategy bet big on a conviction-driven strategy aligned with the founder’s identity and beliefs. However, for GameStop and Trump Media, it felt more like a branding move, a way to appeal to their retail investor base while grabbing media attention that would help the company stay in the headlines.

GameStop and Trump Media also have the issue of scale. For these newer adopters, BTC is just a small piece of their operational strategy. In both instances, their BTC treasuries did not seem material enough to move the needle. It’s beginning to look like investors are realizing that more than they are innovative and bold strategies, they are PR stunts when it comes to BTC treasuries. From an investor’s perspective, some may even begin to consider these BTC treasury announcements as “sell the news” events.

Has the BTC treasury strategy lost its magic?

So, is the BTC treasury strategy officially played out? I wouldn’t say that the strategy is entirely played out, but it is definitely beginning to yield diminishing returns. However, that doesn’t mean the strategy is over.

The future of the BTC treasury strategy may come down to one variable: the price of BTC. If BTC surges again and companies with BTC treasuries see a corresponding jump in shareholder value, we could see another wave of announcements that the media will cover, subsequently setting off a chain reaction that could begin a hype cycle where retail investors pile into these equities, causing prices to surge, getting more media attention for their BTC treasury strategy, and creating a bit of a positive feedback loop.

But if BTC drops sharply, as it has done many times before, then the strategy could backfire. Companies that raised debt to buy BTC could be left in a position where they don’t have the funds to repay their lenders. Earlier this year, MicroStrategy reported an unrealized loss of $5.91 billion due to a drop in BTC’s price. If a smaller company follows this strategy and gets caught on the wrong side of a price swing, it could result in them having to close shop.

This leads me to believe that publicly traded companies are at a crossroads. On the one hand, BTC treasury strategies still offer branding benefits and a chance to fall into favor with a specific demographic of investors and potential business partners. On the other hand, the strategy is starting to look less like a financial move and more like a marketing gimmick, especially now that it is beginning to adversely affect stock prices post-announcement.

Watch: Bringing the Metanet to life with Teranode

English (US) ·

English (US) ·