(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

(Any views expressed here are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

Jerome Powell and Hiroki Kuroda became fast friends within the global central banking circuit. Kuroda’s term as governor of the Bank of Japan (BOJ) ended a few years ago, and Powell often calls him for advice or just to chit-chat. Powell had a very tumultuous meeting with the new US Treasury Secretary Scott Bessent in early March of this year. It mentally scarred him, and he needed someone to talk to – let’s listen in.

Powell: Hiroki, I really need to talk to you. I just had a very disturbing meeting with Scott.

Kuroda: I’m all ears?

Powell: You wouldn’t believe what just happened. Scott called me down to D.C. for a chat. I was like, “I’m a busy; I have the FOMC coming up in a few days. Can we just do this over the phone?” But Scott insisted. I should have known something strange would happen.

Kuroda: Hold on – before you say anything else, I have a suggestion. Have you ever heard of the Jung Center for Central Bankers?

Powell: No, I haven’t. When you say Jung, are you talking about the shrink guy, Carl Jung?

Kuroda: Yeah, that’s him. During the days of the Reichsbank, he created a program to help the prominent central bankers of the time cope with all of the stress and responsibility of their new roles as masters of the universe. After WW2, the practice expanded to London, Paris, Tokyo, and New York.

Powell: This is amazing; I have always felt so lonely. I would love someone to talk to about the unique stresses I face as the most important banker in the world.

Kuroda: I’ll let Justine know that you are coming. She sees clients in her unit at 740 Park Ave.

Powell: Thanks, I’m going to try and get an appointment tomorrow.

Kuroda: Don’t worry. There is only ever one client suitable for her services at any given time. That’s the Fed chairperson. She exists to serve you and you alone.

Jerome felt a wave of relief wash over him. He couldn’t believe there was a dedicated mental health professional just for him. He also couldn’t believe her address. He had been trying all his professional career to snag a co-op in an address like 740 Park Ave. “What the actual fuck,” he thought to himself. With one word out of his mouth, he could bankrupt most of the financiers living in that building. They all were a bunch of pompous over-levered douchebags.

The next day, Jerome made his way uptown to see Justine. He registered with the front desk and was ushered to a private elevator that went directly up to Justine’s unit. As he stepped out of the lift, he saw a goddess. The central banking gods must have read his mind. Apart from her looks, the interior was just how he would have decorated this space. Justine said hello and motioned him to lie down on a Le Corbusier Chaise lounge chair. Next to him sat atop a Noguchi coffee table was a smoothie. Powell took a sip; it was delicious and soothing. It was as if Justine knew him from the inside out.

Justine: It’s perfect, isn’t it?

Powell: I’m flabbergasted; we have never met, yet you know me so well.

Justine: My firm has been serving central banker masters of the universe for almost a century now. We know you, inside and out. I think I understand why you came to see me today. Usually, a chairperson learns about our existence after a disturbing meeting with their counterpart in the treasury or finance department. Let me guess: you witnessed a demonstration of dominance.

Powell: Spot on, you are good at this. Yes, it was so mentally scarring, and I felt like less of a man, no – less of a human being after this recent experience.

Justine: Tell me what happened.

Powell: First of all, I was a bit offended that Scott insisted I drag myself down to the D.C. New York is the capital of the empire, not D.C. Who the fuck does he think he is!

Justine: This is a safe space; this is your space. Let it all out.

Powell: Ok, so I get to Scott’s office on time. He makes me wait for an hour. Motherfucker. Then he ushered me into the room, and I didn’t know how to react. I saw a RealBotix female sex doll positioned on all fours. There was a sheet of paper wrapped over its / her head, and it read “Fiscal Dominance”. Another sheet of paper was affixed on her lower back, and it read ‘Fed Inflation Fighting Credibility”. Scott then told me to sit down in a chair across the room. On the back of the chair read a sign, ‘The Cuck Chair’. Scott then said to me, ‘Do you know what I have, I have the BBC, the Big Bessent Cock.’ Then he proceeded to fuck the doll.

After he finished, he said, ‘I did that to demonstrate to you who is really in charge. I have the BBC, and next week at the FOMC, you are going to start tapering QT for my treasury bonds and announce that QE for treasury bonds will start in the near future. Do You Understand? And when I say it’s time to grant a treasury bond exemption for the SLR, you better approve it immediately.’

I was so mentally unstable I cried and nodded my head in affirmation.

Justine: I kinda guessed something like that happened. Look, don’t feel bad. You are not the first Fed chairperson to have been fiscally dominated. It’s not your fault. It’s not your fault.

Powell (crying now): But Justine, I’m the new-age Paul Volker; he’s my hero. While Scott was fucking that doll, I tried to regain some mental strength by chatting to myself, “I’m Paul Volker, I’m Paul Volker.” And do you know what Scott said as I walked out of his office as if he read my mind? ‘Bitch, you’re just another Arthur Burns.”

Justine: It’s ok, I know. Realizing that you are fiscally dominated and having it thrown in your face as the head of the most powerful central bank in the world is soul-crushing. But others before you have been there. You remember how the Fed was combined with the Treasury for the duration of WW2 up until 1951. I know you think you are independent, but deep down, you know you are not. You need to come to terms with this. I can help you, come back every week, and we can talk it out. But in the meantime, I want you to read a speech by Arthur Burns called “The Anguish of Central Banking”. It will give you strength to know you never had a choice. And what you are doing is the right thing to do. Today’s session is over; you have homework to do. I hope this makes you feel better about doing your duty in a few days at the FOMC. It’s ok; the universe still loves you. Before you leave, let me heal your energy with some crystals.

