Key Notes

- Zcash (ZEC) rebounded 3% to $611 after Saturday’s 4% correction halted its eight-day winning streak.

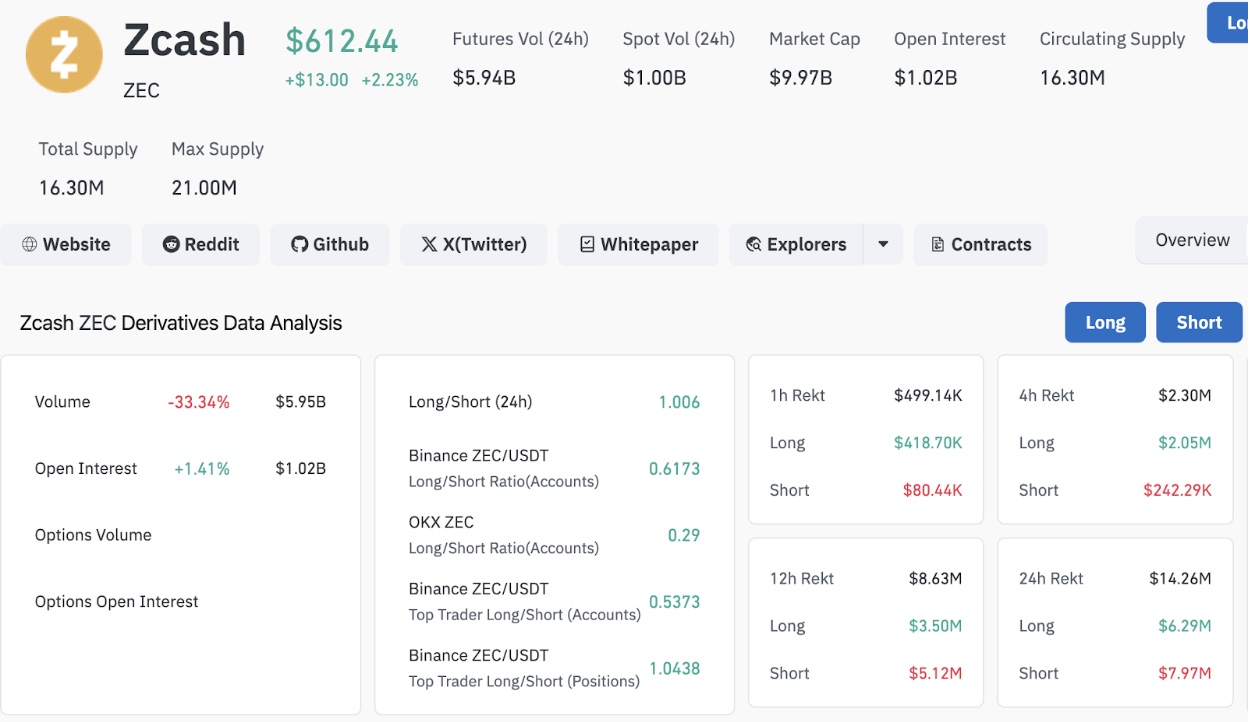

- Open interest in ZEC futures crossed $1 billion, signaling heightened speculative activity and potential volatility.

- Technical indicators show mixed momentum as bulls and bears position for control following a 90% rally in early November.

Zcash (ZEC) rebounded 3% to settle at $611 on Sunday, November 10, reversing part of Saturday’s 4% decline that ended an eight-day winning streak. Over the first eight days of November, ZEC soared nearly 90%, defying broader market turbulence as Bitcoin and Ethereum dropped to multi-month lows.

The brief ZEC price correction failed to dampen enthusiasm among speculative traders. Open interest in Zcash derivatives surged past $1 billion on Sunday, with a 1.4% increase in 24 hours, equivalent to roughly $14 million in fresh long and short positions.

However, the long-to-short ratio, finely balanced 1.006, reflects that latest inflows were evenly split between bulls expecting another leg higher and bears betting on exhaustion after the recent pause. The ZEC near-time price outlook remains uncertain, as traders now await fresh macroeconomic cues for the week ahead.

Zcash Price Forecast: Can ZEC Sustain Its 90% November Surge?

Zcash price action shows signs of consolidation following its steep early-month rally. The daily chart reveals ZEC trading within the upper Bollinger Band range, with prices hovering around $610, slightly below the $667 upper band resistance.

The MACD remains in bullish territory, with the blue line still positioned above the signal line at 101.55 versus 82.91, indicating that underlying momentum remains constructive but is at risk of fading if volume weakens. The flattening histogram suggests diminishing buying pressure after the recent parabolic move.

Zcash (ZEC) Technical Price Forecast | Source: TradingView

Meanwhile, the Money Flow Index (MFI) reads 71.17, just above the overbought mark, implying that inflows remain strong but may soon weaken as traders take profit or rotate positions. A sustained reading above 70 typically precedes short-term corrections or sideways consolidation phases.

On the upside, a clean daily close above $667 would confirm continuation and open a path for Zcash price to approach $750, followed by $820 as the next key upside price target.

Conversely, failure to defend the $560–$580 zone, near the midline of the Bollinger Bands, would expose ZEC price to deeper retracements toward $500.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Altcoin News, Cryptocurrency News, News

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

English (US) ·

English (US) ·