Are you looking to invest in cryptocurrencies but unsure which one to buy? With so many options available, it can be overwhelming to decide how to invest your money. That’s why we’ve compiled a list of the best crypto to buy now, based on factors such as project developments, price performance, and market capitalization, as well as the overall potential for growth.

In this article, we’ll take a closer look at the most promising cryptocurrencies, including staples such as Bitcoin and Ethereum, and a combination of several other promising crypto projects. We’ll discuss their features, advantages, and potential drawbacks, as well as provide insights into market trends. Whether you’re a seasoned investor or just starting out, this article will help you make an informed decision about the best crypto to buy now.

So, let’s dive in and explore the best cryptocurrencies to invest in February 2025:

- Litecoin – Silver to Bitcoin’s gold

- GMX – Decentralized derivatives exchange

- Bitcoin – The world’s oldest and largest crypto

- Ethereum – The leading DeFi and smart contract platform

- Kava – The first decentralized AI network

- Jupiter – A leading DeFi aggregator on Solana

- Hedera – Crypto network based on the Hashgraph algorithm

- Solana – Smart contracts platform with high speeds and low fees

- XRP – The leading crypto remittance solution

- Cardano – One of the largest blockchain ecosystems

- Chainlink – A decentralized oracle network

- Bitget Token – Cryptocurrency utilized by the popular Bitget exchange

The 12 best cryptos to buy right now: Discover top investments for February 2025

The following three cryptocurrency projects highlight our investment selection thanks to important developments and upcoming events that make them especially interesting to follow in the near future. These projects are updated each week based on the most recent developments and trends taking place in the crypto market.

1. Litecoin

Litecoin is a peer-to-peer digital cryptocurrency that was created in 2011 by Charlie Lee, a former Google engineer. It was designed to be a faster and more lightweight alternative to Bitcoin. One of the main advantages of Litecoin is its faster transaction processing times compared to Bitcoin. Litecoin transactions are processed in approximately 2.5 minutes, compared to Bitcoin’s average block time of 10 minutes. This allows for faster confirmation of transactions and potentially higher transaction throughput.

Litecoin also uses a different mining algorithm than Bitcoin, known as Scrypt, which is designed to be more memory-intensive and less susceptible to centralized mining. This means that Litecoin can be mined using standard consumer-grade hardware, whereas Bitcoin mining requires specialized equipment and significant energy consumption.

Why Litecoin?

Litecoin (LTC) has taken the crypto market by storm, posting a +19% gain in the past week—making it the largest gainer among major cryptocurrencies. Historically known as the “silver to Bitcoin’s gold,” Litecoin has always been a solid performer, but its recent price action signals a potential shift.

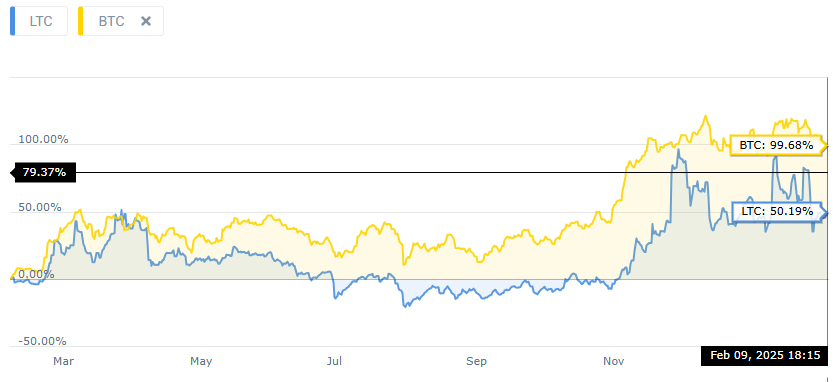

What makes this rally particularly interesting is how Litecoin is significantly lagging behind Bitcoin on the 1-year chart. This performance gap could indicate that LTC is just beginning to catch up with other major cryptocurrencies that have already recorded substantial gains during the current bull run. If past market cycles are anything to go by, Litecoin’s surge might just be getting started.

Bitcoin has recorded nearly double the gains of Litecoin over the last 12 months. Source: CoinCodex

Bitcoin has recorded nearly double the gains of Litecoin over the last 12 months. Source: CoinCodexAdding to the optimism, recent developments have further bolstered Litecoin’s prospects. The cryptocurrency has seen heightened whale activity, with significant transactions suggesting increased interest from large investors. Additionally, speculation around the approval of a Litecoin exchange-traded fund (ETF) has intensified, especially following regulatory shifts that favor such financial products.

