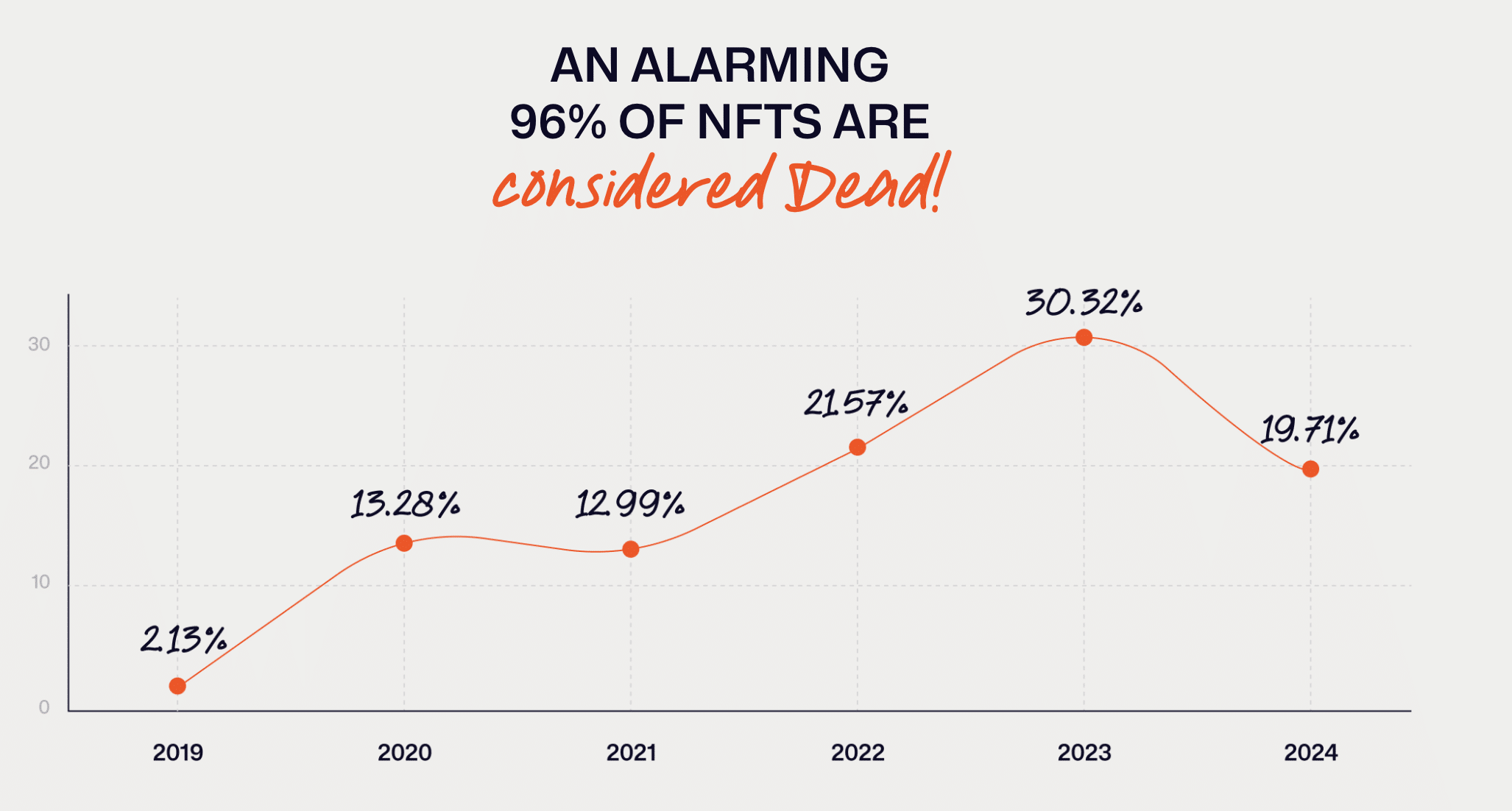

NFT Evening analysts say 96% of 5,000 NFT collections are dead in 2024.