Powell: Thank you. I feel much better.

I felt some pithy satire was needed to drive home the point that the game has materially changed after the Fed’s most recent March meeting regarding global dollar liquidity. Powell laid out a path towards a resumption of quantitative easing focused on the US treasury bond market. While everyone is hemming and hawing about whether the effects of tariffs are good or bad, what the crypto markets should be rejoicing that QE will resume, I believe, by this summer.

The rest of this essay will focus on the political, mathematical, and philosophical reasons why Powell caved. First, I will talk about the consistent campaign promise of US President Trump and how that mathematically necessitates the Fed and the US commercial banking system to print money and buy treasuries. Then, I will talk about why the Fed never stood a chance at maintaining tight enough monetary conditions long enough to slay inflation. Finally, I will discuss how Maelstrom will position itself to profit from this most recent Powell Pivot.

A Promise Made; A Promise Kept

I spent the past few weeks consuming the missives of my favorite macroeconomic analysts. A large part of every essay I read was devoted to parsing Trump’s true intentions. Some say that Trump will go hard and break things until his approval rating slips into the low 30% range. Others say that Trump believes it’s his mission in his last term to remake the world order and put America’s financial, political, and military house in order. The TLDR is that he is willing to tolerate significant economic pain and a precipitous fall in popularity to do what he believes is right for America. As traders, we must take “right” and “wrong” out of the equation and tether ourselves to probabilities and maths. Ultimately, our portfolio doesn’t care about whether America is strong or weak relative to other nation-states but whether there is more or less fiat currency sloshing around the world in the near future. Therefore, instead of attempting to handicap which way Trump leans, I will focus on one chart and one mathematical identity.

Since 2016, Trump’s consistent message has been that America has gotten a raw deal over the past few decades as its trading partners have taken advantage of it. While you may believe he has or will bungle the execution of his plan, his intent has not changed. The Democrats, while not as effusive in their demands for an alteration of the global order, are kinda on board with effecting the same sort of change. Former US president Biden continued Trump’s policies of curtailing Chinese access to semiconductors and other segments of the U.S. market. During her failed presidential campaign, Biden’s Vice President Kamala Harris also employed tough-on-China rhetoric. While the Republicans and the Democrats might disagree on the pace and depth of change, both parties advocate for it nonetheless.