2. GMX

GMX is the native utility and governance token of the GMX decentralized trading platform, which offers a secure and efficient environment for trading cryptocurrency derivatives. Built on Arbitrum and Avalanche, GMX provides users with perpetual futures contracts and spot trading with low fees, deep liquidity, and minimal price impact. The platform leverages an innovative multi-asset liquidity pool (GLP) to facilitate trades and maintain market stability.

Token holders benefit from staking rewards, which include a combination of protocol fees in ETH or AVAX and esGMX tokens, further aligning incentives between traders and long-term holders. As a governance token, GMX empowers its holders to participate in governance decisions. In addition, GMX holders gain access to a share of the platform’s trading fees, creating a sustainable reward mechanism. This dual purpose—combining utility and governance—helps GMX stand out in the rapidly evolving decentralized finance (DeFi) space.

Why GMX?

GMX is riding high after a flurry of recent updates that have caught the attention of investors. Not only did GMX slash trading fees across all markets, but it also unveiled its ambitious 2025 development plan and introduced several new features and listings. Among the highlights are the integration of gmBTC-USD and gmETH-USD pools into Venus, and the launch of GMX-Solana, which strengthens the platform’s position in the ever-growing DeFi space.

The market has responded with enthusiasm, propelling GMX to the top of the gainer charts with an impressive +43% rally in just the past week. With its commitment to continuous development and the rollout of AI-powered solutions like Kudai, GMX is positioning itself as a leader in the evolving decentralized finance landscape.

Furthermore, GMX’s recent proposal to change its revenue distribution model has entered the on-chain voting stage, aiming to enhance the long-term value of the GMX token. This move reflects the platform’s dedication to aligning with community interests and ensuring sustainable growth. As decentralized exchanges gain traction, GMX’s user-centric approach and innovative features make it a standout contender in the DeFi arena.

3. Bitcoin

Bitcoin (BTC) is the original decentralized digital currency, enabling peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. It was created in 2009 by an unknown person or group of people using the pseudonym Satoshi Nakamoto. Bitcoin was the first digital currency to eliminate the double spending problem without resorting to any central intermediaries.

Bitcoin transactions are recorded on a public ledger called the blockchain, which is maintained by a network of computers around the world. This means that the transactions are secure and transparent, as anyone can view them, but they are also anonymous, as the identity of the participants in the transaction is not revealed.

Bitcoin is often referred to as “digital gold” or a store of value, as it has a limited supply of 21 million coins, and its value is determined by market demand. Some people also see it as a hedge against inflation or a way to diversify their investment portfolio. It is by far the largest cryptocurrency by market cap in the industry, accounting for the value of more than 50% of all digital assets in circulation combined, making it arguably the most popular crypto to buy.

Why Bitcoin?

Bitcoin remains the bellwether of the cryptocurrency market. As the saying goes, “If Bitcoin doesn’t go up, neither does anything else.” In times of economic uncertainty, Bitcoin’s performance often dictates the broader market trend, and recent market reactions to global tariff threats and economic unpredictability have reinforced this notion.

Despite facing some headwinds, Bitcoin’s historical resilience in similar situations suggests that it could be gearing up for a strong rebound. Given its dominance in the market of more than 60% and unparalleled adoption rate, Bitcoin continues to be a must-watch asset for any crypto investor.

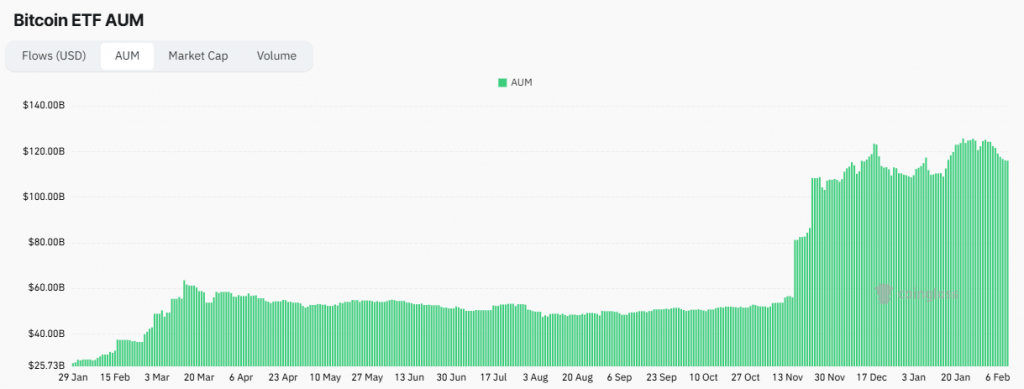

The total Bitcoin spot ETF AUM has surpassed $120 billion, which speaks to significant interest from institutional investors. Source: Coinglass

