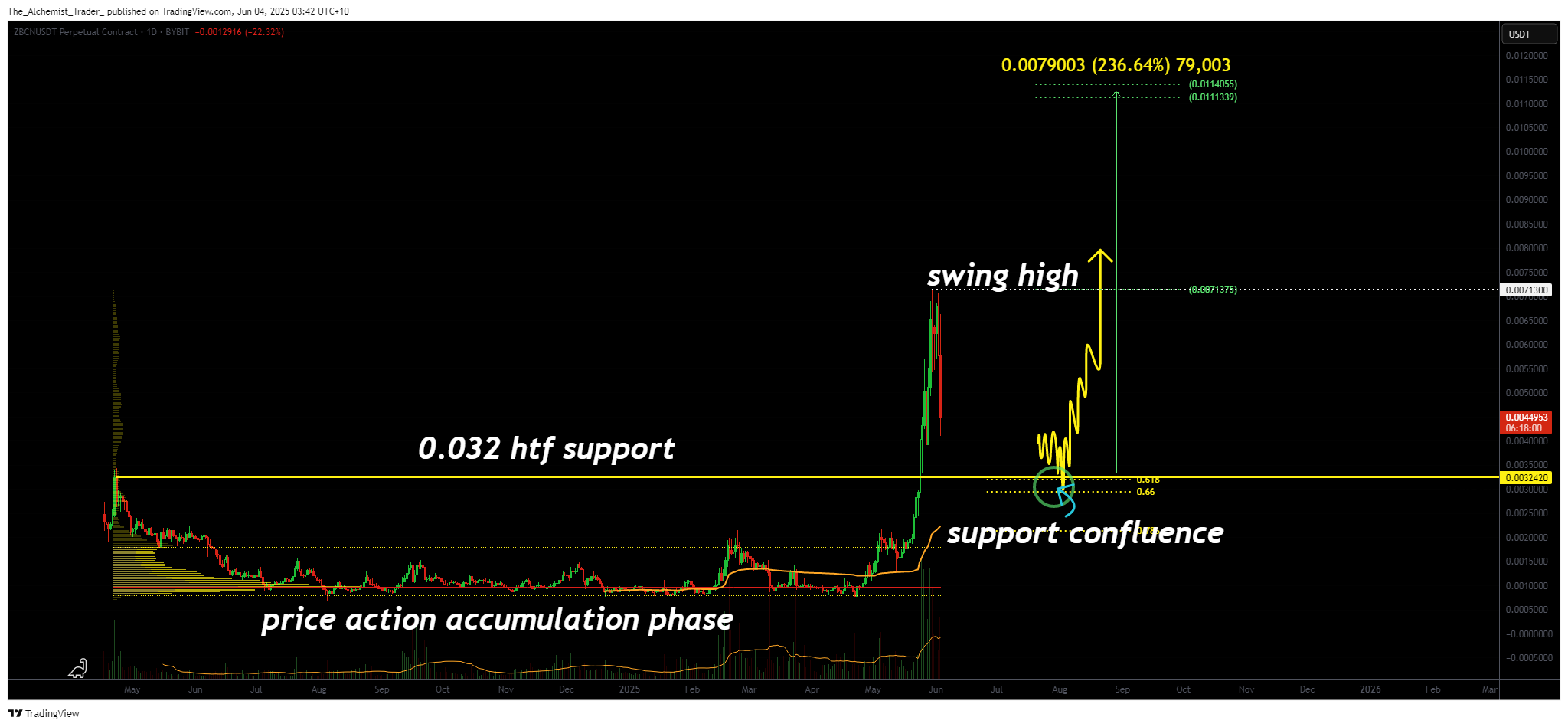

Zebec Network has posted a powerful bullish breakout after a prolonged accumulation phase, and the technical structure now suggests the potential for a major rally continuation. With key support levels now flipped and strong volume backing the move, this could mark the beginning of a significant upside expansion.

Zebec Network (ZBCN) has transitioned from a long-standing consolidation into a bullish expansion phase. After trading within a tight range, price action finally broke above high-timeframe resistance, initiating a strong breakout supported by volume surges and bullish engulfing candles. This momentum shift has attracted trader interest, with eyes now on higher extension targets.

Key technical points

- Accumulation Breakout: Price broke out of a long-term consolidation range, confirming a structural shift.

- Support at 0.032: This level is now a critical area of interest, having flipped from resistance to support.

- Confluence Zone: 0.032 aligns with the 0.618 Fibonacci retracement and VWAP SR, forming a strong technical base.

- Fibonacci Extension Target: A projected move suggests up to 236% gain based on a measured extension from the current swing high.

- Volume Confirmation: Sustained volume is key to validating bullish continuation from this level.

ZBCNUSDT (1D) Chart, Source: TradingView

ZBCNUSDT (1D) Chart, Source: TradingViewThe breakout above the $0.032 level is more than a technical milestone, it represents a psychological shift. This zone, previously a ceiling for price action, has now flipped to act as solid support, bolstered by multiple technical confluences. The 0.618 Fibonacci retracement, a key trend continuation level, adds further validation. In addition, the VWAP SR in the same zone confirms this as a high-probability area for bullish defense.

The rally has now established a new swing high, enabling traders to use Fibonacci extensions to forecast potential upside. Based on this structure, a 236% rally from current levels is in focus—a target derived from measured moves off the base of the prior accumulation range.

What remains critical is how volume behaves. Continued high volume at elevated price levels would confirm strong market conviction and support further bullish momentum. Conversely, a sharp decline in volume may signal potential exhaustion or distribution, making it important to monitor closely.

What to expect in the coming price action

If ZBCN maintains support above $0.032 and volume remains elevated, a move toward the Fibonacci extension target becomes increasingly likely. Continuation toward new highs will depend on sustained buyer commitment at each resistance level as price climbs.

![11 Best Crypto & Bitcoin Casinos in Australia [2025]](https://coincheckup.com/blog/wp-content/uploads/best-crypto-and-bitcoin-casinos-in-australia-coincheckup-1024x576.png)

English (US) ·

English (US) ·