Stablecoins settled $3.7 trillion in 2023 and are on pace to reach $5.28 trillion in 2024, with growing usage beyond exchange settlement, new research shows.

Stablecoins continue to solidify their role in the global financial landscape, with settlement volumes reaching $3.7 trillion in 2023, according to a research report “Stablecoins: The Emerging Market Story,” sponsored by Visa and authored by Castle Island Ventures and Brevan Howard Digital.

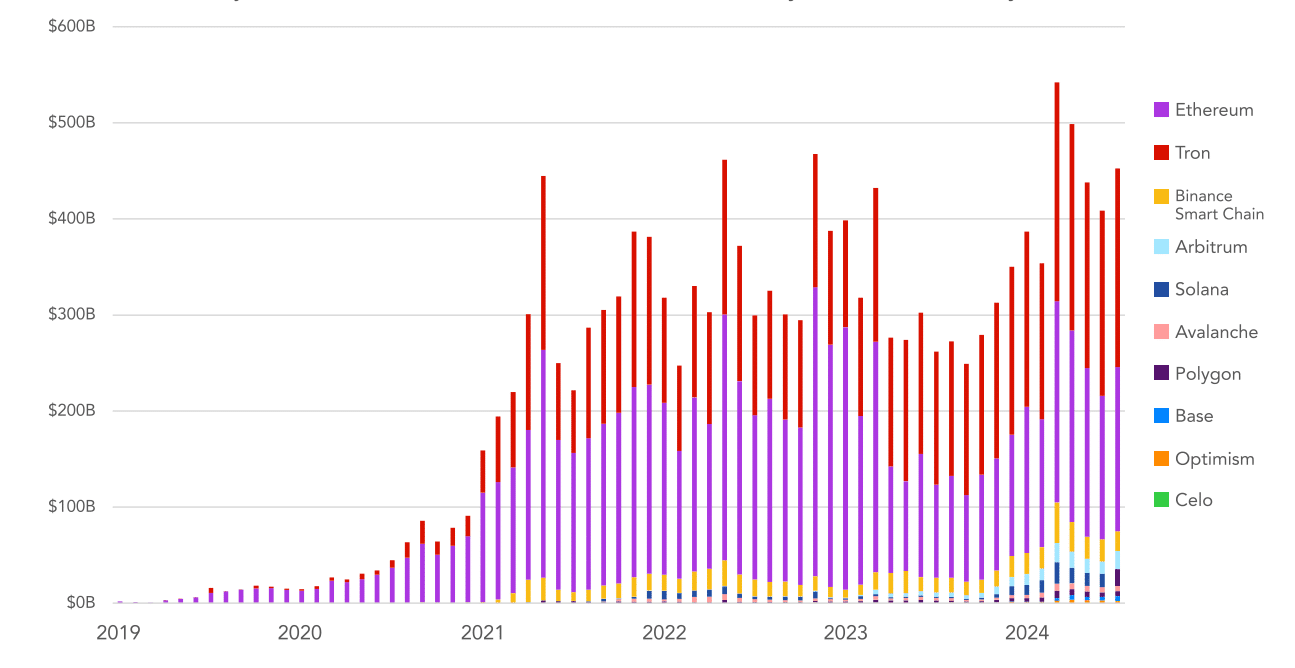

Adjusted stablecoin transaction volume settled by network, monthly | Source: Castle Island Ventures

Adjusted stablecoin transaction volume settled by network, monthly | Source: Castle Island VenturesThe data revealed that in the first half of 2024, stablecoins settled $2.62 trillion in value, putting them on an annualized pace to reach $5.28 trillion by year-end. Despite the broader selloff in crypto and declines in exchange volume over the past two years, stablecoin transactions have grown steadily, highlighting their adoption beyond trading.

