Bitcoin mining stocks jumped by over 5% in the pre-market session as the crypto fear and greed index exited the fear zone.

Mara Holdings, the largest miner by market cap, rose by almost 6%, reaching a high of $16.7. Similarly, Riot Platforms’ stock jumped by 5.3%, while Argo Blockchain climbed by 5%. Other companies like CleanSpark, TeraWulf, and Core Scientific saw similar price action.

This recovery occurred as sentiment in the crypto industry improved. The closely watched crypto fear and greed index rose to the neutral point of 44, its highest level in nearly two weeks.

Most cryptocurrencies were in the green. Bitcoin (BTC) rose to over $63,000 while Ethereum (ETH) moved to $2,500. The two coins have risen by over 8% and 4%, respectively, in the last seven days.

This price action coincided with a strong stock market comeback. The Dow Jones futures jumped by 1.33%, while the tech-heavy Nasdaq 100 index rose by 417 points. Government bond yields and the U.S. dollar index retreated.

Federal Reserve slashed interest rates

The Federal Reserve decided to slash interest rates by 50 bps on Wednesday as it seeks to engineer a soft landing. It also hinted that more cuts were on the horizon, especially if the U.S. continues to publish weak job numbers.

Other central banks have also started cutting rates. The European Central Bank has delivered two cuts, while the Bank of England hinted that it will resume cuts in the final two meetings of the year.

This marks a new phase for global central banks, which raised interest rates to multi-decade highs as inflation surged after the pandemic. Risky assets often perform well when the Fed and other central banks adopt a dovish tone, as funds tend to move away from low-yielding government bonds.

Still, it is too early to predict whether the gains in Bitcoin mining stocks will hold. Their price action will depend on how Bitcoin trades in the coming months.

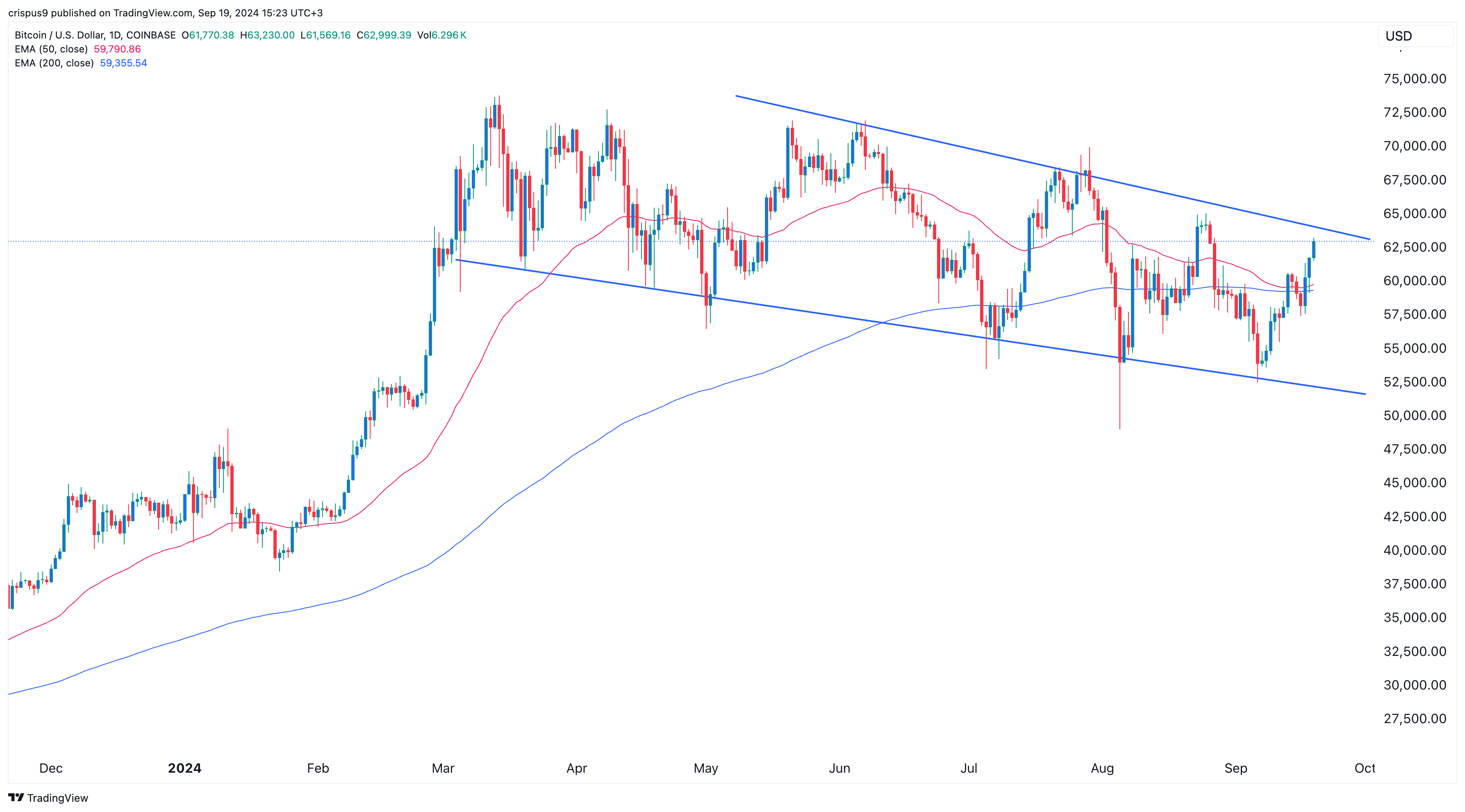

Bitcoin price chart | Source: TradingView

Bitcoin price chart | Source: TradingViewOn the positive side, Bitcoin has avoided forming a death cross chart pattern. Instead, the price has moved above the 200-day and 50-day moving averages, a positive sign for the coin. It has also formed the three white soldiers candlestick pattern, which occurs when there are three consecutive bullish candles.

Bitcoin is also approaching the upper side of the descending channel. A break above that level would signal more upside, which could be bullish for mining stocks.

English (US) ·

English (US) ·