The total Bitcoin spot ETF AUM has surpassed $120 billion, which speaks to significant interest from institutional investors. Source: CoinglassRecent developments further underscore Bitcoin’s prominence. The cryptocurrency has surpassed the $97,000 mark, reflecting renewed investor confidence. Additionally, major institutions, including U.S. foundations and university endowments, are ramping up their exposure to cryptocurrencies, with Bitcoin being a primary focus. This institutional interest not only validates Bitcoin’s status as a digital asset but also suggests potential for further growth as it becomes increasingly integrated into traditional financial portfolios.

2. Ethereum

Launched in 2015 by Vitalik Buterin and a team of developers, Ethereum is a decentralized, open-source blockchain platform that allows developers to build decentralized applications (dApps) and smart contracts.

Ethereum has a wide range of use cases beyond just a store of value or medium of exchange. Ethereum’s smart contract functionality allows developers to build dApps that can run without the need for intermediaries, like centralized servers or institutions.

The Ethereum platform has gained widespread adoption and has become the backbone of the decentralized finance (DeFi) industry. DeFi applications built on Ethereum allow users to access financial services without relying on traditional banks or financial institutions. Ethereum’s smart contract functionality has also enabled the creation of non-fungible tokens (NFTs), which have gained popularity in the digital art and gaming worlds.

While Ethereum has a strong community and has been highly influential in the cryptocurrency industry, it also faces challenges, such as scalability issues and high gas fees. These issues have spurred the development of various Layer 2 scaling solutions. In the long run, future updates are supposed to massively increase Ethereum’s throughput bringing the transaction per second (TPS) figure from 15 to 100,000.

Why Ethereum?

Ethereum has arguably been the most disappointing cryptocurrency during the 2024-2025 bull run. It hasn’t managed to hit a new ATH while Bitcoin, Solana, and many others did, and overall, the coin has been struggling while others surged. To make matters worse, Ethereum plunged -16% to $2,600 over the weekend and is now trading at its lowest value since November 2024.

But the upcoming Pectra upgrade and bullish predictions about ETH’s future might reignite investors’ interest. Let’s start with the Pectra upgrade. The upgrade is designed to improve the network’s performance and user experience. One of the key changes is an increase in the number of data blobs available, which helps Layer-2 networks operate more efficiently. Pectra also makes smart accounts available to all users by allowing them to upgrade existing accounts. Additionally, the upgrade increases the maximum staking limit for validators, introduces security improvements, separates the validator key from the withdrawal key, and more.

Ethereum founder Vitalik Buterin has recently been far more engaged on X, acknowledging the criticism from those who say that Ethereum development is too slow. “The beam chain roadmap got criticism for the “2029” date, but what that criticism misses is that the beam chain roadmap is a completely separate and parallel workstream from the work that is happening already to meet users’ needs in the short term,” he wrote, and added, “In 2025, we need blobs (and L1 cost reductions like EIP-4444). In 2026, we need more blobs.” The Pectra update addresses precisely this problem.

5. Kava

Kava is a cryptocurrency and blockchain platform designed to provide decentralized financial services, such as lending, borrowing, and trading, in a decentralized manner. The Kava platform is built on the Cosmos blockchain, which is a scalable and interoperable blockchain ecosystem. Kava utilizes its own native cryptocurrency called KAVA, which is used as a utility token within the Kava ecosystem to facilitate both governance and various utility use cases.

One of the key features of Kava is seamless interoperability between blockchain platforms, which allows users to share their crypto asset liquidity across different dApps and financial services. This feature enables users to earn interest on their deposited assets and access liquidity without having to swap cryptocurrencies when they want to access protocols across different blockchains. In addition, decentralized governance allows KAVA holders to participate in the decision-making process regarding platform upgrades and investments in new projects.

Why Kava?

Kava is one of the rare major cryptocurrencies that rejected the bearish trend over the weekend and actually gained value. KAVA is up 9% in the last 24 hours and more than 20% in the past week, the second most out of all top 200 cryptos.

