What should you consider when weighing the options between investing in crypto ETFs versus the mature gold ETF market?

Crypto ETFs put up a fight

2024 marks a key milestone in the crypto world with the launch of the first spot Bitcoin (BTC) ETFs on Jan. 10, followed closely by the debut of spot Ethereum (ETH) ETFs on Jul. 23.

These launches, coming after years of struggles and numerous rejected applications, have finally brought mainstream financial products to the crypto market.

To appreciate the importance of these events, consider the first gold ETFs introduced in 2003. They generated substantial hype and interest by making it easier for investors to gain exposure to gold without physically holding it, thereby democratizing gold investment practices.

As per World Gold Council as of August 2024, new inflows have pushed the total assets under management (AUM) for gold ETFs to $257 billion, although collective holdings remain near their lowest since 2020.

Now, a similar wave of enthusiasm surrounds the crypto ETFs. As of Sep. 13, spot Bitcoin ETFs have impressively reached over $61 billion, approximately 25% of the gold ETFs’ AUM in just six months since their inception.

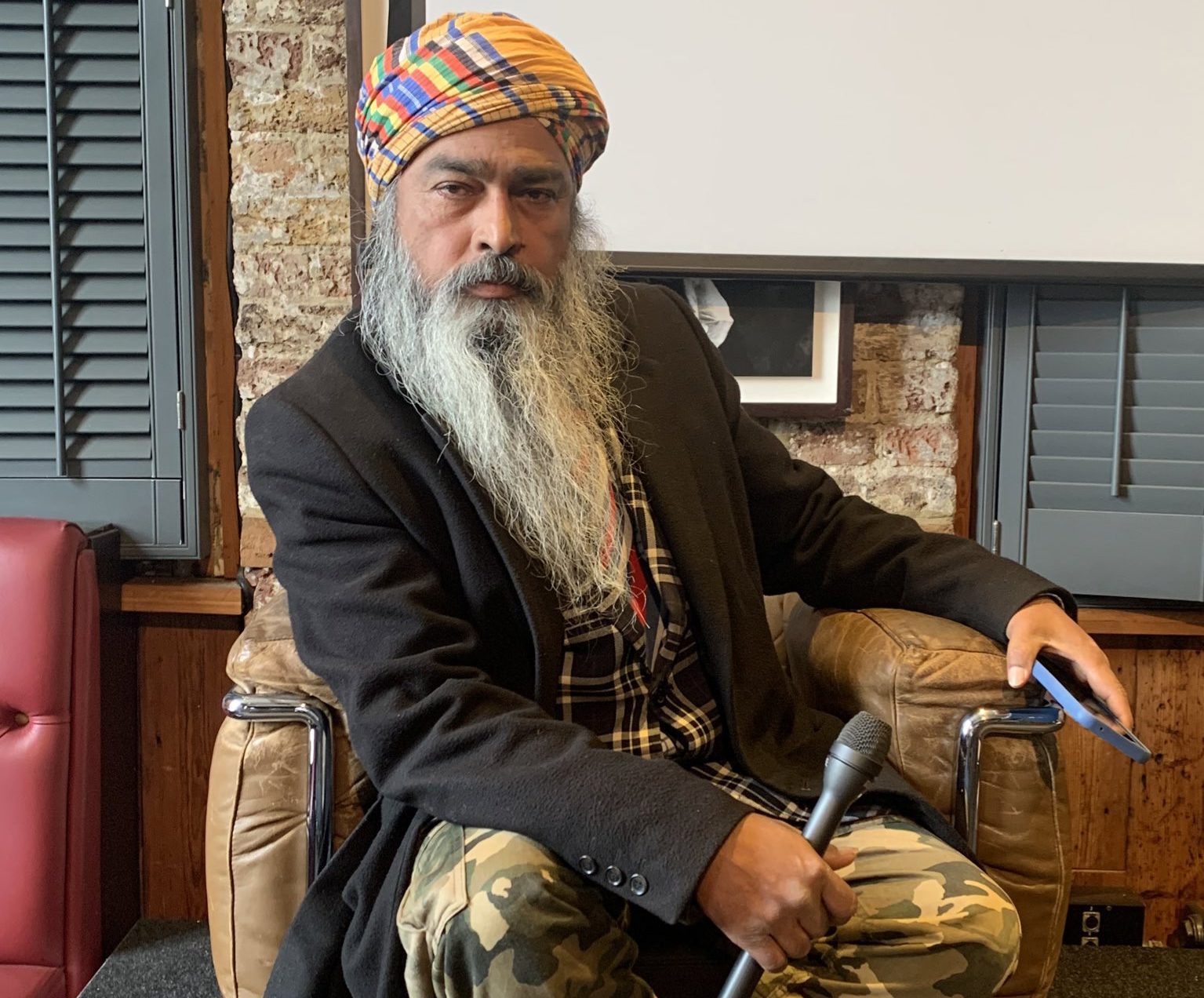

Meanwhile, spot Ethereum ETFs have seen substantial inflows, except for Grayscale’s Ethereum Trust (ETHE), which has experienced large outflows due to its high expense ratio.