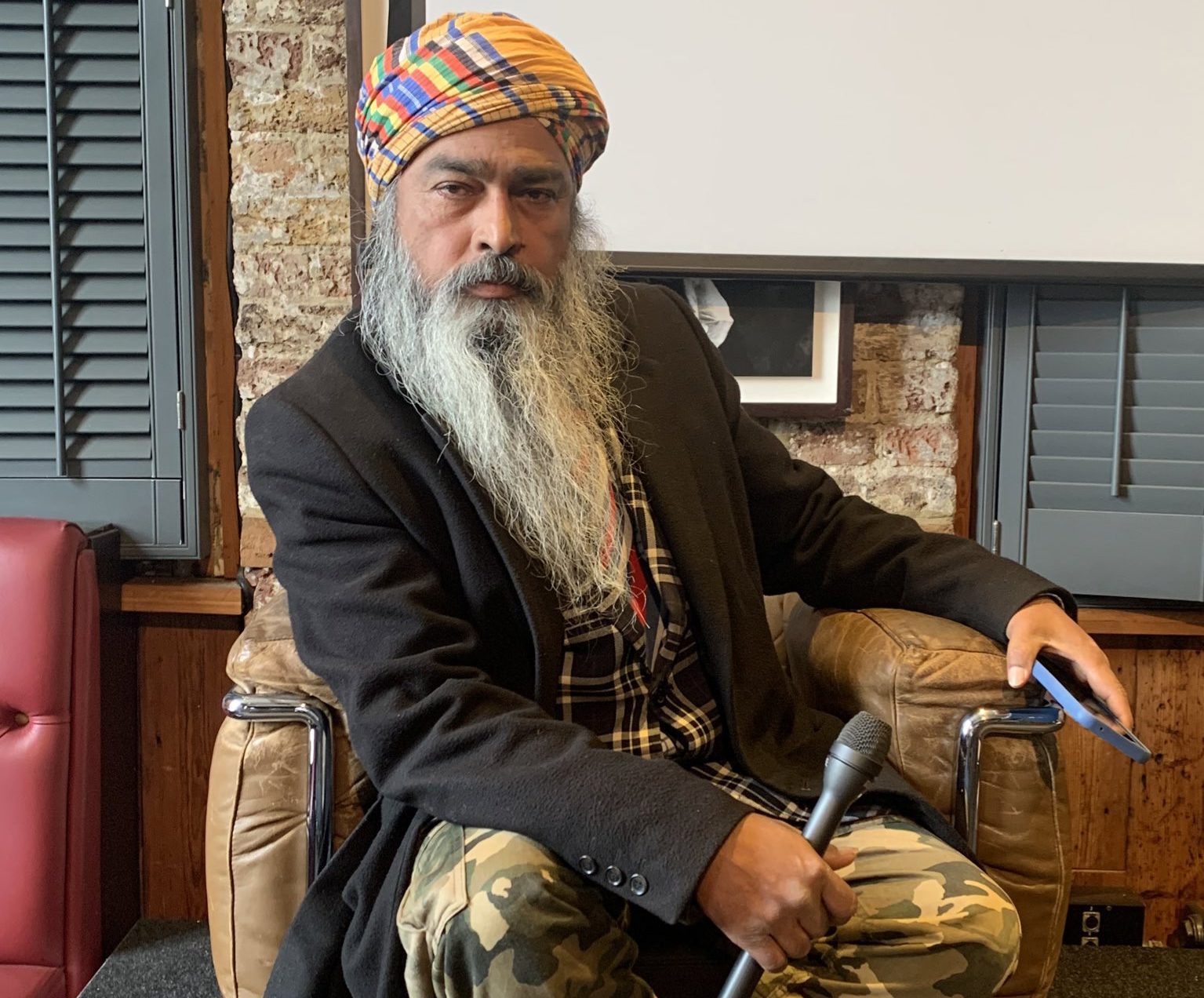

Nic Carter, founding partner at Castle Island Ventures, explained to crypto.news that the research aimed to highlight “how regular folks are actually using stablecoins.”