The report reveals the state of the non-fungible token market and its problems in 2024. According to experts, 96% of more than 5,000 existing NFT collections are “dead.” This means that they have zero trading volume, no sales for more than seven days, and no activity on the X social network.

Source: NFT Evening

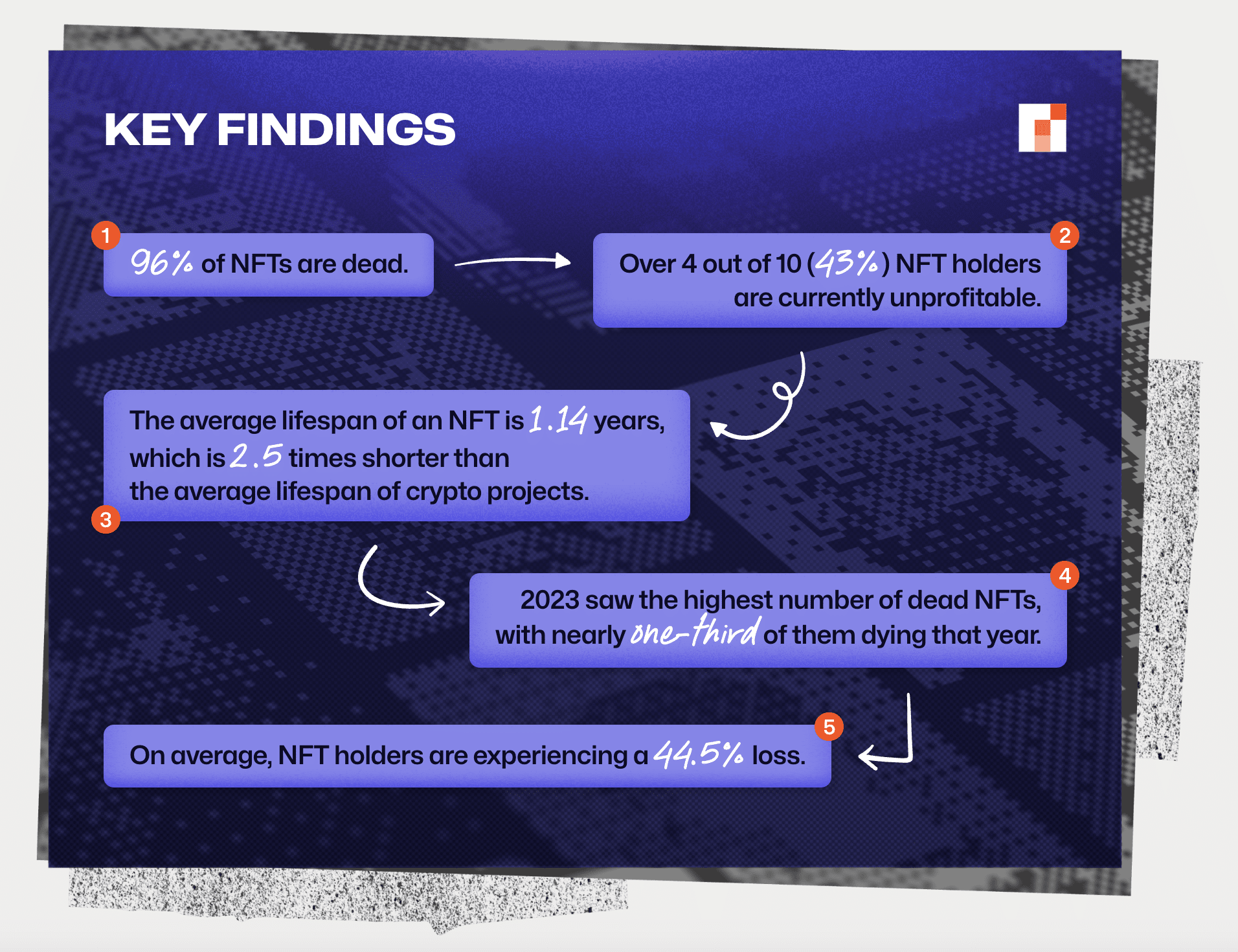

Source: NFT EveningAnalysts note that 4 out of 10 NFT owners currently need to make a profit from their tokens. At the same time, the average lifespan of collections is 1.14 years. This is 2.5 times less than the same indicator for classic crypto projects.