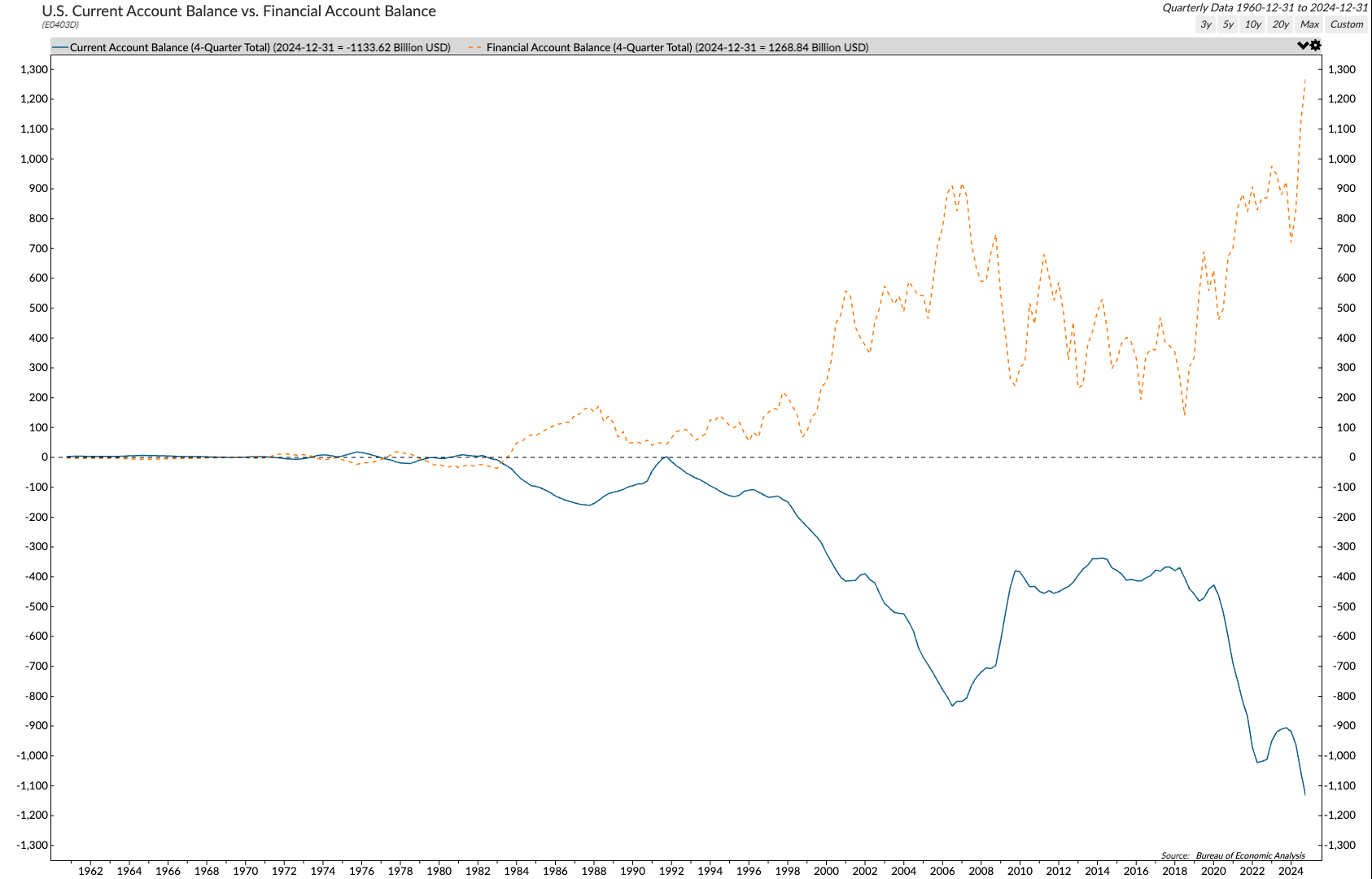

The blue line is the US current account balance, which is basically the trade balance. As you can see, the US imported vastly more goods than it exported starting in the mid-1990s and accelerating post-2000. What happened in that time frame? China.

In 1994, China massively devalued the yuan to start its journey as a mercantilist export powerhouse. In 2001, US President Bill Clinton allowed China to enter the World Trade Organization, drastically reducing tariffs they paid to export goods into America. As a result, the US manufacturing base shifted to China, and the rest is history.

USDCNY y-axis inverted.

USDCNY y-axis inverted.

Trump’s supporters are those negatively affected by this off-shoring of American manufacturing. These are folks with no university degrees, who live in the country’s interior, and who own very little in terms of financial assets. Hilary Clinton calls them deplorables. Vice President JD Vance affectionately calls them and himself hillbillies.

The orange dotted line and top panel of this chart is the US financial account balance. As you can see, it’s practically a mirror image of the current account balance. China and other exporters can continually rack up large trade surpluses because when they earn dollars by selling things to the US, they do not re-invest those dollars back home. Doing so would mean they sell dollars and buy their domestic currency like the yuan, and then their currency appreciates in value, which raises the price of their exports. Instead, they take those dollars and buy US treasury debt securities and US stocks. This has allowed the US to run monster deficits without blowing up the treasury debt markets and have the best-performing global stock market over the last few decades.

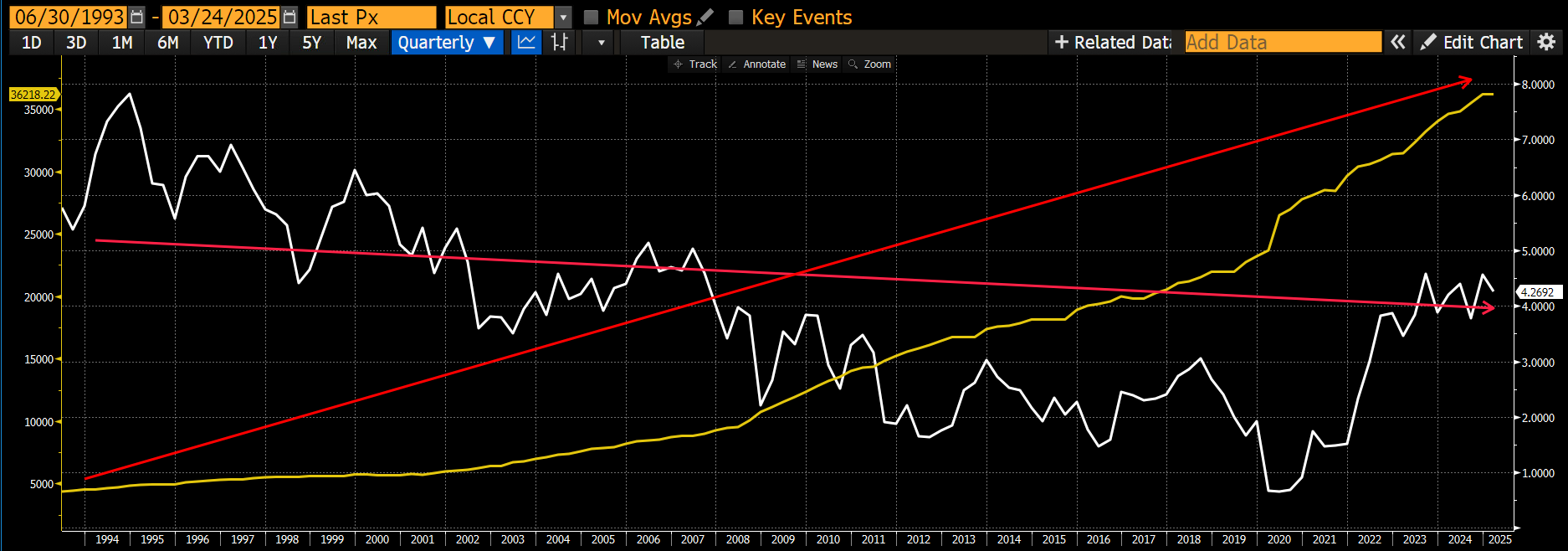

US Treasury 10-yr yield (white) is slightly lower, whilst, over the same time frame, the total amount of debt outstanding (yellow) is up 7x.

US Treasury 10-yr yield (white) is slightly lower, whilst, over the same time frame, the total amount of debt outstanding (yellow) is up 7x.