In mid-Janury, Kava introduced Oros, which the team dubbed as the “first Agent Layer product”. “Unlocking intelligent portfolio management, seamless transactions, and developer-friendly APIs,” were just some of the features attached to the first decentralized AI (deAI) layer in the industry. For context, the project’s pivot toward AI started in 2024, when the team launched Kava AI and, later, the AI marketplace.

Now, roughly two weeks after the Oros announcement, the team announced that that was just the start and that Kava is moving toward building the “world’s largest decentralized AI network.” This has evidently piqued investors’ interest.

As per the 2025 roadmap, the project aims to launch AI Launchpad, an AI chatbot that can execute multi-step transactions across the Kava ecosystem; a fully decentralized AI model built to compete with centralized AI providers like OpenAI and Google; AI-focused blockchain; EVM cross-chain integration for Oros; and benchmark comparison between Kava deModels and OpenAI O1, Deepseek R1, and Claude.

6. Jupiter

Jupiter is the largest swap aggregation protocol on Solana, allowing users to exchange different Solana-based tokens using dedicated liquidity pools. The Jupiter platform is much more than a barebones decentralized exchange (DEX) – it allows users to schedule recurring transactions, participate in governance via a dedicated decentralized autonomous organization (DAO), leverage its powerful API for external integrations, and more.

Moreover, the platform recently added a Launchpad feature, which aims to provide users with the ability to invest in up-and-coming crypto projects. In turn, the projects listed on the LGD Launchad can look forward to the exposure provided by one of the most popular DeFi protocols in the industry.

Why Jupiter?

At the inaugural ‘Catstanbul 2025’ event, Jupiter’s anonymous founder ‘Meow’ announced that Jupiter will burn 3 billion JUP tokens and allocate 50% of protocol fee revenue to buy back JUP tokens, with the rest going toward growth and operations. This strategy aims to reduce emissions and stabilize the token’s fully diluted value (FDV). Following the announcements, JUP’s price spiked 40%, rising from $0.90 to $1.27 before retreating to $1.11.

At the event, Jupiter also debuted a V2 redesign of the platform, reintroducing it in beta with features like real-time slippage estimation, smart trigger orders, an “Ultra Mode” promising improved efficiency, and a security tool named “Jupiter Shield.” Even more impressively, the team announced ‘Jupnet,’ an omnichain network in early testnet, designed to aggregate all blockchains into a unified decentralized ledger. The vision, called “1A3C” (one account for all chains, currencies, and commodities), includes decentralized validators and cross-chain transaction execution.

In addition, Jupiter also launched a $10 million ‘Magic Fund’ for open-source AI development, announced the expansion of AI agent platform ‘Virtuals’ to Solana, and acquired a majority stake in meme coin platform Moonshot.

7. Hedera

Hedera (previously called Hedera Hashgraph) is a public distributed ledger and cryptocurrency platform that differs from traditional blockchain technology. Instead of a linear chain, it uses a directed acyclic graph (DAG) called “hashgraph” which allows for faster transaction speeds and higher scalability. This architecture enables Hedera Hashgraph to process transactions in parallel, significantly reducing the time and energy required compared to blockchains.

The platform supports smart contracts, file storage, and offers strong finality, with transactions confirmed within seconds. The native cryptocurrency of the Hedera network is HBAR. It is used to power decentralized applications, pay for transaction fees, and secure the network through staking. Hedera aims to provide a more efficient, secure, and fair digital economy, positioning itself as a next-generation platform for a wide array of applications.

Why Hedera?

HBAR has been one of the most impressive cryptocurrency performers recently despite the relatively poor performance over the past couple of days. When looking at longer time periods, HBAR’s performance is nothing short of impressive – the coin gained more than 520% over the past 3 months, which leads all major cryptos (apart from certain meme coins).

Last week, the Hashgraph Association announced a partnership with Taurus to enhance secure custody, staking, and tokenization of Hedera’s HBAR cryptocurrency and other assets. The collaboration aims to make Hedera’s ecosystem more accessible to financial institutions globally, focusing on regions with clear regulatory frameworks, such as Europe, Asia, the Middle East, and Africa.

In related news, Hedera co-founder and other higher-ups at the project attended the first ever “crypto ball,” a gala event celebrating Trump’s upcoming inauguration. In addition to Hedera, the event saw participation from notable individuals from other major US-based crypto projects such as Coinbase, Kraken, Ripple, Crypto.com, MicroStrategy, and many more.