“We wanted to demonstrate with data that stablecoins have uses outside of pure crypto trading and speculative use cases. And I think this data clearly showed that.”

Nic Carter, founding partner at Castle Island Ventures

The report identifies Ethereum (ETH), TRON (TRX), Arbitrum (ARB), Coinbase’s Base, BNB Chain (BNB), and Solana (SOL) as the most popular blockchains for stablecoin settlements, with Ethereum leading by a significant margin, while BNB Chain and Solana also feature prominently.

Emerging markets fuel stablecoin adoption

Having surveyed over 2,540 crypto users across Nigeria, Indonesia, Turkey, Brazil, and India, researchers found that while trading crypto or non-fungible tokens remains the most popular use for stablecoins, non-crypto purposes are not far behind.

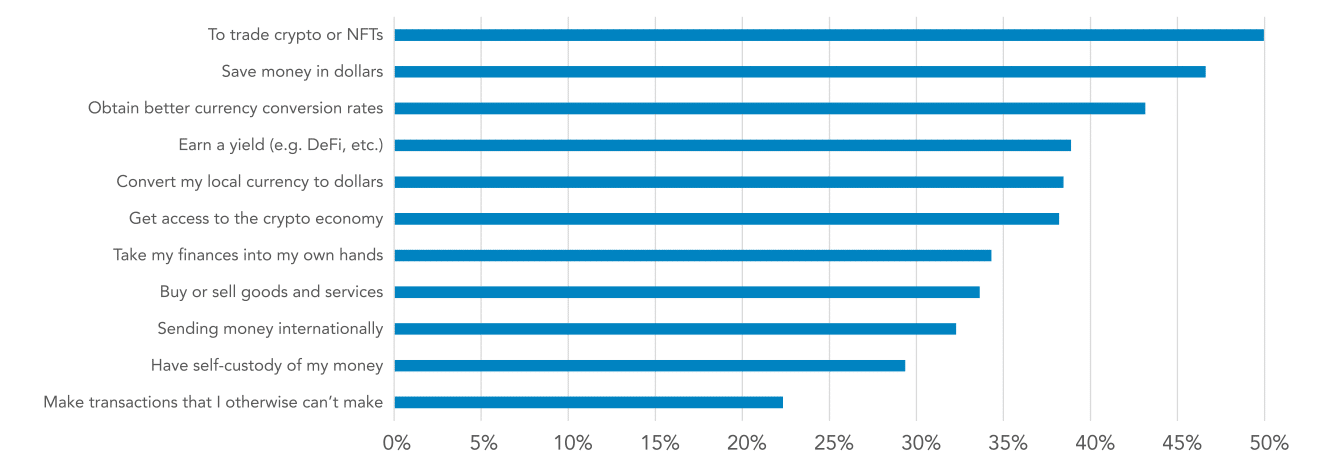

Stablecoins usage by primary goals | Source: Castle Island Ventures

Stablecoins usage by primary goals | Source: Castle Island VenturesIn fact, 47% of respondents cited saving in dollar-denominated assets as a primary goal, 43% highlighted better currency conversion rates, and 39% focused on earning yield. The findings underscore that non-crypto uses now account for a significant share of stablecoin activity in these emerging markets.

Among the key findings, 57% of users reported increased stablecoin usage over the past year, and 72% expect their usage to grow in the future.

Tether (USDT) remains the most trusted and widely used stablecoin thanks to “user trust, liquidity, and its track record relative to other stablecoins,” the report reads. Users in these markets cited stablecoins as a preferred alternative to U.S. banking, citing “yield, efficiency, and lower likelihood of government interference.”

The report emphasized that the findings “contradict the common belief that stablecoins are exclusively used as a tool for the speculative trading of cryptoassets.” The evolution in stablecoin usage shows that these assets have evolved from “mere trading collateral to a general-purpose digital dollar instrument in the countries surveyed,” the report reads.

English (US) ·

English (US) ·