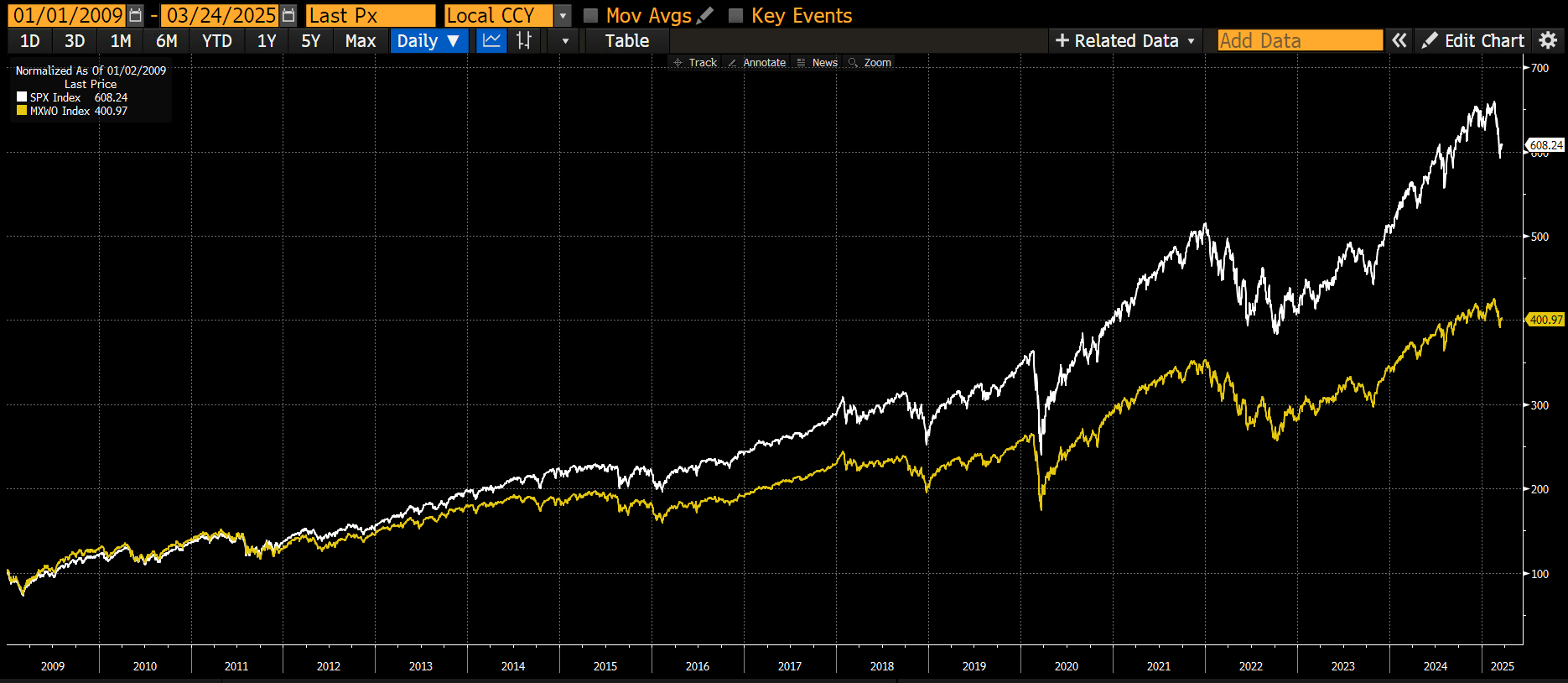

The MSCI US Index (white) has outperformed the MSCI World Index (yellow) by 200% since 2009.

The MSCI US Index (white) has outperformed the MSCI World Index (yellow) by 200% since 2009.

Trump believes that by bringing these manufacturing jobs back to America, he can give good jobs to the roughly 65% of the population who have no University degree, become militarily stronger because weapons and such will be produced in the quantities needed to face off against a peer or near-peer rival, and grow the economy above trend, e.g. at 3% real GDP growth.

There are some apparent issues with this plan. Prices will fall if China and others do not have dollars to prop up the treasury and stock market. Scott Bessent, US Treasury Secretary, needs buyers for the gargantuan amount of debt that must be rolled over and for the persistent federal deficits out into the future. His plan is to lower the deficit to 3% from roughly 7% by 2028. The second issue is that capital gains taxes from a rising stock market are the marginal revenue driver for the government. When rich folks aren’t making money slinging stonks, the deficit grows. Trump didn’t campaign on a platform to cease military spending or cut entitlement benefits like healthcare and social security. He campaigned on a platform of growth and elimination of fraudulent spending. Therefore, he needs capital gains tax revenue, even though it’s rich people who own all the stocks, and on average, they didn’t vote for him in 2024.

That’s Trump’s overarching policy goal. Let’s dig into the maths.

Assuming that Trump successfully reduces the deficit from 7% to 3% by 2028, the government is still a net borrower year after year and cannot retire any of the existing debt stock. Mathematically, that means that interest payments will continue to rise exponentially.

That sounds bad, but the US can mathematically grow itself out of the problem and deleverage its balance sheet. If real GDP growth is 3%, and long-run inflation is 2% (I don’t believe this will happen, but let’s be generous), that means nominal GDP growth is 5%. If the government is issuing debt at 3% of the GDP rate but is economically growing nominally at 5%, then mathematically, the debt-to-GDP ratio will decline over time. There is one missing piece: at what interest rate will the government be able to finance itself?