8. Solana

Solana is a smart contract platform known for its distinctive architecture, enabling it to handle thousands of transactions per second while maintaining very low costs. It accomplishes this by using a combination of a unique Proof-of-History algorithm and a Proof-of-Stake consensus mechanism. SOL, the native cryptocurrency of the platform, is one of the cheapest to transfer, with users typically paying less than $0.001 per transaction.

Founded in 2018 by Anatoly Yakovenko, Solana’s mainnet went live in March 2020 and experienced a surge in adoption throughout 2021. Despite a significant drop in value during the 2022 bear market, Solana remains one of the most robust ecosystems in the cryptocurrency space and continues to be seen as a potential candidate for significant future growth.

Why Solana?

After experiencing a prolonged downturn over the past couple of weeks, SOL erased its losses and surged from $178 on January 14 to a new high of $295 on January 19, just a couple of days later. The reason for the massive rally could be attributed to the generally positive sentiment permeating the crypto market, which can be traced to Trump’s inauguration and the belief that his administration will be very crypto-friendly.

However, Solana probably benefited the most from the historic decision made by Trump and his team to launch the official Trump token on the Solana blockchain. As one would expect, given the current investment climate, the TRUMP coin surged from $20 to $55 just hours after its January 18th launch. In fact, the coin surpassed the $10 billion market cap milestone in less than 24 hours. On top of that, Trump’s wife, Melania, also launched her own token, MELANIA, which currently trades at around $10 and has a market cap of about $2 billion.

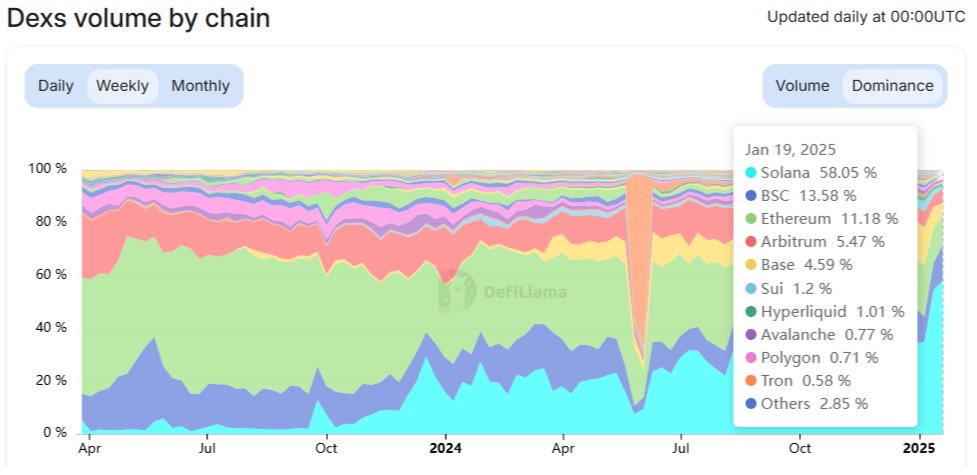

Thanks to the unprecedented move by Trump and his team, trading volume on Solana DEXs exploded. According to DeFi Llama, Solana controlled about 58% of all DEX volume during the week ending on January 19th. In other words, more than $89 billion worth of crypto changed hands on Solana DEXs like Raydium and Orca between Jan 12 and Jan 19. Meanwhile, the second closest chain during the time period, BSC, recorded “just” $16 billion in trading activity.

The data from Blockworks shows that users paid as much as $57 million in daily fees on January 19, which is a huge jump from the multi-week average of around $10 million per day. These numbers speak to the chain’s clear economic value and adoption among retail users. What’s more, Solana is one of the cheapest chains overall, which makes this feat all the more impressive.

9. XRP

XRP is a digital cryptocurrency that was created by Ripple Labs in 2012. It is used as a means of payment and transfer of value on the Ripple payment protocol, which is designed to enable fast and secure transactions between financial institutions as well as individuals.

XRP is unique in that it is not based on the blockchain technology used by many other cryptocurrencies. Instead, it uses a distributed consensus ledger called the XRP Ledger, which is maintained by a network of validators. This allows for faster transaction processing times and lower fees compared to traditional payment methods.

XRP has been popular among cryptocurrency traders and investors due to its high liquidity and clear potential for broader adoption, especially as a remittance solution. However, it has also been the subject of controversy and legal action, with US regulators alleging that it is a security and should thus be subjected to securities regulations. This has somewhat hindered the potential of XRP as an investment, and handcuffed Ripple’s growth as a company.

Why XRP?

