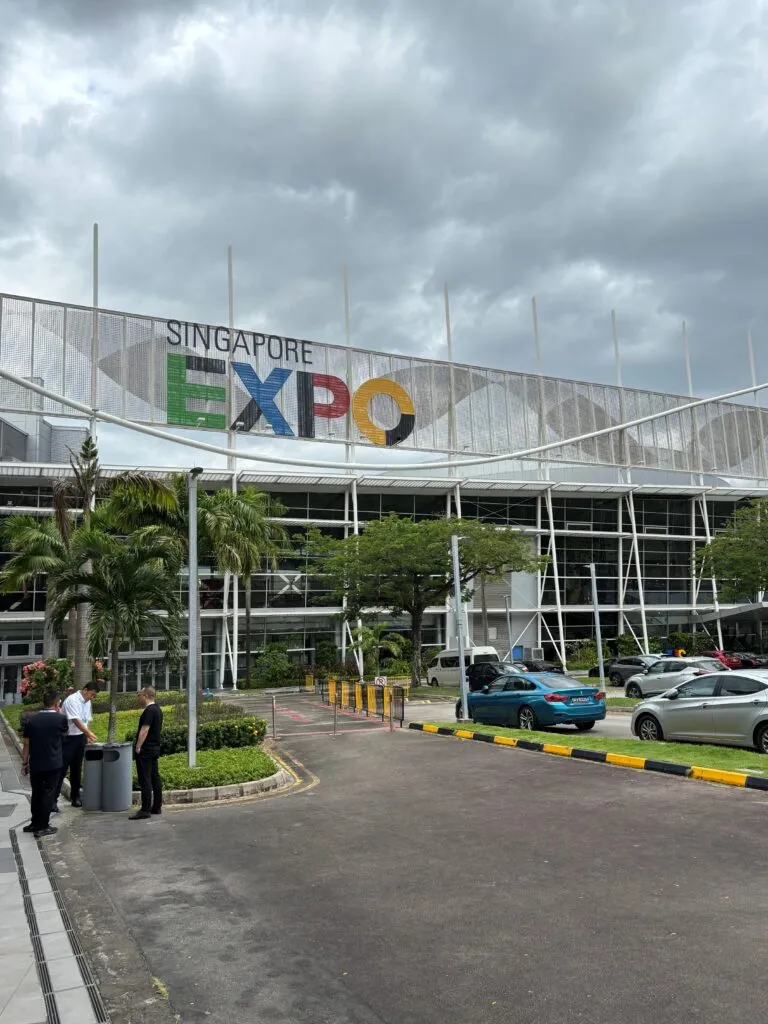

At the recent Asia Tech x Singapore Summit, a powerhouse panel of founders, investors, and innovation leaders pulled back the curtain on what it takes to build, scale, and sustain a startup in today’s volatile market.

For founders, venture capitalists (VCs), Web3 enthusiasts, and developers, their candid insights offer a valuable blueprint, not just for fundraising and expansion, but for navigating ambiguity, choosing investors wisely, and building resilience into the very DNA of a startup.

Timing, luck, and the science of fundraising

Grace Sai, co-founder of climate-tech company Unravel Carbon, kicked off the discussion by emphasizing the often-underestimated role of timing and luck in startup success.

“We just came out of Y Combinator. It was the peak of all climate regulations around the world about to open up like a…hundreds of billions of total addressable market and so we were just at the right time and place,” Sai recalled.

But while timing and market readiness played their part, Sai underscored that founders can still take a scientific approach to fundraising.

“Some of it would include having a very short condensed time to fundraise—like have a hundred chats within three weeks. And so you’re able to line up the offers to make the best decision,” she explained.

This strategy not only creates competitive tension among investors but helps founders optimize valuations and terms.

Sai’s advice is especially relevant for early-stage startups navigating Web3 and blockchain, where regulatory landscapes and adoption curves can shift rapidly.

Fundraising is just the beginning

Anuj Srivastava, founder of Livspace, shared hard-earned wisdom from raising over $400 million for his company. For Srivastava, raising capital is merely one checkpoint in a much longer journey.