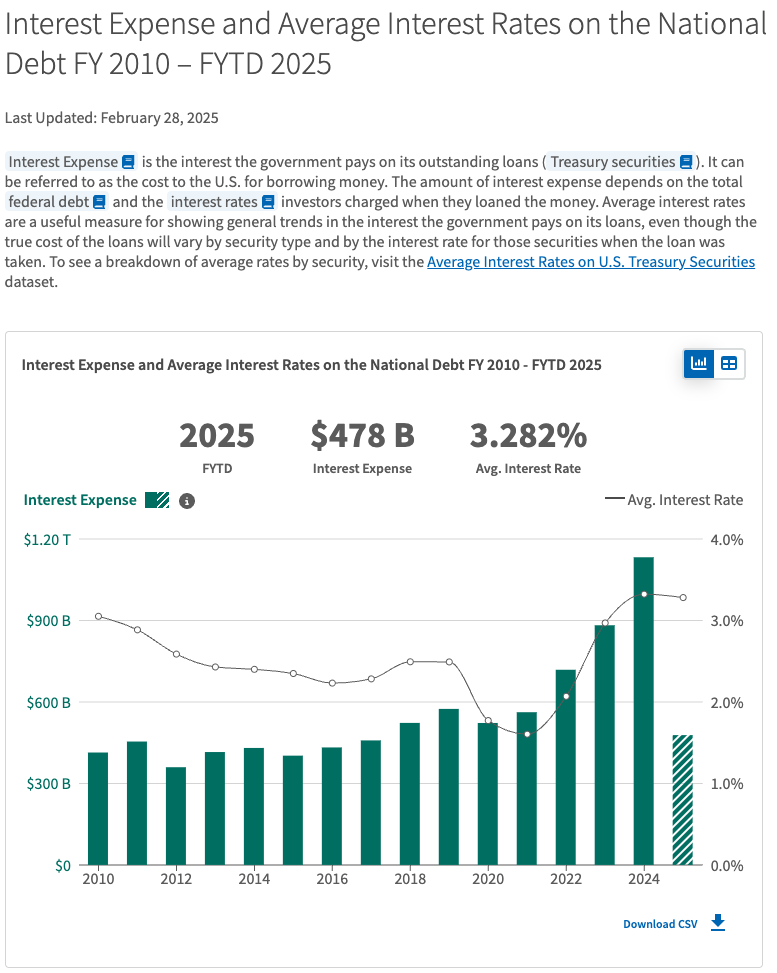

Theoretically, if the US economy grows at 5% nominally, treasury investors should demand at least 5%. But that would materially increase interest costs because currently, the treasury pays a weighted average interest rate of 3.282% on its ~$36 trillion and growing debt pile.

The maths don’t add up unless Bessent can find a buyer of treasuries at an uneconomically high price or low yield. The Chinese and other exporters can’t and won’t buy treasuries because Trump is busy remaking the global financial and trade system. Private investors won’t because the yield is too low. Only US commercial banks and the Fed have the firepower to buy the debt at a level the government can afford.

The Fed can print money and buy bonds, which is called quantitative easing (QE). Banks can print money and buy bonds, which is called fractional reserve banking. However, it’s not that easy.

The Fed is supposedly busy with its quixotic quest to bring the manipulated and fugazi metric of inflation below their made-up 2% target. They are actively removing money/credit out of the system by reducing their balance sheet, which is called quantitative tightening (QT). Because banks fucked up so badly in the 2008 Global Financial Crisis (GFC), regulators required them to pledge more of their own equity capital against treasuries that they purchased, called the supplementary leverage ratio (SLR). Therefore, banks cannot finance the government using infinite leverage.

However, it is very simple to change this state of play and turn the Fed and banks into inelastic buyers of treasuries. The Fed can decide, at a minimum, to end QT and, at a maximum, to restart QE. The Fed can also exempt banks from the SLR, allowing them to purchase treasuries using infinite leverage.

The question then becomes why would Jerome Powell’s Fed (he is the Fed chairperson) help Trump accomplish his policy goals? The Fed blatantly helped Harris in her bid to win the election by cutting rates by 0.5% in September of 2024, and post-Trump’s victory proved to be obstinate to Trump’s demands that they increase the quantity of money such that long-term treasury yields decline. To understand why Powell will do what is required of him by the government, let’s take a detour back to 1979.

The Cuck Chair

Right now, Powell is sitting in the cuck chair, watching the BBC ravage the Fed’s credibility in fighting inflation.

The BBC reigns supreme because fiscal dominance is in play. In short, the Fed will eschew independence and do what is necessary to finance the government at affordable rates once the total amount of debt gets too large.

If you think this is something new, let’s step through a seminal speech by former Fed chairperson Arthur Burns.

Western financial historians excoriate Burns for creating the easy monetary conditions in the 1970s that led to the eye-watering inflation in the early 1980s. Powell is rumored to have proclaimed within the hallowed walls of the Marriner Eccles building that he would not go down in history as the 21st-century Arthur Burns but as Paul Volker. The same historians heap praise, a lot of it unearned, on the “turnaround” former Fed chairperson Volker engineered in inflation and the US economy alongside US President Ronald Regan. This is why, while sitting in the cuck chair, I bet Powell chants to himself, “I’m Paul Volker, I’m Paul Volker”, while the BBC pumps his credibility to shreds across the room.

Burns gave a famous speech in 1979 entitled “The Anguish of Central Banking”. I will pull out a few quotes to help contextualize the current political and monetary situation in which Powell finds himself embroiled. I will add some colorful annotations to focus attention on what I believe are the salient points. Soz, not soz about the long quote blocks, this speech is so prescient and apropos of today’s situation that it must be re-read and its lessons internalized.