After explosive growth in November, during which XRP gained about 300%, the cryptocurrency has been moving mostly sideways in the $2.00 – $2.50 range. However, the upcoming administration change in the US, and especially the accompanying shakeup at the helm of the Securities and Exchange Commission (SEC), has provided positive tailwinds for XRP.

According to crypto analyst World of Charts, XRP is in a strong position to move toward $4 on the heels of “strong volume.” At the moment, XRP is trading at $2.90, up more than 35% in the past month. As long as the coin’s price doesn’t reach the lower trendline at $2.30, the scenario outlined by the analyst remains in play.

Another crypto analyst, Peter Brandt, believes XRP is in for an even stronger rally, potentially reaching $6.40. Brandt noted that if his observation of technical indicators turns out to be correct, XRP could reach a whopping $500 billion market cap. Assuming no changes in the market cap of other currencies, XRP would overtake ETH as the second-largest cryptocurrency by market capitalization.

According to our algorithmic price prediction, XRP could reach as high as $4.49 in the next 3 months

10. Cardano

Cardano was founded by Charles Hoskinson, one of the co-founders of Ethereum, and his team. The main goal of Cardano is to provide a secure, scalable, and sustainable infrastructure for the development of decentralized applications (DApps) and smart contracts.

Cardano’s blockchain is built using a unique layered architecture, separating the settlement layer from the computation layer. This design approach aims to improve the efficiency, flexibility, and security of the platform. The settlement layer is responsible for handling transactions and maintaining the cryptocurrency (ADA) ledger, while the computation layer is used for running smart contracts and executing DApps.

The platform utilizes a consensus algorithm called Ouroboros, which is a type of proof-of-stake (PoS) mechanism. This means that validators (also known as stakeholders) are selected to create new blocks and validate transactions based on the amount of ADA they hold and are willing to “stake” as collateral.

Cardano has a strong focus on academic research and peer-reviewed development. The team emphasizes scientific rigor and evidence-based protocols to ensure that the platform is secure, scalable, and capable of handling complex use cases.

Why Cardano?

Cardano was the biggest gainer in the past week out of all major cryptocurrencies – ADA appreciated by more than 24%, surpassing the $1 mark.

The price increase follows the introduction of a new Cardano Improvement Proposal (CIP), the CIP-113. According to Cardano developer Matteo, the improvement proposal has been actively developed for more than a year and is currently being finalized.

CIP-113 establishes a new standard for interoperable securities, real-world assets (RWAs), and stablecoins on Cardano, enhancing DeFi capabilities. It introduces smart accounts linked to stake credentials for secure token management, with on-chain registries tracking programmable assets and user statuses (e.g., blacklisted or whitelisted).

Users can create custom programmable tokens supported by wallets, while a library is being developed to simplify integration for dApps like FluidTokens and MinswapDEX. Finest Tokenize plans to tokenize stocks using this standard, and stablecoins like USDC can freeze or pause transfers when needed. Mixed transactions with native and programmable tokens are supported, and the design is safer than Ethereum’s ERC20 as it eliminates token delegation risks.

The standard is set to be fully operational by Q1 2025, unlocking significant new use cases for Cardano.

11. Chainlink

Chainlink is a decentralized oracle network that acts as a bridge between smart contracts on blockchain platforms and real-world data. Its primary role is to ensure the reliability of data used in smart contracts by connecting to multiple data sources, reducing the risk of data manipulation or failure. This enhances the versatility of smart contracts, allowing them to access and utilize a wide range of external data sources and services beyond their native blockchain environment.

One of Chainlink’s notable features is its security model. It relies on a decentralized network of nodes to fetch and validate data, eliminating the single point of control or failure. However, there are concerns about centralization, with some major node operators having substantial influence in the network. Additionally, integrating Chainlink into smart contracts can be complex, potentially posing challenges for developers.

Chainlink acts as a crucial intermediary, enabling smart contracts to interact with real-world data. It enhances data reliability, expands the potential use cases for smart contracts, and relies on decentralization for security.

Why Chainlink?

In the past week, LINK jumped by 17% and climbed to the 12th spot on the list of largest cryptocurrencies by market cap. That marked the biggest weekly change out of all the top 25 cryptos and helped the coin reach its highest price in 37 months. The surge follows the revelation that World Liberty Financial, a crypto company backed by former president Donald Trump, bought 78,387 LINK tokens since December 11.

