Popcat, a meme coin on the Solana blockchain, recorded an impressive run, making it the top gainer among the top 100 crypto assets over the past day.

The recent 50-basis-point rate cut by the U.S. Federal Reserve has triggered bullish sentiment across the crypto market, which Popcat (POPCAT) has leveraged, recording a 22% rise in price in the past 24 hours.

Popcat is trading at $0.8738 at the time of writing, extending its gains with a 39.03% surge in the last seven days. Its market cap now stands at $856.4 million, with a $135 million daily-hour volume signaling surging investor interest.

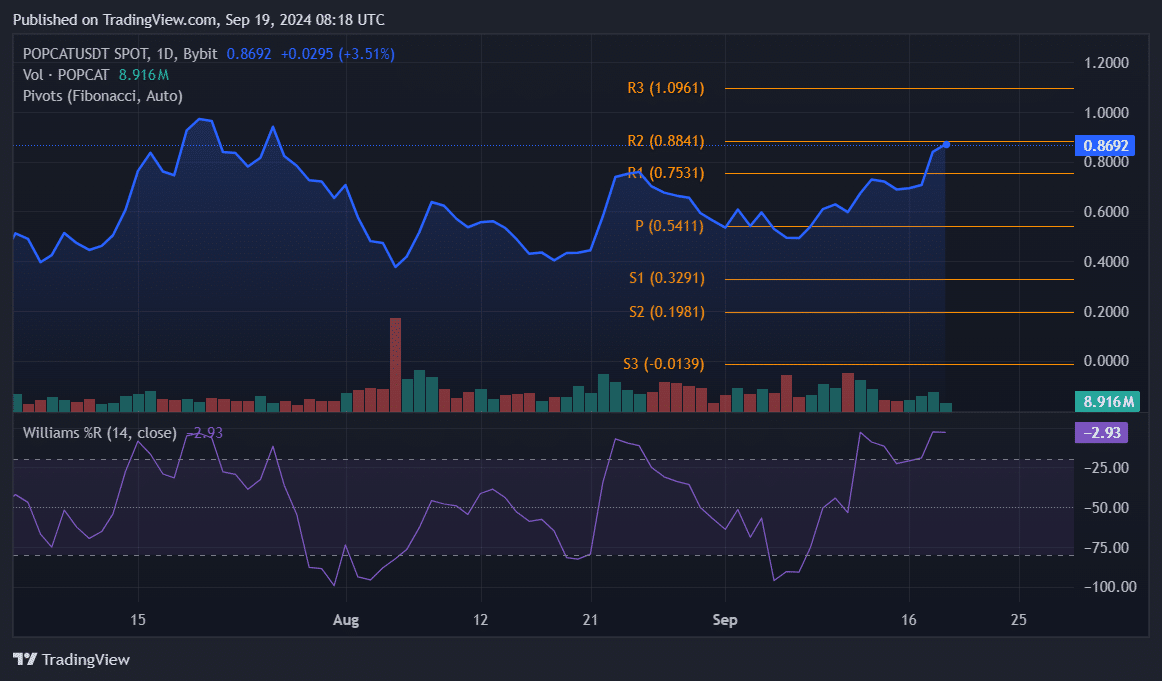

POPCAT 1D chart – Sept. 19 | Source: crypto.news

POPCAT 1D chart – Sept. 19 | Source: crypto.newsA pattern contributing to the surge was the rounded bottom formation on the daily chart, which often indicates a potential bullish reversal. Most of the rally occurred in the last trading session, with Popcat gaining nearly 19% yesterday, its largest intraday gain in a month.

The Fibonacci pivot points suggest resistance at various levels, starting at $0.88 and moving higher to the all-time high at $1.09. As the bulls look to again surpass the $1 price level, the $0.88 resistance threshold presents a formidable roadblock.

On the downside, immediate support lies at $0.75, with lower supports at $0.54 and $0.32. The price recently pushed above the critical $0.46 level, which was highlighted by analysts as a key indicator for a bullish breakout.

According to an X post by the pseudonymous analyst Impulsive Dom, this breach signals a solid upward momentum, with the possibility of Popcat targeting the $2 to $3 range on a third Elliott Wave push, provided the momentum continues.

$POPCAT about to pop? 📈

If #POPCAT holds above $0.46, there's a solid chance it pushes past the July high. In that case, I'd be looking at a 3rd wave targeting $2-$5.

But don't be a degen at these levels, downside to the August low is 70% — manage your risk and position size. pic.twitter.com/IfQH37rQe7

Additionally, the Williams %R indicator, which currently stands at -2.93, points to an overbought condition. Readings closer to zero indicate that the asset might be nearing a short-term top, and the market could face selling pressure soon. A pullback from this level is possible, given the recent sharp rise.

Looking ahead, if Popcat maintains its momentum, the $1 target could come into play. However, caution is advised, as failure to hold above $0.75 could lead to a retest of lower support levels near $0.54 and $0.32.

English (US) ·

English (US) ·