… the persistent inflationary bias that has emerged from the philosophic and political currents that have been transforming economic life in the United States and elsewhere since the 1930s. The essence of the unique inflation of our times and the reason central bankers have been ineffective in dealing with it can be understood only in terms of those currents of thought and the political environment they have created.

The politicians told me to do it.

Together, these and other New Deal measures laid the foundations of an activist government—a government responsible not only for relieving suffering and insuring against economic adversity, but also for limiting “harmful” competition, subsidizing “worthwhile” activities, and redressing unequal balances of market power. In less than a decade the government became a leading actor on the economic stage.

The New Deal was the woke, inclusivity and DEI bugaboo of the 1970s. Rich people are always ok with the central bank printing money to bailout their financial assets, but are never ok when poor people get some government succor as well. That’s not to say government handouts actually elevate the masses out of poverty, but they do make people feel good and less likely to cause social unrest.

But the rapid rise in national affluence did not create a mood of contentment. On the contrary, the 1960s were years of social turmoil in the United States, as they were in other industrial democracies. In part, the unrest reflected discontent by blacks and other minorities with prevailing conditions of social discrimination and economic deprivation—a discontent that erupted during the “hot summers” of the middle 1960s in burning and looting. In part, the social unrest reflected growing feelings of injustice by or on behalf of other groups—the poor, the aged, the physically handicapped, ethnics, farmers, blue collar workers, women, and so forth. In part, it reflected a growing rejection by middle class youth of prevailing institutions and cultural values. In part, it reflected the more or less sudden recognition by broad segments of the population that the economic reforms of the New Deal and the more recent rise in national affluence had left untouched problems in various areas of American life—social, political, economic, and environmental. And interacting with all these sources of social disturbance were the heightening tensions associated with the Vietnam War.

Then as today, “prosperity” was not evenly distributed, and the people demanded the government do something about it.

The interplay of governmental action and private demands had an internal dynamic that led to their concurrent escalation. When the government undertook in the mid-1960s to address such “unfinished tasks” as reducing frictional unemployment, eliminating poverty, widening the benefits of prosperity, and improving the quality of life, it awakened new ranges of expectation and demand.

The people got what they wanted, and the government got involved directly in an attempt to solve problems of key voting constituencies. Attempt is the key word. Actual results may vary.

Many results of this interaction of government and citizen activism proved wholesome. Their cumulative effect, however, was to impart a strong inflationary bias to the American economy. The proliferation of government programs led to progressively higher tax burdens on both individuals and corporations. Even so, the willingness of government to levy taxes fell distinctly short of its propensity to spend.

The people believed it was the government’s job to solve their problems. Governments solve problems by spending money to do stuff, which embedded inflation into the economy.

In fact, much of the expanding range of government spending was prompted by the commitment to full employment. Inflation came to be widely viewed as a temporary phenomenon—or, provided it remained mild, as an acceptable condition.

Why does the Fed tolerate 2% yearly inflation? Why does the Fed use phrases like “transitory” inflation? 2% inflation over 30 years compounded leads to an 82% rise in the price level. But if unemployment goes up 1%, the sky is falling. Things that make you go, hmmm…

Viewed in the abstract, the Federal Reserve System had the power to abort the inflation at its incipient stage fifteen years ago or at any later point, and it has the power to end it today. At any time within that period, it could have restricted the money supply and created sufficient strains in financial and industrial markets to terminate inflation with little delay. It did not do so because the Federal Reserve was itself caught up in the philosophic and political currents that were transforming American life and culture.

This is the punch line. The Fed is supposedly independent, but as an arm of the government that philosophically is inclined to solve everyone’s problems, it will not and cannot stop the inflation necessitating such intervention. The Fed acts as a willing accomplice and, in the process, creates the inflation they swore an oath to destroy.

Facing these political realities, the Federal Reserve was still willing to step hard on the monetary brake at times—as in 1966, 1969, and 1974—but its restrictive stance was not maintained long enough to end inflation. By and large, monetary policy came to be governed by the principle of under-nourishing the inflationary process while still accommodating a good part of the pressures in the marketplace.

This is precisely what Powell did and is doing with monetary policy. This is the definition of fiscal dominance. The Fed will do what is necessary to fund the government. You can quibble about whether you believe the policy goals are good or bad. Still, the message from Burns is that when you become a Fed chairperson, you implicitly agree to do whatever is necessary to ensure the government can fund itself at affordable levels.

I know that Powell and the Fed will continue to sit in the cuck chair because he told us so at the latest Fed press conference. Powell had to justify why he was reducing the pace of QT when, by all measures, the US economy was strong and monetary conditions were loose. I say that because unemployment is low, the stock market is at all-time highs, and inflation is still above its 2% target.

The Federal Reserve said on Wednesday that starting next month it will slow the pace of its balance sheet drawdown amid an ongoing impasse over lifting the government’s borrowing limit, a shift that will likely hold for the remainder of the process.

– Reuters

This constraint is always true; even the venerated former Fed chairperson Paul Volker let up on his tight monetary policy when the economic pain became too great. The following quote is from the Fed’s historical archives:

By the summer of 1982, House Majority Leader James C. Wright Jr. was calling for Volcker’s resignation. Wright said he had met with Volcker eight times in hopes of giving the Fed chairman an “understanding” of what high interest rates were doing to the economy, but Volcker was apparently not getting the message (Todd 2012).

However, in July the data showed that the recession had bottomed out. Volcker told lawmakers that he was backing off his previous targets for tight monetary policy and that a recovery in the second half of the year – long touted and targeted by the Reagan administration – was “highly likely.”