It’s worth noting that the Trump-backed DeFi project bought ETH and AAVE as well. “To me, it is a way to gain additional trust or a way to boost the project [World Liberty Financial] by shedding light on these assets as the project will likely do well if these assets do,” explained the investment Nicolai Søndergaard, Nansen’s research analyst.

In addition to World Liberty Financial’s investment, whale activity has probably also played a role in facilitating the large surge in LINK’s price. According to data from Santiment, whales have bought nearly 5.7 million LINK in the last two months, worth about $168 million at the time of writing.

The market activity could be a reflection of the growing confidence in Chainlink and its goal to capture a large chunk of the growing RWA market, which could grow to $10 trillion by 2030, according to some reports. Just recently, the company partnered with Coinbase’s Project Diamond, a platform designed for tokenized assets that is regulated by the Abu Dhabi Global Market.

12. Bitget Token

Bitget Token (BGB) is the native token of the Bitget cryptocurrency exchange, offering a range of exclusive benefits to its holders. Launched in 2021, 3 years after the Bitget exchange, BGB provides users with reduced trading fees, access to promotional campaigns, and eligibility for premium features on the Bitget platform, including launchpad participation and staking opportunities.

In addition to being a utility token for the exchange, BGB is also central to the Bitget Wallet, providing users with governance rigths and rewards. Its design is aimed at fostering a robust community of traders and investors, making it a valuable asset for those participating in the Bitget ecosystem.

Why Bitget Token?

After months of stagnation in the $1 price range, the Bitget token experienced a massive price surge in December, rising by over 50% just in the last week to reach its new ATH of $8.49 on December 27th. This marks the biggest weekly change out of the top 50 cryptos, and is one of the few cryptocurrencies that is still on the bullish trend.

The increase comes on the back of Bitget’s token merger of their Bitget Wallet Token with the Bitget Token. This merged token will integrate with both the centralized cryptocurrency exchange and the Bitget Wallet, serving as the sole ecosystem token. This allows holders to access features of both platforms, without needing to hold separate tokens.

Shortly after the merger, Bitget announced plans to burn 40% of the BGB token’s total supply (amounting to around 800 million tokens). They will also introduce quarterly burns of the BGB token by using 20% of their total profits from the exchange and wallet platforms to buy back and burn tokens, starting in 2025. This common strategy was first employed by Binance, with other exchanges following suit shortly after.

Best cryptocurrencies to buy at a glance

| Native Asset | Launched In | Description | Market Cap* | |

| Litecoin | LTC | 2011 | Silver to Bitcoin’s gold | $8.84 bln |

| GMX | GMX | 2021 | Decentralized derivatives exchange | $224 mln |

| Bitcoin | BTC | 2009 | A P2P open-source digital currency | $2.06 tln |

| Ethereum | ETH | 2015 | The leading DeFi and smart contract platform | $410 bln |

| Kava | KAVA | 2019 | The first decentralized AI network | $545 mln |

| Jupiter | JUP | 2021 | A leading DeFi aggregator on Solana | $1.84 bln |

| Hedera | HBAR | 2018 | Crypto network based on the Hashgraph algorithm | $13.0 bln |

| Solana | SOL | 2020 | Smart contracts platform with high speeds and low fees | $92.9 bln |

| XRP | XRP | 2012 | The leading crypto remittance solution | $119 bln |

| Cardano | ADA | 2017 | One of the largest blockchain ecosystems | $30.6 bln |

| Chainlink | LINK | 2019 | A decentralized oracle network | $13.5 bln |

| Bitget Token | BGB | 2021 | Cryptocurrency of the Bitget ecosystem | $8.89 bln |

Best crypto to buy for beginners

If you are just starting out in crypto, it is advisable to stick to cryptocurrency projects that are less prone to volatility and are generally more established. While this approach does have a downside, as it becomes much more difficult to expect triple-digit or larger gains, the major upside is that you are not exposed to projects that have a chance of failing and, thus, losing your entire investment.

In order to identify projects that are stable and thus feature low volatility, you can start by following the parameters listed below:

- The crypto asset has a market capitalization that places it into the cryptocurrency top 100 (roughly $1 billion as of late 2024)

- The crypto asset is available for trading on the best crypto exchange platforms and can be exchanged for fiat currencies

- The crypto asset boasts healthy liquidity ($100M/day and more), which allows you to execute buy and sell orders quickly and without slippage

- The crypto asset is part of a reputable crypto project with clear goals, a realistic roadmap, and products and services that look to address real-world problems

Some of the best cryptos to buy for beginners are those that follow the above criteria and have earned their standing in the crypto market due to robust security, popular products and services, and clear growth potential. Some beginner-friendly crypto investments are:

- Bitcoin

- Ethereum

- Litecoin

- Cardano

- BNB

It is worth noting that cryptocurrency investments are inherently risky, even if you stick to the biggest and most reputable projects. The reason for this is simple – the crypto sector is relatively new, and the landscape might look completely different in the future.