Given these developments, you might be wondering whether you should invest in spot crypto ETFs for Bitcoin and Ethereum. What are the pros and cons? What factors should you consider before making an investment?

Let’s dive deeper to explore these questions and help you make an informed decision.

What are crypto ETFs?

Crypto ETFs, or cryptocurrency exchange-traded funds, are financial products that allow you to gain exposure to cryptocurrencies without directly buying them.

Just like stock ETFs, which bundle a group of stocks together, crypto ETFs bundle cryptocurrencies, making it easier for you to participate in the crypto market without dealing with the complexities of buying, storing, and securing digital assets.

Crypto ETFs operate by holding a portfolio of crypto assets, often mirroring the performance of a particular crypto asset or a group of assets.

When you invest in a crypto ETF, you are essentially buying shares of a fund that owns the crypto. The value of your shares will rise and fall with the value of the underlying assets.

For example, a spot Bitcoin ETF directly holds Bitcoin. When the price of Bitcoin goes up, the value of the ETF shares increases. If Bitcoin’s price drops, so does the value of the ETF shares.

Several major players have emerged in the crypto ETF market. Among them are well-known financial institutions and crypto companies such as Grayscale, BlackRock, Fidelity, and others.

Pros and cons of crypto ETFs

Investing in crypto ETFs can be a great way to enter the crypto world, but it’s essential to weigh the pros and cons before making a decision. Here are some key points to consider:

Pros of crypto ETFs

- Simplicity: Crypto ETFs make investing in cryptocurrencies easy. You don’t need to worry about setting up a digital wallet, securing your private keys, or dealing with crypto exchanges. You can buy and sell ETF shares just like any other stock.

- Regulation: Crypto ETFs are typically regulated by financial authorities, such as the SEC, providing an added layer of security and trust for investors. This can be particularly reassuring for those who are wary of the often unregulated nature of the crypto market.

- Liquidity: ETFs can be bought and sold on stock exchanges during market hours, offering high liquidity. This means you can quickly convert your investment to cash if needed, unlike direct investments in certain crypto assets that might have lower liquidity.

- Accessibility: Crypto ETFs can be purchased through traditional brokerage accounts, making them accessible to a broader range of investors who might not be comfortable dealing with crypto exchanges.

Cons of crypto ETFs

- Fees: Crypto ETFs come with management fees, which can eat into your returns over time. These fees are higher than simply holding the crypto assets directly in some cases.

- Indirect Ownership: When you invest in a crypto ETF, you don’t actually own the underlying crypto assets. This means you don’t have the same benefits, such as using your assets in decentralized finance (DeFi) applications or participating in network governance.

- Limited Options: While the number of crypto ETFs is growing, the selection is still relatively limited compared to the vast array of cryptocurrencies available on the market. This might limit your investment choices.

- Tax Implications: The tax treatment of crypto ETFs can be complex and may vary by country. You might face different tax consequences compared to directly holding cryptocurrencies, potentially complicating your tax situation.

How to pick a crypto ETF

Picking the right crypto ETF can be challenging, but here are some tips to help you make an informed decision.

- Research the ETF Provider: Look for well-established companies with a strong track record. For example, providers like BlackRock, Fidelity, and VanEck have a history of managing successful ETFs in the past, enhancing their credibility.

- Understand the fund’s Strategy: Some ETFs may simply track the price of Bitcoin or Ethereum, while others might use more complex strategies like futures or derivatives. Make sure you understand how the ETF operates and its investment approach.

- Expense ratios: Pay attention to the fees. Higher fees can eat into your returns over time. Compare the expense ratios of different ETFs to find a cost-effective option.

- Performance history: Look at the historical performance of the ETF. While past performance is not a guarantee of future results, it can give you an idea of how the ETF has managed market fluctuations.

- Liquidity: Ensure the ETF has enough trading volume. Higher liquidity means you can buy and sell shares more easily without affecting the price too much.

Should you invest in spot crypto ETFs and how much to allocate?

Deciding whether to invest in spot crypto ETFs and determining how much to allocate requires careful consideration. Here are some key points to consider:

- Assess Your risk tolerance: Crypto ETFs can be volatile. Only allocate what you are comfortable losing. A common rule of thumb is to keep high-risk investments like crypto ETFs to a small portion of your portfolio, such as 5-10%.

- Diversify: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to spread risk. Crypto ETFs should be just one part of a broader investment strategy.

- Consider Your Investment Horizon: If you have a long-term investment horizon, you might be able to withstand more volatility. Short-term investors might want to allocate less to crypto ETFs due to their price swings.

- Stay Informed: The crypto market is constantly evolving. Keep up with news and trends to make informed decisions about adjusting your allocation as needed.

The road ahead

As the market evolves, we’re set to see some exciting new financial products, like ETFs for different cryptos. The direction these developments take largely depends on the regulatory climate—will the rules tighten or loosen?

Meanwhile, watching how spot BTC and ETH ETFs perform will be key, as it could steer future innovations and broader integration of crypto into the financial space.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

English (US) ·

English (US) ·