Not even Volker, the most venerated Fed chairperson ever, could stand up to the political pressure to keep the monetary spigot open. Volker got this much heat, and the financial position of the US government was so much better in the early 1980s, e.g., 30% debt-to-GDP as compared to today’s 130% debt-to-GDP.

Powell proved last week that fiscal dominance is alive and well. Therefore, I am confident QT, at least regarding treasuries, will stop in the short to medium term. Going further, Powell stated that while the Fed may maintain mortgage back security runoff, it will net buy treasuries. Mathematically, that keeps the Fed balance sheet constant; however, that is treasury QE. Bitcoin will scream higher once this is formally announced. Furthermore, because the banks and the Treasury demand it, the Fed will grant the SLR exemption for the banks, which is another form of treasury QE. Ultimately, the reason is that the maths I posted above will not work otherwise, and Powell cannot stand by and allow the US government to falter even if he detests Trump.

Here are some direct quotes from Powell and Bessent backing up my future prognosis.

Here is Powell talking about what I call QT Twist at the March 19th FOMC press conference:

We will stop the roll-off on net at some point…we haven’t made any decisions about that. We strongly want the MBS to roll-off our balance sheet at some point. We would look closely at letting the MBS roll off but keep the overall balance sheet size constant…at some point…a point that we’re not at yet.

Here is Bessent speaking about the SLR on the recent All-In Podcast:

So, I actually think there’s a chance that if we take it is called the supplementary leverage ratio. If we take that away, it becomes a binding constraint on banks. We might actually pull treasury bill yields down by 30 to 70 basis points. Every basis point is a billion dollars a year.

Finally, let’s climb the tariff wall of worry. When asked at the March FOMC about his views on the inflationary effects of proposed Trump tariffs, Powell said his base case was that any tariff-induced inflation was “transitory”. The belief in “transitory” inflation allows the Fed to continue easing even if inflation spikes due to a hefty tariff hike. Tariffs, at least for assets that trade solely on fiat liquidity, no longer matter. As such, I don’t care anymore about Trump’s self-proclaimed “liberation day” on April 2nd and how high, if at all, Trump raises tariffs.

At his post-meeting news conference, Chair Jerome Powell said the current outlook is that any price jumps from tariffs will likely be short-lived.

Asked if the Fed is “back at transitory again,” the central bank leader responded: “So I think that’s kind of the base case. But as I said, we really can’t know that.

– CNBC

Dollar Liquidity Maths:

Remember that we care about the forward-looking change in dollar liquidity relative to prior expectations.

Treasury QT Prior Pace:

$25 billion per month reduction

Treasury QT Pace Post April 1:

$5 billion per month reduction

Net:

Dollar Liquidity Positive Change of annualized $240 billion

What’s the effect of QT Twist:

Max $35 billion per month MBS reduction

If the Fed balance sheet is kept constant, then they can buy:

Max $35 billion per month of treasuries or annualized $420 billion

We know an additional $240 billion of relative dollar liquidity will be created starting April 1. In the near future, I believe it will happen at the latest in the third quarter of this year, that $240 billion will rise to $420 billion annualized. Once QE starts, it doesn’t stop for a long time; it increases as the economy needs more printed money to stand still.

The BBC In Action

To round out my dollar liquidity analysis, I cannot forget some specific things regarding how the Treasury will fund the government. Specifically, will the Treasury refill its general account (TGA) after the debt ceiling is raised?

The TGA stands at ~$360bn, down from ~$750bn at the beginning of the year. Due to the debt ceiling being reached, the TGA is spent down to fund the government. In the past, once some last-minute political deal raised the debt ceiling, the TGA was then refilled. That is dollar liquidity negative. But it’s a bit silly to carry such a large cash balance; during Bad Gurl Yellen’s tenure, the target TGA balance was $850 billion. Given that the Fed can print money at will, surely the Fed should just loan the Treasury money if need be. And the Treasury can just issue some treasury bills to pay back the Fed. This reduces the government’s financing needs. This would require more coordination between the Fed and Treasury even though the heads of each organization support different political factions. But now we know that Powell must bow down to the BBC, so I think it’s entirely likely that in the next Quarterly Refunding Announcement (QRA) in early May, the treasury forecasts no increase in TGA relative to the prevailing level at the time the QRA is published. This removes any negative dollar liquidity impulse once the debt ceiling is raised.

2008 GFC Case Study

Stocks and gold both react positively to an increase of fiat liquidity. However, stocks require statist legal fiction to exist. Therefore, in a deflationary bust, where the solvency of the system of the state is questioned, stocks may not react as promptly to the injection of fiat liquidity as an anti-establishment commodity financial asset like gold does. Let’s evaluate how the S&P 500 and gold performed during the height of the 2008 GFC and into the recovery. This case study is relevant because I want to ensure I’m intellectually honest with myself. Just because I believe dollar liquidity has taken a sharp turn positive doesn’t mean the negative economic headwinds cannot adversely affect the price trajectory of Bitcoin and crypto.

