content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

The US Department of the Treasury and the Internal Revenue Service (IRS) have formally scrapped a controversial crypto rule that would have mandated decentralized exchanges to comply with broker reporting obligations.

US Treasury, IRS Drop Crypto Broker Rule

On Thursday, the US Department of the Treasury and the IRS officially revoked the crypto broker rules that required decentralized exchanges and protocols to report detailed customer data to the tax agency.

The rule was originally proposed in November 2021 through the Infrastructure Investment and Jobs Act, aiming to close the “tax gap” by broadening the definition of “brokers” to include crypto exchanges and other intermediaries.

At the end of the Biden administration, the IRS finalized the rule, expanding the definition of a “broker” while requiring DeFi platforms to report proceeds from digital asset transactions and detail user transaction information, including names and addresses.

As reported by Bitcoinist, the regulation was set to take full effect in 2027 but faced heavy criticism. Industry players considered the policy to be “unworkable” and an overreach, noting that the “arbitrary” definition of a “broker” was too broad, and many market participants didn’t have access to the data the agency was requesting.

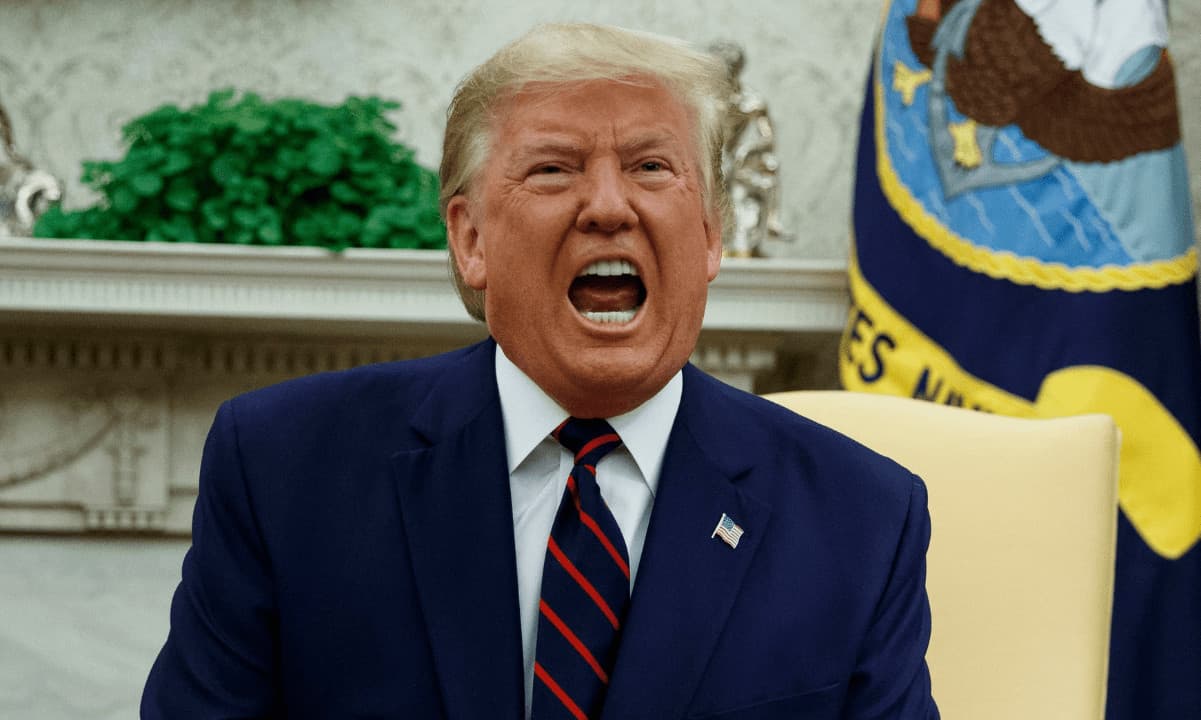

In March, Congress passed a joint resolution under the Congressional Review Act (CRA) disapproving of the final rule. The resolution, titled “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales,” was signed by President Donald Trump in April, becoming the first crypto bill signed by a US president.

Starting July 11, 2025, this crypto broker rule has no legal force or effect, as the Treasury Department and the IRS have removed it from the Code of Federal Regulations (CFR) and reverted the relevant text of the CFR to the text that was in effect before the final rule.

The federal agencies noted that the CFR change was made to reflect the accomplishments already achieved through congressional and presidential action. “Accordingly, the Treasury Department and the IRS are not soliciting comments on this action, nor are they delaying the effective date,” the revocation reads.

Shift From Biden-Era Regulation

The rule’s removal follows the regulatory shift under President Trump, who has vowed to turn America into the “crypto capital of the world.” Amid this process, other federal agencies have revoked other Biden-era rules and guidance.

In May, the US Department of Labor (DOL) rescinded its 2022 guidance, which discouraged fiduciaries from including digital asset investments in 401(k) retirement plans. The direction, issued in March 2022, followed Biden’s executive order that required the government to assess the risks and benefits of digital assets.

“We’re rolling back this overreach and making it clear that investment decisions should be made by fiduciaries, not DC bureaucrats,” US Secretary of Labor Lori Chavez-DeRemer explained.

In June, the US Federal Reserve (Fed) announced it had updated its approach to bank examinations to remove “reputational risk” from its guidelines, easing crypto firms’ access to traditional banking.

Meanwhile, the Securities and Exchange Commission (SEC) and the Department of Justice (DOJ) have disbanded their crypto enforcement-focused units and changed their long-criticized “regulation by enforcement” approach.

Notably, Congress is also working to advance the highly anticipated crypto framework, pushing for approval of the stablecoin bill, the GENIUS Act, and the market structure legislation, the CLARITY Act, which will be the focus during the upcoming “Crypto Week.”

Featured Image from Unsplash.com, Chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

English (US) ·

English (US) ·