“The promise is not just in raising; the promise is in creating a highly governed structure, focus on a lot of fiduciary responsibilities but making sure that we are now setting the company up for returning the money,” Srivastava said.

In today’s climate of higher scrutiny, public and private investors demand growth, capital discipline, and value creation.

Srivastava emphasized the importance of investor alignment. His cap table includes major institutional names like KKR, TPG Growth, Goldman Sachs (NASDAQ: GS), and IKEA, which bring not only capital but strategic value and global market knowledge.

The need for patient capital

While fast-scaling sectors like consumer Internet may fit the traditional venture model, deep tech, medtech, and climate tech require a fundamentally different investment approach. Kohki Sakata, CEO of IGPI Singapore, introduced the concept of “patient money”—capital willing to wait 10, 20, or even 30 years for returns.

“For our semiconductor business… we’re looking for like 10 years. But if you talk about the regional transformation, we look at 20 years, 30 years,” Sakata explained.

His firm has built specialized investment structures like ATT&CK (Advanced Technology Acceleration Corporation) to support research-based startups with longer horizons.

Srivastava agreed that fund structures must evolve: “Money has never been patient. Money should be patient. There has to be some degree of transformation… to allow value creation to happen without unnecessary stress and impatience getting created.”

For Web3 startups tackling infrastructure, artificial intelligence (AI) integration, or interoperability challenges, patient capital may prove to be one of the most critical enablers of success.

Expanding across borders: Know your strategy

Global expansion presents another set of complex challenges. Ivan Lau, co-founder of AI startup Pantheon Lab, shared his experience launching an AI company back in 2019—before “generative AI” was even a widely recognized term.

“There was literally no market… We bootstrapped with a few angels who actually saw the idea, and we just started the R&D, waiting for the market,” Lau said.

Lau’s story highlights the importance of conviction, persistence, and continuous market monitoring: “We keep looking at the signals… and if everything is aligned, then we keep bootstrapping.”

Sakata cautioned founders to avoid straddling both global and local strategies simultaneously, saying, “If you are trying to dominate one country by country, you have to take a dominant strategy… whereas if you really want to scale globally, it’s a different format.”

Srivastava added that successful global expansion often hinges on a “one-plus-one” leadership model: pairing internal talent who deeply understand the company’s ethos with local partners who understand market-specific nuances, regulations, and culture. He also stressed the importance of “investing in adequate capabilities”—building in-house legal, compliance, and finance expertise to mitigate cross-border risks.

The power—and pitfalls—of corporate partnerships

As startups mature, corporate partnerships become increasingly strategic. Sai noted that Unravel Carbon deliberately avoided corporate venture capital (CVC) money early on due to its slower decision-making processes.

“Their pace and their structures are not friendly to what an early stage company requires to just survive, right, which is speed, agility, a lot of rapid experimentations,” she said.

But at the right stage, CVCs can open doors to new markets and customer bases.

“They open up new markets. They help you sell in the new markets. They put their sales team behind your product,” Sai explained.

Sakata advocates for a more integrated partnership model that connects startups with conglomerates and academia. His ATT&CK platform serves as a bridge between research institutions, startups, and large corporations to co-develop technology at scale.

As for Srivastava, he advised founders to approach corporate partnerships with clear expectations and formalized agreements.

“You’re kind of making a promise to each other… deeply think about the promise that you are making to each other and reflect that in the terms or conditions or term sheets.”

Final takeaways: Grit, vision, and learning velocity

The panel closed with rapid-fire advice for founders. Sai emphasized the importance of market selection: “Find a market that is big enough and a problem that you know you have a special insight into, and that makes you the best person to solve for.”

Lau urged founders to stay persistent but also adaptive: “Stick to what you believe in…but learn the feedback.”

Srivastava offered a final framework for founders navigating the uncertainty of startup life: “A high degree of first principle problem solving, high emotional quotient, ambiguity quotient—and the learning velocity, which is the ability for someone to actually learn really quickly on the job.”

In today’s fast-evolving Web3 and tech landscape, these principles may well separate the startups that thrive from those that stall.

Watch | Block Dojo’s success stories: Transforming legacy businesses & future of travel tech

English (US) ·

English (US) ·