Best crypto for long-term

When deciding which cryptocurrency to buy for the long term, it’s important to consider projects that are well-established, have a strong community, are highly liquid, have a large market cap, and have a clear reason for existing (such as solving a real-life problem, introducing new functionality, etc.). Without these characteristics, a project might fail to survive in the long term, rendering it a bad long-term investment.

It is worth noting that, typically, most long-term crypto investors are looking for projects that have the potential to generate decent returns but also provide a degree of investment stability. Roughly speaking, only the largest cryptocurrencies fit the bill, as others have a low market cap and liquidity that doesn’t bode well for a long-term commitment (unless you’re prepared to take on more risk).

In addition to Bitcoin and Ethereum, there are a number of other cryptocurrencies that fit the criteria of being low-risk, long-term crypto investments.

If you are planning to hold onto your digital assets for a longer period of time, it is best to take care of crypto custody yourself. Holding large amounts of crypto on an exchange can be risky, as we’ve seen over the years with the collapse of high-profile exchanges like Mt. Gox and FTX. Use one of the reputable crypto hardware wallets to store your crypto. Ledger hardware wallets, for instance, allow you to manage your crypto holdings easily and provide a much higher degree of security than crypto exchanges or even software crypto wallets.

Best place to buy crypto

One crucial aspect to consider when choosing which platform to use to buy crypto is the range of cryptocurrencies and trading pairs available. Since different exchanges support varying digital assets, it’s important to choose a platform that accommodates the specific cryptocurrencies you intend to trade.

Additionally, assessing an exchange’s liquidity and trading volume is essential. Higher liquidity generally results in improved price stability and faster trade executions. Furthermore, it is prudent to examine the fees charged by the exchange, encompassing deposit, withdrawal, and trading fees. Comparing fee structures across different exchanges can help you identify the most cost-effective option that aligns with your trading style. With that said, here are some of the best exchanges on the market right now:

- Binance – The best cryptocurrency exchange overall

- KuCoin – The best exchange for altcoin trading

- Kraken – A centralized exchange with the best security

By diligently considering these factors, you can make an informed decision and select a cryptocurrency exchange that meets your requirements for security, variety, liquidity, and affordability.

How we choose the best cryptocurrencies to buy

At CoinCheckup, we provide real-time prices for over 22,000 cryptocurrencies, with the list growing by dozens each day. As you can imagine, making a selection of a dozen top cryptocurrencies to buy out of such an immense dataset can be difficult and will for sure lead to some projects that should be featured being omitted. To minimize the chance of that happening, we follow certain guidelines when trying to identify the best cryptocurrencies to invest in.

Availability

One of the most important factors for any cryptocurrency investment is the crypto asset’s availability, meaning how easy it is to buy and sell it across various cryptocurrency exchanges. We tend to stay away from assets that are not available on major exchanges and require complex procedures to obtain.

Market Capitalization

Another important metric for identifying whether a crypto project is worth covering its market cap. A high market cap means that the project has reached a certain level of adoption from users, making it less risky to invest in.

Growth Potential

While this metric is mostly subjective, it is still an important metric on which we curate our selection. We won’t feature projects that we think are stagnating or have no real upside in the future.

Purpose and Use Case

We consider the purpose and use case of cryptocurrency, particularly in a real-world setting. Some cryptocurrencies focus on specific industries or applications, such as decentralized finance, gaming, or supply chain management.

Team and Development

The team and people involved in the project can tell you a lot about the potential of a particular cryptocurrency project. We examine the team’s experience, expertise, and track record and evaluate the development activity and updates to ensure the project is actively maintained and evolving.

The bottom line: What crypto should you buy right now?

The decision of which crypto to buy now is dependent on your own risk profile and investment goals. For some, investing in a crypto asset with a proven track record like Bitcoin is the only type of exposure to crypto they are willing to take on.

Meanwhile, those with a higher risk tolerance might see Bitcoin as too stable, looking instead toward newer and smaller projects that carry a higher degree of upside.

If you are looking for more investment ideas, check out our crypto price predictions section.

English (US) ·

English (US) ·