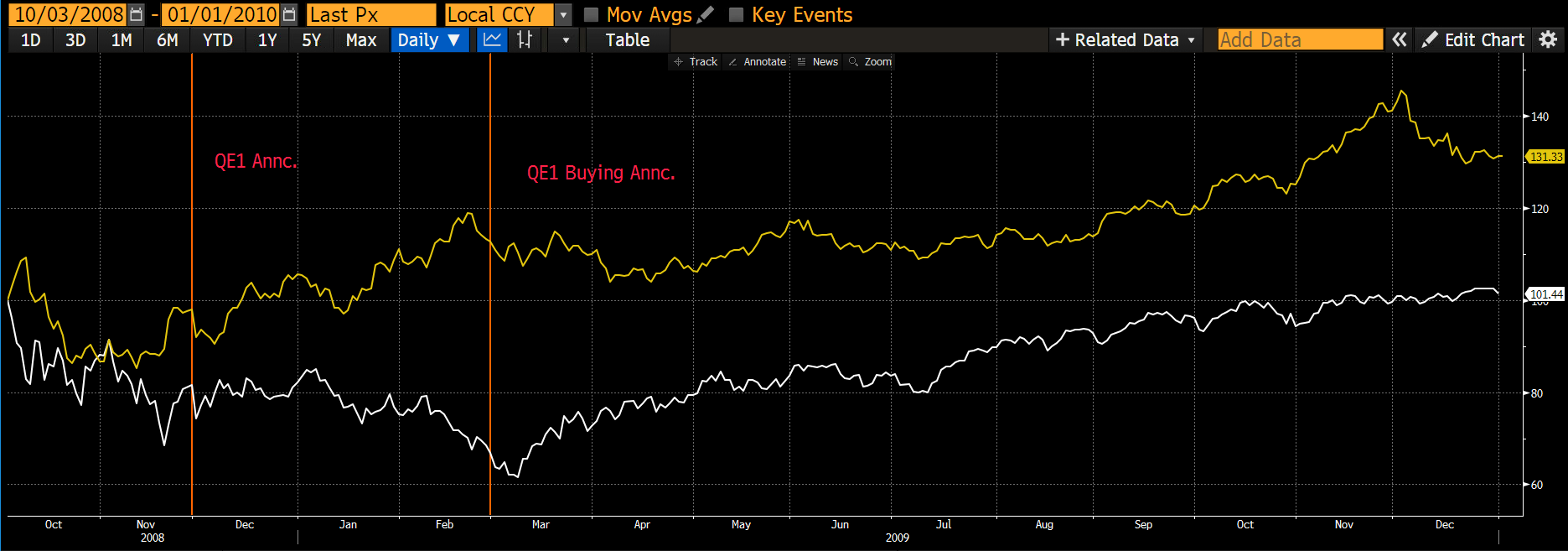

The S&P 500 Index (white) and gold (gold) are indexed at 100 starting October 3, 2008. This is the day on which the Troubled Asset Relief Program (TARP) bailout was announced. That failed to quell the destruction the bankruptcy of Lehman Brothers brought upon the markets, and both stocks and gold fell. When TARP proved insufficient to stop the collapse of the Western financial system, Fed Chairperson Ben Bernanke announced Large Scale Asset Purchases, now called Quantitative Easing (QE1), in early December 2008. Gold started rallying, but stocks continued to fall. Stocks didn’t bottom until shortly after the Fed began printing money in March 2009. By early 2010, gold was up 30%, and stocks were up 1% post-Lehman’s failure.

The S&P 500 Index (white) and gold (gold) are indexed at 100 starting October 3, 2008. This is the day on which the Troubled Asset Relief Program (TARP) bailout was announced. That failed to quell the destruction the bankruptcy of Lehman Brothers brought upon the markets, and both stocks and gold fell. When TARP proved insufficient to stop the collapse of the Western financial system, Fed Chairperson Ben Bernanke announced Large Scale Asset Purchases, now called Quantitative Easing (QE1), in early December 2008. Gold started rallying, but stocks continued to fall. Stocks didn’t bottom until shortly after the Fed began printing money in March 2009. By early 2010, gold was up 30%, and stocks were up 1% post-Lehman’s failure.

Bitcoin didn’t exist back in 2008. But now it does.

Bitcoin Value = Technology + Fiat Liquidity

The technology works, and there aren’t any major changes, good or bad, occurring in the near future. Therefore, Bitcoin trades solely based on the market expectation for the future supply of fiat. If my analysis of the Fed’s major pivot from QT to QE for treasuries is correct, then Bitcoin hit a local low of $76,500 last month, and now we begin the ascent to $250,000 by year-end. Of course, this is not an exact science, but using the gold example, if I had to place a bet on whether I thought Bitcoin would hit $76,500 or $110,000 first, I would bet on the latter.

Even if US stocks continue falling in reaction to tariffs, a collapse in earnings expectations, and or foreigner demand waning, I am confident that the odds favor Bitcoin continuing to climb higher.

Cognizant of the good and bad, Maelstrom is deploying capital cautiously. We use no leverage, and we buy in small clips relative to the size of our total portfolio. When the market goes up, I want to wish my size was bigger, but I’m thankful it’s not when the market trades lower. We have been buying Bitcoin and shitcoins at all levels between $90,000 to $76,500. The pace of capital deployment will quicken or slacken depending on the accuracy of my predictions. I still believe Bitcoin can hit $250,000 by year-end because now that the BBC has put Powell in his place, the Fed will flood the market with dollars. That allows Xi Jinping to instruct the PBOC to stop tightening monetary conditions onshore to defend the dollar-yuan exchange rate, which increases the net quantity of yuan. And finally, Germany decided to build an army again paid for with printed euros and every other European nation must respond by building their own army with printed euros because they are afraid of a 1939 Remix to Ignition.

Yahtzee!

Want More? Follow the Author on Instagram, LinkedIn and X

Access the Korean language version here: Naver

Subscribe to see the latest Events: Calendar

English (US) ·

English (US) ·