Dogwifhat price has surged by over 250% from its lowest point in April and formed a rare pattern that points to more gains in the coming weeks.

Dogwifhat (WIF) rose to $1.0142 on Tuesday as Bitcoin (BTC), altcoins, and the stock market rallied. This surge pushed its market cap to $1.01 billion, making it the fourth-biggest Solana meme coin after Trump, Bonk, and Fartcoin.

WIF has strong technicals and fundamentals that may support further upside in the coming weeks. First, Santiment data shows that network growth surged from Monday’s low of 1,690 to over 5,000. This metric tracks the number of new addresses created daily.

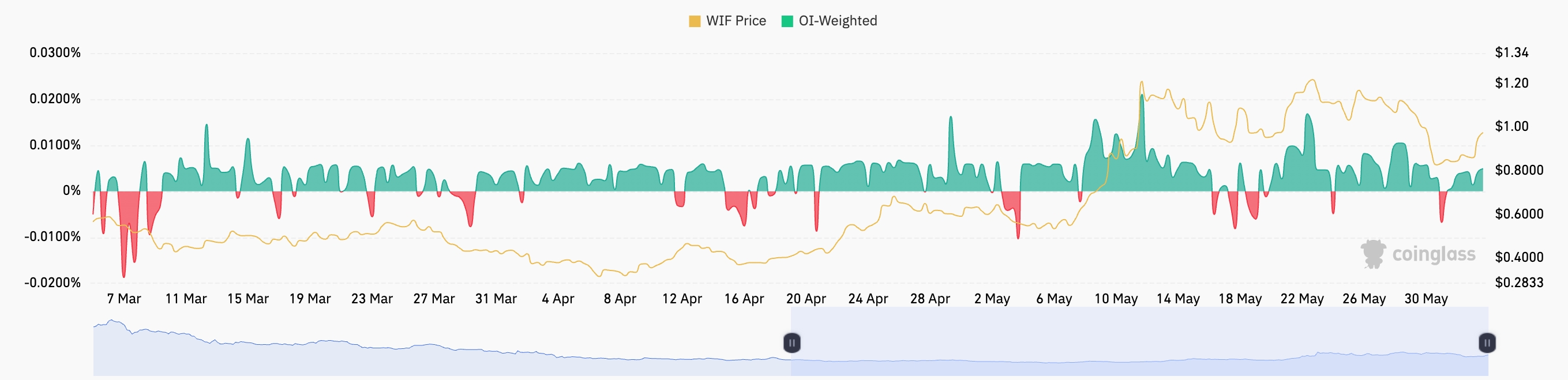

Second, WIF’s funding rate turned positive after dipping into negative territory on June 1. A positive funding rate signals that traders are increasingly optimistic about the coin’s near-term performance.

WIF exchange inflow and outflow | Source: CoinGlass

WIF exchange inflow and outflow | Source: CoinGlassAdditional data from SolScan shows that the number of WIF holders has climbed steadily to over 236,000, indicating rising demand and investor confidence.

Moreover, WIF’s inflow/outflow ratio has turned negative over the past two days, suggesting that more investors are withdrawing their tokens from exchanges—a sign they may be preparing to hold as the price climbs. Futures open interest has also increased for two consecutive days, reaching $398 million.

WIF price technical analysis

WIF price chart | Source: crypto.news

Technical analysis indicates that WIF may have more room to run after forming a cup-and-handle pattern on the daily chart. The lower side of the cup was at $0.3185, the low from April 8, while the upper boundary sits at $1.3472, giving the cup a depth of approximately 76%.

The recent pullback from $1.3473 to a low of $0.7825 formed the handle portion of the pattern. Applying the same depth as the cup from the upper resistance suggests a price target of $2.3885, which would represent a 130% increase from current levels.

![11 Best Crypto & Bitcoin Casinos in Australia [2025]](https://coincheckup.com/blog/wp-content/uploads/best-crypto-and-bitcoin-casinos-in-australia-coincheckup-1024x576.png)

English (US) ·

English (US) ·