In addition, 2023 was a record year for the number of NFT collapses. During this period, almost 30% of projects from this segment fell into the “dead” category. According to experts, 44.5% of NFT owners face losses.

Source: NFT Evening

Source: NFT EveningThe NFT Evening team also identified the most profitable collection to date. It turned out to be the Azuki project, which, on average, increased the investments of token owners by 2.3 times.

“This success can be attributed to the collection’s strong community engagement, unique artistic appeal, and effective marketing strategies.”

The experts also mentioned the most unprofitable NFT collection — Pudgy Penguins. It experienced a 97% drop in value, which makes it the current record holder for a decrease in owner income.

Experts emphasized that the non-fungible token market has declined, and investors in the segment must act cautiously. In addition, experts believe NFT creators should reconsider their approach to project implementation.

End of an Era

NFTs from popular collections bought on the wave of excitement in 2022 are sold at colossal losses.

For example, Arkham Intelligence calculated that NFTs purchased by pop star Justin Bieber in 2022 worth about $2 million are now worth just over $100,000. The losses reached 94.7%.

Justin Bieber NFT Purchases: Down 94.7%

Did you know that Justin Bieber bought more than $2M of NFTs during 2022 – now worth barely over $100K.

His wallet on Arkham now holds just under $500K in ETH and APE.

Details below: pic.twitter.com/U6qH84C3OO

The singer’s wallet initially received $2.34 million in Ethereum (ETH). Most of the amount, $1.86 million, went to purchase two Bored Ape Yacht Club (BAYC) and a pair of Mutant Ape Yacht Club (MAYC). The portfolio also included tokens from the World of Women, Doodles, Otherdeed, and Metacard collections. Since then, the assets have lost between 89.7% and 97.4% in value.

In addition, in August, Deepak Thapliyal, the owner of the most expensive CryptoPunk #5822, who purchased the token for 8,000 ETH ($23.7 million at the time of the transaction) in 2022, got rid of the asset without disclosing the sale price. Amidst the excitement in the sector, the deal became the fourth most expensive among all NFTs in 2022.

End of an Era.

👋 #5822, Enjoy your new 🏡

The community suspected that the token was sold at a loss. The buyer was allegedly user X, who goes by the nickname VOMBATUS. The token was reportedly purchased for 1,500 ETH (~$3.9 million), 80% cheaper than the previous price.

The Rise and Fall of OpenSea

In January 2022, the total volume of non-fungible tokens peaked at over $6 billion. As of July 2024, it had fallen below $430 million. NFTs are still alive, but they are in a bad way.

OpenSea, once the largest NFT marketplace, is in an even worse situation, The Verge notes that claims from the Securities and Exchange Commission and the Federal Trade Commission, U.S. and international tax authorities, increased competition, allegations of discrimination, and employee layoffs.

In addition, OpenSea‘s valuation fell from $13.3 billion to $1.4 billion after one of its largest investors, New York venture capital firm Coatue Management, overvalued its stake in the crypto startup by 90%, from $120 million to $13 million.

However, The Verge notes that the company still has some steam left. An internal document shows that as of November 2023, OpenSea had $438 million and $45 million in crypto reserves. It expects that with this capital and a new business model, it will be able to overcome difficult times.

“It had $438 million in cash and $45 million in crypto reserves as of November 2023, according to an internal document, and it’s coasting on that capital as it hopes a ‘2.0’ pivot will help it navigate choppy seas.”

What will happen to the NFT market?

The NFT market has long been limited to marketplaces like OpenSea or Rarible, where users can issue new NFTs or trade them with others.

There are lending services or platforms for trading derivatives on NFTs from large collections, allowing users to speculate on NFTs without owning them.

However, the bearish dynamics in the non-fungible token market persist, as evidenced by the rapid decline in prices of NFTs from the blue chip collections.

English (US) ·

English (US) ·